Consumer and biotech stocks have been some of the hottest spaces in the bull market since 2009. We all know about companies like Biogen Idec (BIIB), Gilead (GILD) and Celgene (CELG) in the biotech industry, as well as Starbucks (SBUX), Chipotle (CMG), and Ross Stores (ROST) in the consumer realm. Those names make headlines. But another stealth leader among consumer plays has been Kroger (KR), the major US retail grocer.

Looking at the chart below, you’ll notice that the Kroger stock rally really didn’t get going until the summer of 2012 when it began to break out of a 14-year consolidation phase. The once steady and boring grocery company then nearly quadrupled to recent levels. If you factor in dividends, the return would have been about 285% from the 2012 low to the YTD 2015 high.

Looking more near-term, Kroger seems to finally be showing signs of exhaustion. Recent down days have been on strong volume, as well as moving decidedly below its 50-day moving average for the first time in more than a year. The below chart has a lot going on, so I’ll highlight a few key features.

The recent high in March and April occurred on negative divergence when looking at the RSI (Relative Strength Index) indicator at the top of the chart. Bulls like to see a new high in price occur on equal, if not stronger, momentum. Kroger spent many months with the RSI above the 70 level, which was an incredible run. Another feature of the RSI is the concept of the ‘bullish’ and ‘bearish’ zones. The ‘bullish’ zone is thought to be between 40 and 80 – so the stock should find support at the 40 level on RSI. Kroger held the 40 level several times on prior pullbacks, but recently fell to 31.

The ATR, or Average True Range, has risen to $1.19, which is not overly elevated at 1.7% of price, but it is up significantly during the downturn in recent days.

A key support level in price that will be interesting to watch is the gap-fill area in the $69-70 area from an earnings reaction in early March. A move below $69 would help to confirm a trend reversal in Kroger stock price.

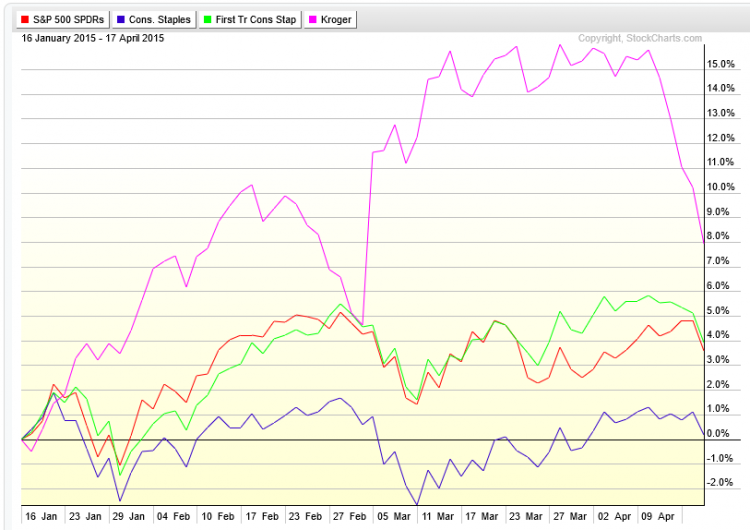

It is always helpful to review the relative strength of a stock to the overall market and sector. Kroger outperformed its industry, sector and the overall market in the past year during that remarkable run-up. The past week’s downturn was quite volatile, though, and underperformed the industry/sector/market. It also underperformed on a pullback in late February, but the chart of Kroger was stayed intact at that time. Will it stay intact again on this pullback? In my opinion, the relative weakness coupled with an exhausted looking chart could spell trouble.

Looking briefly at some fundamental factors, Kroger has traded at 21x trailing twelve month operating earnings most of this year; quite an elevated level for a large, steady, relatively low-growth consumer staple company. Speaking of earnings, Kroger just suffered its worst weekly price performance since late November 2010, which included an earnings reaction. To find a non-earnings week decline that was worse than this past week’s, you have to go back to January 2009! So what could have been a driver of this sharp move?

Perhaps there is a correlation with energy prices, as Kroger’s surge in the past year came at the same time as energy prices collapsed. Maybe there was a perceived boon to consumers, particularly at the low-mid end who would then be able to spend a little bit more at the grocery store? I’m not sure about that, but it is interesting how the breakout in crude oil prices also corresponded to the decline last week in Kroger’s share price.

Calling a top is often a fool’s game. But I do believe some caution is warranted here. In full disclosure, I am an owner of Publix Super Markets private, restricted stock which moves similar to Kroger. So I hope the sector holds up here. I will be “happy” to say I am wrong if the stock reverses last week’s decline to hit new highs later this year.

Trade safe and thanks for reading.

Follow Mike on Twitter: @MikeZaccardi

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.