In the last ten years we’ve seen some pretty important financial events that rocked markets around the world. First was the bursting of the housing bubble in the US and, to a lesser degree, the Greek insolvency crisis and Euro area woes. Although they were very different situations, they had one factor in common: a rapid build-up of debt. We are currently risking a third situation and this time the setting may be the emerging markets.

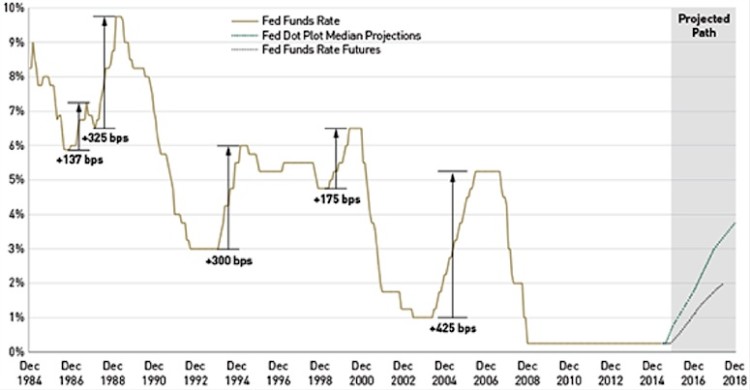

Last year was an important year for financial markets. It was characterized by the exasperated countdown for the first interest rate hike by the Federal Reserve in ten years. There was a similar anxiety surrounding the tapering of its QE cycle in 2013. In both cases, the economies that took the brunt of those changes were emerging markets which, in both cases, witnessed huge capital outflows.

The performance of emerging markets currencies in 2015 was dire, to put it mildly. The Brazilian Real toppled 43%, the South African Rand dropped 25%, the Turkish Lira 20%, the South Korean Won 20% and the Russian Ruble lost 15% and of its value. One of the key reasons for these declines was the rise of the US Dollar against these currencies in view of the said interest rate hike.

Currencies, however, weren’t the only reason. The sharp slowdown of the Chinese economy and the commodity market slide put in their fair share. The negative performance of commodities slowed down many economies while pushing others into recession. Countries had large trade balances with China fared the worst. Brazil comes to mind here. According to estimates by the Institute of International Finance, capital outflows in emerging markets were greater than inflows for the first time since 1988. The same Institute estimates outflows to have been roughly USD 548 billion in 2015.

One of the things to keep a close eye on here is explosive debt growth. In a six year cycle ending in 2014, the 15 largest emerging market economies experienced a spectacular GDP growth of 48% (cumulative) versus the 6% of G20 nations. Much of that growth was spurred by debt.

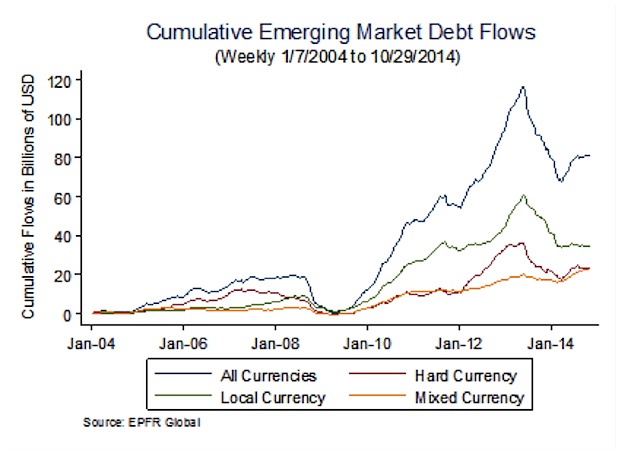

In the decade from 2004 to 2014 emerging market corporate debt (excluding banks) rose from $4 Trillion to $18 Trillion with a 70% influence on GDP. In China, the credit gap (ratio between corporate debt and GDP) is 25% above its historical average. Brazil, Thailand and Turkey have credit gaps that are 10% above their national average.

The explosive debt situation is correlated to the Federal Reserve’s aggressive monetary expansion policy in order to confront and control the effects of the 2008 financial crisis. The zero percent interest rate policy in Washington pushed other economies to adopt the same tactic in order to avoid an excessive strengthening of their currencies by using debt. Exporting nations were particularly worried about a hit on their exports which could spill over into the manufacturing sector.

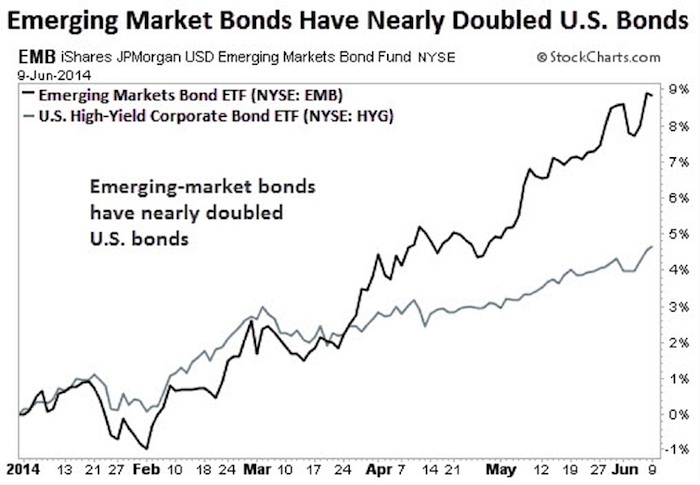

With interest rates at or near zero in the US and Europe, asset managers looking for yield poured enormous amounts of cash into emerging markets. This brought an unprecedented increase in emerging market Bond emissions.

Debt crises in emerging markets are nothing new. In some ways, one could claim that the defaults and broken currency peg crises of the 1980’s and 90’s were more dramatic. Nonetheless, a spiraling of the current crisis could potentially hit growth much harder and weaken the world economy more than in those cases.

A true change in the Fed’s policy along with the slowing down of the Chinese economy, and the slide in raw materials prices, has put the sustainability of the enormous amount of debt accumulated over the years at risk. On one hand, the higher interest rates make it more costly to refinance the debt while the slowing economic cycle makes it more difficult to pay off the creditors. The problem becomes even more dangerous if a large portion of this debt is in an increasingly strong currency like the US Dollar.

Sources: Federal Reserve and lordabbett.com

The debt situation is under control for the time being but the capital outflows will likely continue, and the current situation in China may amplify them. If we don’t see a general improvement in macro-economic prospects, the tightening of interest rates in the US could wind up having a negative impact. Not all emerging market economies would be hit to the same degree but the effects would be substantial on a global level. This is one aspect that investors should be aware of as we move forward into 2016.

Another factor to keep in mind, however, is whether the Fed actually will continue to tighten and to enter a rising rate environment as estimated in the chart above. Many observers feel that the December 16th rate hike wasn’t warranted and that it was more of a symbolic event spurred by the Fed’s need to maintain its credibility and to have some leeway in case things do get ugly.

Will the US Dollar continue to rise in 2016? That is a difficult question to answer and it has spurred debates that are still ongoing. There is no way to know for sure but there is also absolutely no guarantee that it will. Interest rate policy will undoubtedly have its say in the matter going forward. Emerging markets will require more time to work through a complex unwinding process and the US Dollar is one of the factors that may or may not allow that to happen in a sustainable time frame.

In view of how the markets are reacting to the compounding of situations abroad in the first week of 2016, it’s more than reasonable to assume that the Fed will be careful about the path it takes with regards to the tightening cycle in the coming months.

The interconnected nature of the world’s financial system will not allow the US to simply brush off the effects of an eventual explosion of the debt bubble in emerging markets. Our stock market made that pretty clear here in the early going of 2016.

Thanks for reading.

Twitter: @DDCapitalFund

The author does not have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.