Investors: Keep An Eye On The Credit Markets

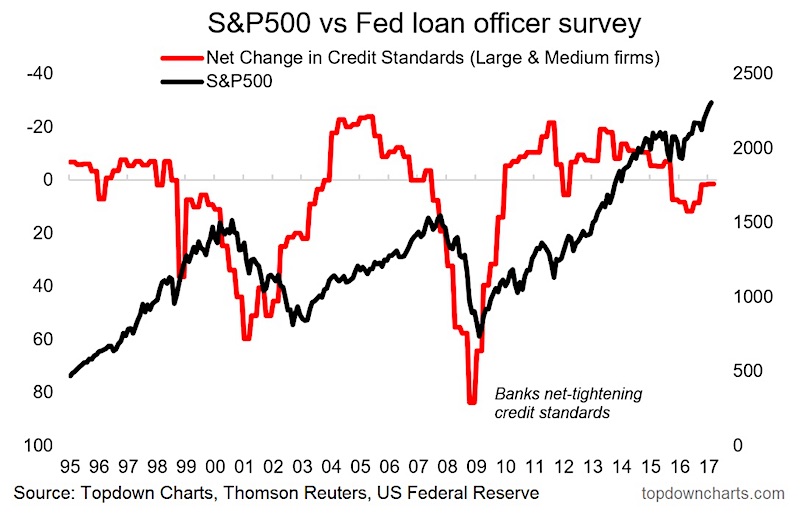

In a recent edition of the Weekly Macro Themes we looked at one indicator that has in the past served as a bear market warning for the S&P 500 (INDEXSP:.INX): The Fed SLOOS (Senior Loan Officer Opinion Survey).

Prior to the dot-com bust, and the financial crisis in 2008, the survey responses for “net change in credit standards” for large and medium firms made a sharp turn towards increasingly aggressive tightening of credit standards.

We can debate about whether this was in response to a weakening macro outlook and trouble in the loan books, or whether indeed it was an actual driver in that once you turn off the credit spigots the economy slumps, liquidity in the system wilts, and you get a reduction in stock buying power as well as weakening earnings prospects.

But the bottom line is it seemed to work as a leading indicator to the last two major bear markets.

So it’s worth paying attention to.

The most recent signal from the indicator was an orange flashing light during the market turmoil of 2015/16, but it has reverted to more neutral levels now. It remains an indicator we will continue to watch, particularly as it still technically is on the tightening credit side of the line. It may not take much to send it back into warning mode, so while it’s saying proceed with caution, it will pay to keep watch for a change in the “traffic lights”.

Thanks for reading.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.