By Andrew Kassen “The Yen Carry Trade” – whatever your tenure in and familiarity with financial markets, it’s a litmus phrase evoking a quizzical expression of bafflement here; a far-off, contented gaze there; or a haunted look of stricken agony remembered and old wounds never quite healed. No wonder, then, that news that a combination of speculative positioning and a central bank-endorsed blank check is reviving the Yen Carry Trade elicits many and varied reactions.

By Andrew Kassen “The Yen Carry Trade” – whatever your tenure in and familiarity with financial markets, it’s a litmus phrase evoking a quizzical expression of bafflement here; a far-off, contented gaze there; or a haunted look of stricken agony remembered and old wounds never quite healed. No wonder, then, that news that a combination of speculative positioning and a central bank-endorsed blank check is reviving the Yen Carry Trade elicits many and varied reactions.

What Is the Carry Trade, Anyway?

In case you arrived late in the game (post-2008), here’s a brief overview:

In foreign exchange, world currencies each carry an overnight borrowing rate as dictated by their central bank. Because economic health varies from country to country, monetary policy (read: rates) varies as well. As a result, these currencies are each characterized by their own rate along a spectrum across which significant disparities and rate spreads occur.

“The Carry Trade” refers to a strategy that attempts to exploit this variation between interest rates. In its simplest implementation, a trader seeks to simultaneously borrow a currency with low interest cost, converting those assets into a separate higher-interest-yielding currency. What results is a synthetic position in which the Currency A is effectively shorted and its interest rate – the cost of borrowing – paid out, while Currency B is held long and the interest rate on it received. The spread between the rate paid and the rate received is referred to as “carry” – in this case “positive carry” because the net result is interest received by the trader.

Carry Trade 2013: AUD/JPY

For the sake of argument, let’s observe how this works with the Japanese Yen (JPY) and the Australian Dollar (AUD), one of the fewer developed economies with an overnight rate exceeding 1%:

Currently, the nominal overnight rate on the JPY is buried at 0.00%-0.10%. In marked contrast, the rate on the AUD is 3.00%. At its tightest, there is a 290bps spread between the currently prevailing JPY and AUD rates. To take advantage of this spread, a trader may borrow the Japanese Yen – or short the currency outright – paying up to 10bps for their trouble either way. At the same time, they may convert the JPY borrowed into Australian Dollars – or simply purchase AUD outright with separate capital – garnering 300bps. At the end of the day, they’ve been paid 3% while paying 0.1%, pocketing the 2.9% spread.

Sounds like easy money, right? Wait: it gets even better! Consider that this 2.9% is at a 1:1 ratio; i.e. with no leverage or margin involved. In the U.S. – subject to house risk controls – may utilize up to 50:1 leverage, in effect multiplying the rate of interest received on post margin – their money – by 50 times. In this way, 2.9% on a $100,000 nominal position yields a figure far more impressive. If you’re not impressed, get out a calculator and do a little computation.

Now, you’re reasonably intelligent (…right?): even though this seems a bit esoteric (it’s not), you can tell it smacks of snake oil, is understood just easily enough to not be one of those painfully abstruse, veil-wrapped “best-kept secret” things and is otherwise and in any case far, far too good to be true.

This Will End Well

The risk – and it’s a massive one – inherent to the Carry Trade is that the rate of exchange between the debt currency – JPY here – and credit currency – AUD – is not static.

During some periods, usually characterized by global expansion in our contemporary era, these rates of exchange do not experience much volatility. A low yielding currency such as the Yen doesn’t usually denote a thriving economy, so there’s little sustained interest in plowing money into it; the converse being true for a high yield currency, like AUD. As a result, the risk of being long AUD while short JPY is usually outstripped by the positive carry earned on those positions; and all other things being equal, the rate regime and all its implies creates a tailwind for the long AUD/JPY position.

In times of tension or crisis, though, this idyllic state of affairs is slammed on its head.

Speculative “risk-on” bets are flattened to reallocate to safe haven instruments: in our example, the Japanese Yen receives a steady bid because traders buy it back to close their carry trade, aside from outright purchase of the JPY as a safe haven currency. At the same time, the complementary AUD position is sold to close, placing steady selling pressure on the underlying currency.

In point-of-fact, why risk-off flows go where they do when they do and as fast as they do is immensely complicated, but know this: whatever the precise reasons, this activity results in a contrary shift in exchange rates where the Yen now steadily and significantly appreciates against Australian Dollar. Depending on the severity of the macro event(s) catalyzing this reversal, the exchange reversal can be rapid and – depending on the amount of leverage employed, in a word – brutal. That beneficial drift enjoyed on the long AUD/JPY position in the days of plenty can be quickly eliminated and the positive carry (even – especially! – 290bps at 50:1) effortlessly outrun in the famine of mounting capital losses on the underlying position.

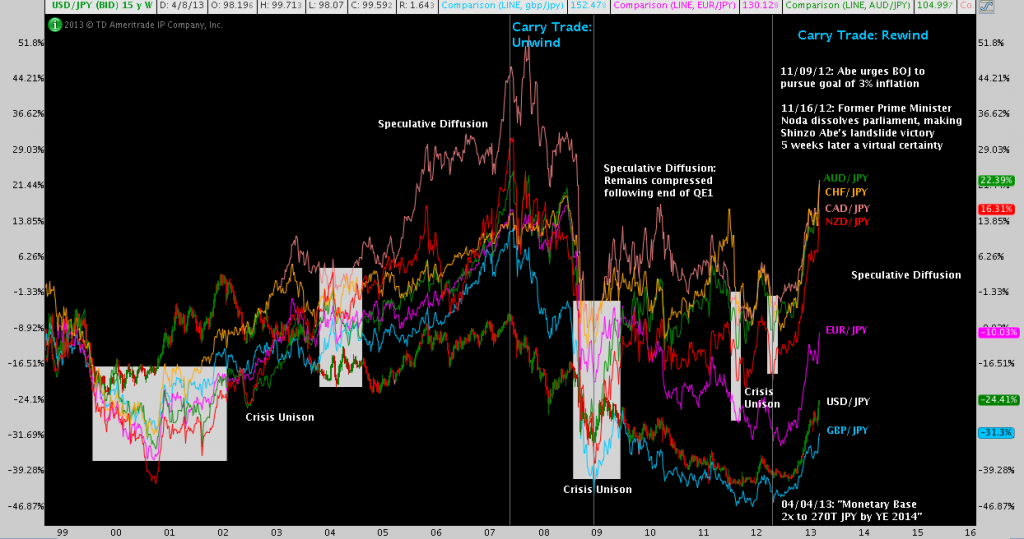

A (Very) Brief Pictorial History of the Yen Carry Trade

If you’ve persevered through our example, you’re now basically familiar with the mechanics of the carry trade. Earlier I alluded to tenure, as well. Here’s why (click image to zoom):

The binary alternation of crisis unison preceded (and followed) by speculative diffusion is unmistakable. As one might expect, there’s no better example of this cycle than 2007-2009.

Now for the first time since 2004-2007, the speculative diffusion of a revived Yen carry trade is underway. Much has been made of the carry trade’s return in recent days, but flows out of the JPY began basing and then quietly mounting beginning in late-May/early-June 2012. Though the rate spectrum is far more compressed than it was in the early 2000s – compare the US overnight rate at 5%+ then v. 0-0.25% now – with Japanese Prime Minister Abe’s accession in December, installment of the monetary marionette Haruhiko Kuroda at the helm of the BOJ in late Spring and rollout of most accommodative monetary policy in the history of the universe last week, assuming no impediments of crisis the stage is set for the Yen Carry trade to resume in earnest.

Twitter: @andrewunknown and @seeitmarket

No position in any of the mentioned securities at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.