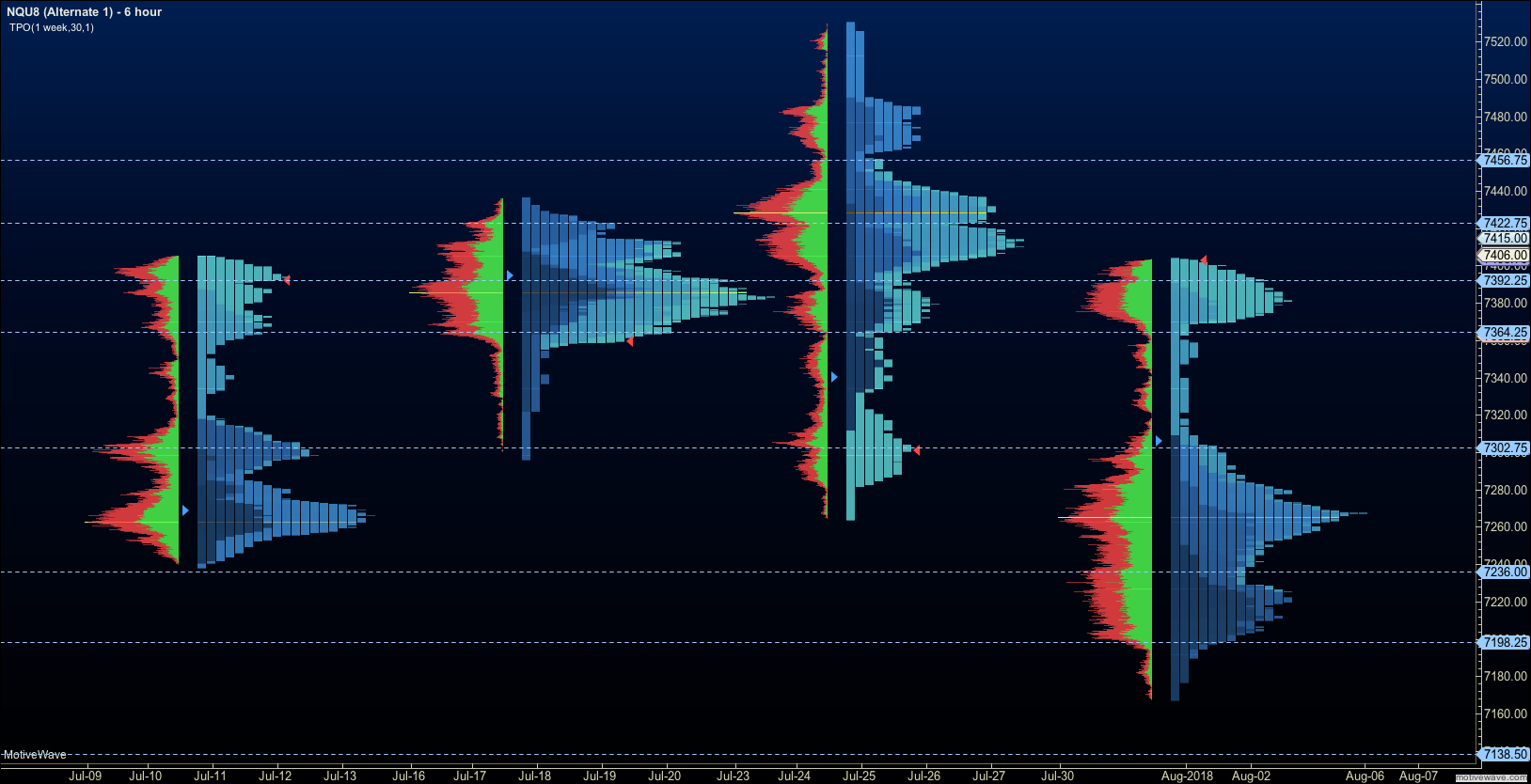

Above we see the passage of 4 weeks in the mini Nasdaq futures (NQ_F).

If you’re not accustomed to seeing these kinds of images with no candlesticks, no need to fret.

They still tell us the same thing about motion, but add a critical element- how much volume participates at the levels in question.

The NQ_F chart here tells me that I am sitting near solid regions of new higher support holding but I have congestion areas ahead that I need to make my way through. Thin volume below still poses a problem that will surely raise its head in the future as a problem but as it sits right now, pullbacks remain buying opportunities for most participants in the market.

So how did I get this information from the chart we see?

We might notice in these mountainous formations, the peaks and valleys present each week. What they represent is the level of participation in terms of volume.

From these images, we are able to say with quite a bit of surety that if I drift into the regions near the higher peaks, I am likely to stay there for a while. It will chop or grind through those levels on its way to the next ones.

When traders behave this way, they agree that the instrument is near a price at which traders desire to participate – usually in both directions.

In the spaces where we see the valleys, we are likely to lift (or fade) through these regions quickly when we approach them. When traders quickly move away from a price it means that it has created a space where the level of participation becomes one-sided (again, either direction is possible), creating directional motion. These are my favorite places to identify as a trader as they can give me swift movement in participation.

Knowing these two pieces of information can help you see how to both enter and manage your trades a bit better by realizing what the likelihood of behavior might be with other traders.

As always, manage your risk – the is the most important thing you will do as a trader – it will provide the road for longevity, which is the only true measure of success in this business.

You can learn more about trading and our memberships HERE.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.