In the past month, as U.S. stocks persistently climbed to higher altitudes, air has progressively gotten thinner as far as shorts are concerned. With that said, the action last Friday raises the odds that the latter is about to get a fresh dose of oxygen.

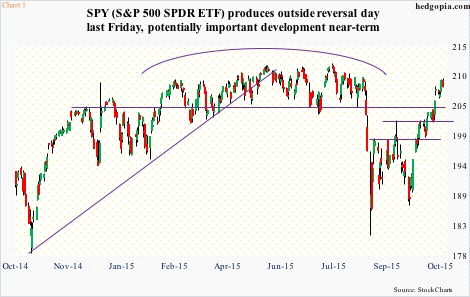

For the SPDR S&P 500 ETF (SPY), Friday was an outside reversal day (see chart 1 below). Having come on the heels of a one-month-long, 11-percent rally on the S&P 500, this has the potential to be an important development.

Needless to say, the S&P 500 ETF remains grossly overbought, but has been that way for a while now. So kudos to the bulls for keeping the momentum alive for as long as they have. But how much longer can stocks continue higher before a pullback?

Should a pullback commence over the near-term, below are some support levels to watch on the S&P 500 ETF (SPY).

S&P 500 ETF (SPY) Daily Chart

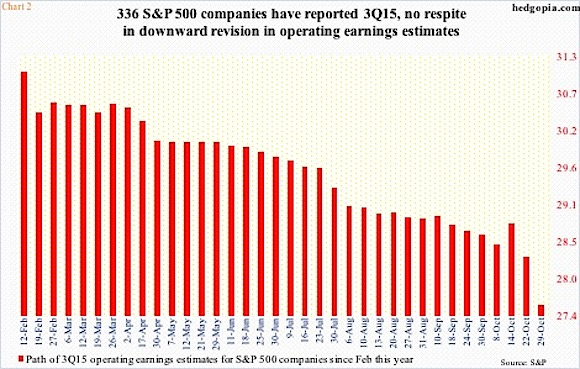

Lowered earnings expectations have helped. At the end of September, third-quarter operating earnings estimates of S&P 500 companies stood at $28.61, down from $34.86 at the end of June last year and $31 as early as February this year.

Even with this level of downward revision, as of Thursday last week, only 70 percent have beaten on an operating basis (and only 42 percent on an as-reported basis). With two-thirds of the way through, 3Q estimates – now at $27.55 (see chart 2 below) – continue to head lower; 2015 is at $109.11, down from $110.98 when the quarter ended.

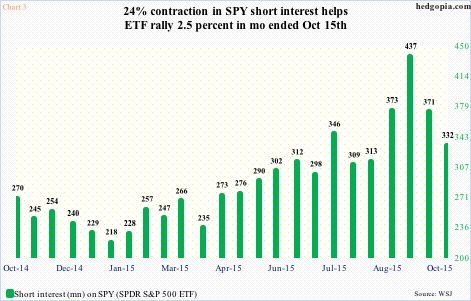

Central bank talk/action has helped as well. On October 22nd, Mario Draghi, ECB president, hinted of additional stimulus (perhaps as soon as December). A day later, the People’s Bank of China cut its benchmark lending and reserve requirements for banks. In those two sessions combined, the S&P 500 ETF (SPY) tacked on 2.8 percent. Shorts probably got squeezed even more.

SPY short interest had been building a while, having jumped 86 percent between the end of March and the middle of September (see chart 3 below). Then in the next month, it declined 24 percent, lending a hand to SPY’s 2.5-percent rally.

A similar phenomenon could be observed in the futures market.

continue reading on the next page…