With the Fed pivot last week and the inversion of the yield curve, investor sentiment has swiftly surrendered to the bearish side. Indeed, it’s entirely possible that the Fed even takes preemptive action and eases further e.g. with rate cuts.

But here’s at least a hypothetical question, what if inflation comes back faster than we expect?

The chart of today’s post comes from some work I did last week in a special report where I looked at some scenarios for the Fed, and what we might expect next.

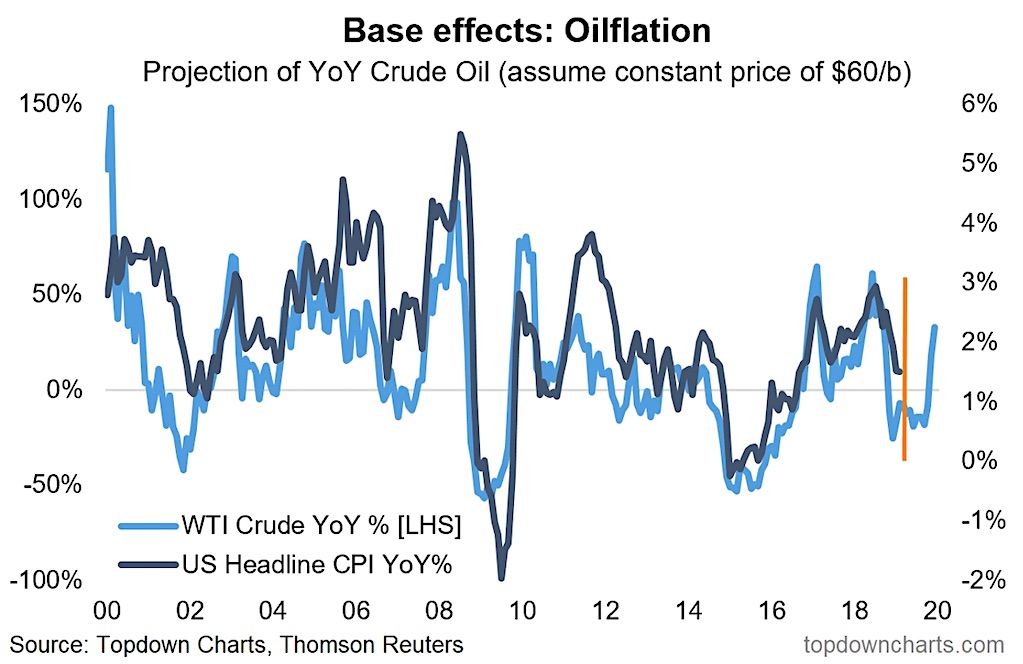

The chart shows US headline CPI inflation against the YoY change in the WTI crude oil price.

US Headline CPI Inflation vs YoY Crude Oil Price

You’ll notice there’s a projection period, and for argument’s sake I’ve shown the YoY change in WTI crude oil if you assume a constant price of $60 per barrel.

Two things are clear: firstly there is a loose but obvious relationship between the YoY change in crude oil prices and the consumer price index. Secondly, you’ll notice the projection period features a sharp tick-up in the YoY change by the end of the year.

To be sure, the Fed typically will look through headline CPI and the swings in commodity prices, to an extent. But there often is feed-through of these transitory type inflationary pressures into wider price setting if it’s sharp enough or prolonged enough.

More to the point, if the slowdown we’re currently going through ends up to be a passing growth scare, and inflationary and wage growth pressures pick right back up, then adding a surge in oil-driven inflation would only compound the effects.

It’s just an alternate scenario, but given that $60/barrel is not an overly ambitious level (my view = oil goes higher), it’s something to keep in the back of your mind as the year progresses…

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.