Following a disastrous revenue outlook in February, LinkedIn Corp (LNKD) reported Q1 results on April 29th that topped Wall Street estimates, soaring 35% on year over year basis to $861M.

The business-oriented social media company trades at a forward P/E ratio of 30.91x (2017 estimates), price to sales ratio of 5.37x, and a price to book ratio of 3.74x. Given the steady annual earnings growth in the 20% to 25% range, paying just over 30x EPS isn’t outrageous for the $15B company.

At 105.5M monthly active users, LinkedIn falls short of Twitter’s 310M and Facebook’s massive 1.65B user base. However, on a revenue/user ratio, LinkedIn’s $28.30 generated per user is quadruple that of Twitter and is well above the $10.80/user that Facebook (the largest social media company) is bringing in on the top line.

Their Talent Solutions segment is leading the company with nearly 40% growth in the U.S. and internationally, but unlike it’s two competitors has a substantial premium subscription model (+22% in the first quarter to $149M).

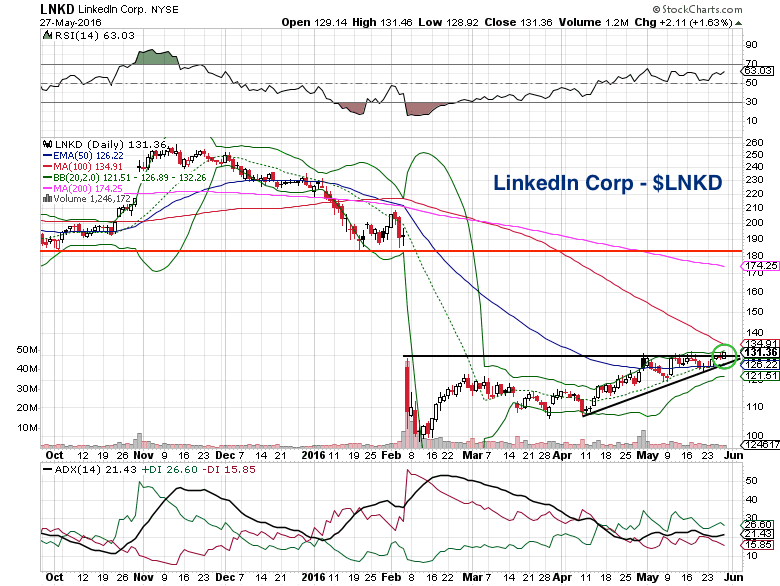

LinkedIn Corp Stock Chart

Observations and Considerations:

- Shares of LinkedIn are down more than 41% year to date

- After being nearly cut in half on a massive gap lower in early February, the stock then traded sideways for several months

- Now LNKD is attempting to break out above the $130 resistance level (began with a series of higher lows in April)

- LNKD traders may want to consider a stop loss under $125 on stock positions or buying the July 15 $130 calls for $6.50 for a favorable reward/risk ratio

It’s probably unrealistic to expect a gap fill to the $180-$190 range anytime soon (or for this year that matter), but the combination of improving sentiment, a growing, diversified business model, and a potential technical breakout could push shares to $150 sometime this summer. Second quarter earnings results are due out on July 28th.

Thanks for reading and good luck out there.

Twitter: @MitchellKWarren

The author does not hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.