The popular averages fell for the second week in a row last week. The S&P 500 Index (INDEXSP:.INX) dropped nearly 1.00% while the NASDAQ Composite (INDEXNASDAQ:.IXIC) and Russell 2000 suffered larger losses. Stocks have been negatively impacted by rising interest rates, a weak start to third quarter corporate earnings season and increased volatility in the world’s currency markets.

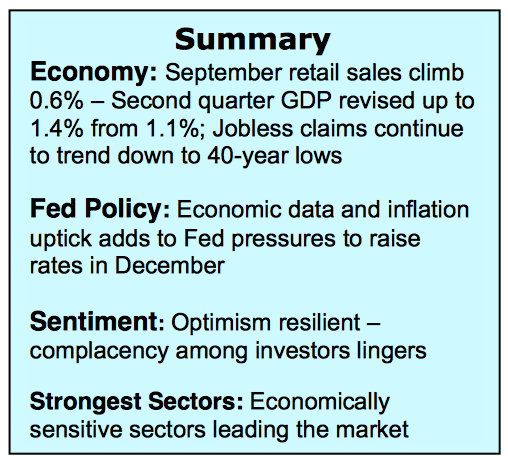

Although there is no overwhelming evidence to dissuade us from the view that the fourth quarter will ultimately belong to the bulls, some near-term hurdles for the market remain.

The uncertainty surrounding the transition from an interest rate driven market to a market where earnings growth is the dominant factor is likely to cause stocks to trade defensively as we move closer to the November election. Additionally, third quarter corporate earnings expectations are less than enthusiastic. The complete third quarter profits picture will not be available for two or three weeks just prior to the election but the overall results could provide for an upside surprise. The bottom line is that while October is likely to find stocks still trapped in the current trading range, the seasonal history is for stocks to turn bullish in November and continue to be supportive into early 2017.

The technical condition of the stock market has experienced some near-term deterioration suggesting a continuation of the three- month trading range. Stock market breadth weakened last week with fewer issues hitting new 52-week highs and the new-low list expanded.

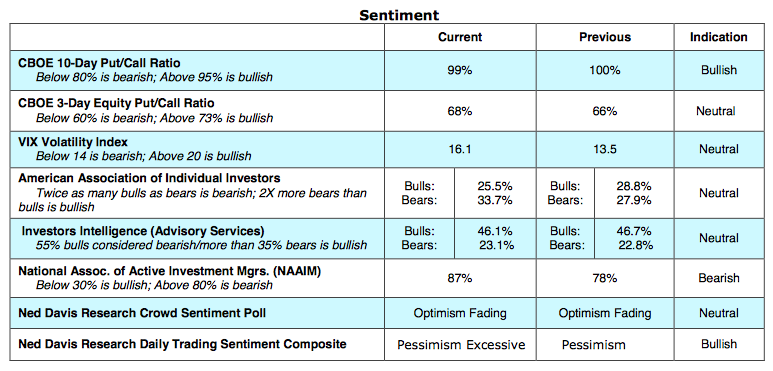

Despite the underperformance in early October, measures of investor psychology continue to show widespread complacency. The strongest rallies the past three years have occurred when stocks were deeply oversold and investor pessimism was excessive. In order to turn investor psychology from complacency to concern and skepticism, will likely require further downward pressure on the popular averages. Evidence of a shift in the mood of investors would be apparent with a jump in the CBOE Volatility Index (VIX – 16) above 20. Additionally, a drop in bulls in the Investors Intelligence data below 40% accompanied by a drop in the National Association of Active Investment Managers (NAAIM) allocation toward stocks below 50% would argue that the seeds for the next rally have been sown. At this juncture cash levels for both individual and institutional investors are at historically low levels. Since there is an inverse relationship between sentiment and liquidity, a jump in investor pessimism would argue cash is being accumulated to help fuel a fourth-quarter rally.

It will take time to fully assess third quarter corporate earnings (and outlooks). This may keep the market choppy near-term. Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.