WisdomTree US Growth & Momentum Fund (WGRO) Highlights and Takeaways

This WisdomTree ETF (WGRO) seeks to capture upside market momentum while avoiding overextended stocks

Monthly rebalancing uses a more traditional approach versus other momentum ETFs

An index backtest shows successful return and risk characteristics versus US large cap growth indexes

A Fresh Option for Momentum Investors

The US stock market’s doubling from the March 2020 lows has been driven by several sectors and styles at various times. Large cap growth’s surge last summer, and more recently since June, always commands headlines. Small cap value and cyclicals’ rebound late last year and through 1Q21 gave hope to many beaten-down areas.

The Infamous iShares Momentum Rebalance

Capturing momentum swings has been challenging, but lucrative for those with the right timing. It’s also fraught with risk – just look at the iShares MSCI USA Momentum Factor ETF’s (MTUM) rebalance in late May. That fund’s re-shuffling from tech and growth names into value sectors came at just the wrong time. Since June 1, the S&P 500 has returned 4% while MTUM is up just 1.5%.[i]

Vanguard’s Active Approach

An ETF I tweet about on occasion is the Vanguard U.S. Momentum Factor ETF (VFMO)[ii]. This is a little different animal relative to MTUM. It essentially has a small cap tilt since the weighting scheme sets each holding almost equal in size. The fund rebalances much more frequently than MTUM and is perhaps the most active of all momentum ETFs, ironic considering it comes from Vanguard.

Enter: WGRO

A recently-launched ETF is the WisdomTree US Growth & Momentum Fund (WGRO). Fans of William O’Neil’s CANSLIM approach, focused on identifying strong fundamental growth stocks in price uptrends, will likely find this approach appealing. The ETF focuses on four factors in its security selection: Pullback, Volatility, DataGraph, and Hotness. There is also a minimum size requirement ($250 million market cap) and a liquidity screen.

WGRO’s Unique Feature

WGRO will hold 50-100 stocks as determined by the four scoring factors. What sets WGRO apart from the other momentum plays is the pullback factor. While the O’Neil DataGraph Rating finds the top fundamental relative-strength stocks, the Pullback feature attempts to pick stocks at attractive entry points. WGRO wants to discard equities that have become over-extended from their long-term trend.

Weighting and Rebalancing

WGRO weighting structure is based on the four factor scores with a weight range ratio of approximately 2:1, often nearly equal-weighted to avoid idiosyncratic risk. Rebalancing occurs monthly at the close of trading on the second Tuesday of the month. WisdomTree launched the ETF late last month, so we don’t have a long track record to analyze quite yet.

The Pullback Factor

Digging into the factors that determine portfolio positions, investors might be most curious about how the Pullback factor works. It weights long-term momentum by two-thirds and short-term momentum by one-third. It seeks to increase exposure to stable growth equities with positive recent price action.

The Volatility Factor

The Volatility factor analyzes a stock’s standard deviation over one year. There are a couple of mathematical nuances that I won’t dive into, but the goal is to keep long-term volatility of the portfolio in check. By using triangular-weighted volatility (assigning more weight to more recent price action), the ETF tracks more swiftly adapts to sudden changes in volatility.

The DataGraph Factor

The third factor is something O’Neil fans will love. If you’re like me and read “How to Make Money In Stocks” early in your investing career, you know what a DataGraph is. But for those unaware, it’s a proprietary rating system that uses earnings, relative strength, price & volume, industry group rankings, and other factors to find the best growth stocks with relative strength in uptrends. Flip through William O’Neil’s book, and you’ll see DataGraphs embedded on the charts.

The Hotness Factor

Hotness is the final factor. It’s a proxy for how much crowding is in a name. Intending to lower portfolio standard deviation, the hotness factor seeks to screen out stocks with high short-term speculative interest.

ETF Details

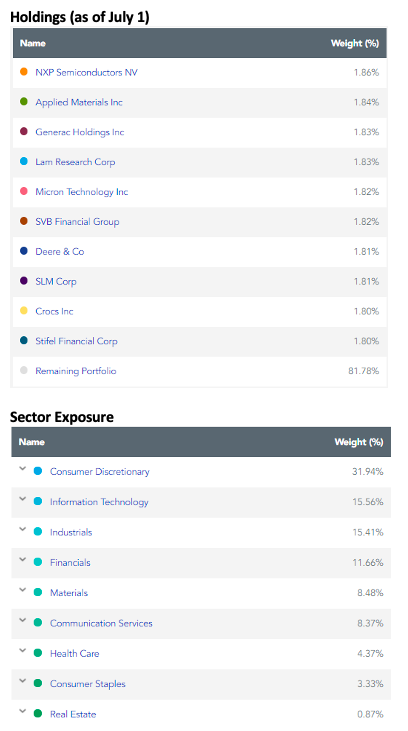

WGRO’s current portfolio, rebalanced on Tuesday, July 13, is 31.9% Consumer Discretionary, 15.6% Information Technology. With MTUM’s 33.2% exposure to Financials, you might be curious about WGRO’s exposure to that value sector—it’s just 11.7%. So WGRO will move materially differently than MTUM. The ETF tracks the O’Neil Growth Index. WisdomTree provides additional details on the index.

I also like to investigate the tradeability of an ETF; WGRO’s median bid/ask spread is 0.19% (average daily since the June 24 inception). WGRO’s expense ratio is 0.55%, above MTUM’s 0.15% and VFMO’s 0.13%.

The size factor is another important determinant of returns. WGRO’s median market cap (before the latest rebalance) was $37.7 billion with 69% exposure to mid-caps and 31% in large caps. For perspective, the Russell 1000’s median market cap is north of $200 billion.[iii]

Holdings as of July 1, 2021:

Conclusion

WGRO takes a different approach to momentum investing. The fund, based on the O’Neil Growth Index, seeks to provide upside during growth-led markets while limiting downside risk during corrections. I look forward to tracking WGRO against other momentum ETFs—particularly if we see heightened market volatility.

[i] https://stockcharts.com/h-perf/ui?s=SPY&compare=MTUM&id=p11932411756

[ii] https://investor.vanguard.com/etf/profile/portfolio/vfmo

[iii] https://investor.vanguard.com/etf/profile/portfolio/vong

I am a Chartered Financial Analyst (CFA) and Chartered Market Technician (CMT). I have passed the coursework for the Certified Financial Planner (CFP) program. I look to leverage my skills in a consultant role for financial advisors – that could be portfolio analysis, planning, writing etc. Please reach out to me at mikeczaccardi@gmail.com for more information. Connect on Linkedin.

Twitter: @MikeZaccardi

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.