It’s been over 2 years since investors experienced a day like Wednesday. The steady stream of measured selling finally gave way to a bit of fear and capitulation as investors were forced to make decisions in the face of market volatility that felt crashy. At one point, the S&P 500 was down over 3 percent. It was the perfect series of events for an uncertain market: A gap lower that looked ugly (nausea) followed by a stron rally (relief) and the feeling that a bottom may have occurred… BUT this was then followed by another violent wave of strong selling to new intraday lows (panic) that hovered for a while before reversing higher to end the day in a better place.

It’s been over 2 years since investors experienced a day like Wednesday. The steady stream of measured selling finally gave way to a bit of fear and capitulation as investors were forced to make decisions in the face of market volatility that felt crashy. At one point, the S&P 500 was down over 3 percent. It was the perfect series of events for an uncertain market: A gap lower that looked ugly (nausea) followed by a stron rally (relief) and the feeling that a bottom may have occurred… BUT this was then followed by another violent wave of strong selling to new intraday lows (panic) that hovered for a while before reversing higher to end the day in a better place.

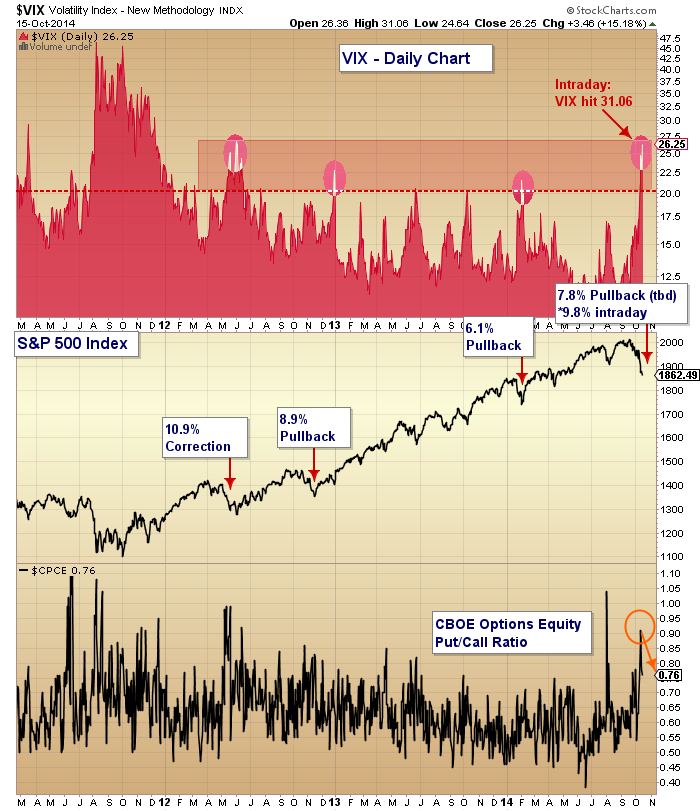

But the question remains: Was this truly a capitulation day? And was this sell-off/reversal enough to mark a short-term low? On Sunday night I wrote a piece questioning if investor capitulation was nearing. At the time, the Volatility Index (VIX) was at 21 and the market was down just over 5 percent. Today, the VIX reached an intraday high of 31.06 and the S&P 500 came close to reaching correction territory on an intraday basis. See the updated chart below.

Volatility Index vs S&P 500 vs CBOE Options Equity Put-Call Ratio

One word of caution for those calling this the bottom: Markets almost always see retests. And quite often price gives way to brief undercuts or new lows/legs lower. Additionally, the Options Equity Put-Call ratio still hasn’t pushed above 1.00 and managed to drop to .78 today. That said, market volatility as measured by the VIX briefly spiked over 30. And the S&P 500 pierced a key Fibonacci support level but managed to close above it.

When markets act chaotic, sure they tell us that fear is present, but they also tell us that investor psychology is fragile. With this in mind, I think that the next few days will be important. Consolidating for a day or two would relieve some selling pressure. And this could lead to a tradable rally.

Ideally, the low from today would produce a brief rally that gives way to a retest or undercut. It could come as early as tomorrow or as late as a week or two. It won’t feel comfortable, but the timing of events and behavior of the price action will dictate whether this is a run of the mill correction or if this is 2011 all over again.

Thanks for reading.

Follow Andrew on Twitter: @andrewnyquist

The author holds a trading position in the S&P 500 (SPY) at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.