In a recent report I was prompted to look at the NAFTA economies and equity markets. A key reason was the Canadian rate hike that had the Bank of Canada joining the US Federal Reserve and Banco de Mexico on the rate hiking path.

But aside from being exposed to a certain common political risk, and sharing geographic proximity, having their central bank hiking interest rates was where much of the similarities ended.

NAFTA Equities: more in difference than in common

From a cyclical perspective the NAFTA economies look to be on fairly divergent paths judging by composite leading economic indicators. On the stock market front, PE10 valuations were 3 different stories (US = expensive, Mexico = neutral, and Canada = cheap).

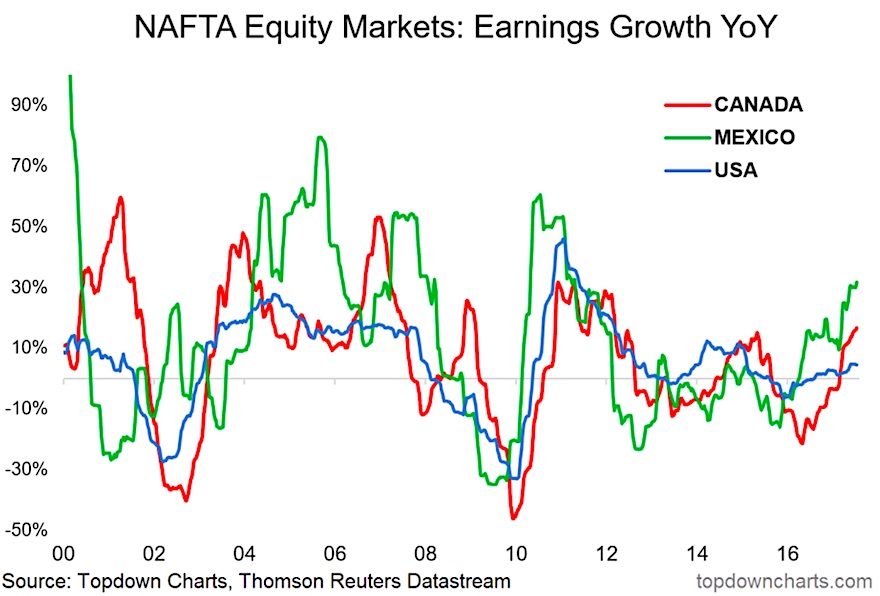

Yet on earnings there was one similarity, all 3 have positive YoY trailing EPS growth.

On closer inspection however there is yet again a couple of important differences. Canada clearly seems to be benefiting from base effects, which could quickly dissipate. Mexico is seeing solid growth, yet with much greater earnings volatility. Likewise US earnings are seeing much more gradual growth and more stable growth.

So while the NAFTA economies have a couple of things in common, and the NAFTA equity markets are all seeing positive YoY EPS growth, they all have more in difference than in common. And each equity market offers a different risk and reward trade-off along with a different cyclical outlook and monetary policy setting. Thanks for reading.

ALSO READ: China’s Economic Forecast: Sunny… Until 2018

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.