For the past year, the Federal Reserve has stuck to its guns on the idea that supply-chain disruptions are causing a short-term increase in inflation, and that in 2022 inflation will decrease towards their 2% target.

However, with continuous news of job shortages, shipping problems, rising food costs, and more, it doesn’t look as though inflation is going away anytime soon.

On top of that, the Core Consumer Price Index, which the Fed uses to gauge inflation has shown yet another increase of 0.2% in September bringing it up to 4% year over year.

Now the Fed is faced with a shift of changes that are not so transitory.

For instance, a mass wage increase has spread across the United States along with rising rent prices.

Both rent and wage increases tend to stick in price as landlords don’t look to decrease rent and employees don’t expect their jobs to suddenly pay less.

This leaves the Fed with their back against the wall as they don’t want to cause worry but should face the fact that the longer it takes for the country to get back to pre-pandemic times means a continued shift in living costs.

With that said, what does this mean for the market as investors seem to be catching the hint that pandemic related issues and rising inflation will continue into 2022?

One possibility is the market could easily run into a stagflation type of environment with continued growth but more rangebound market price action.

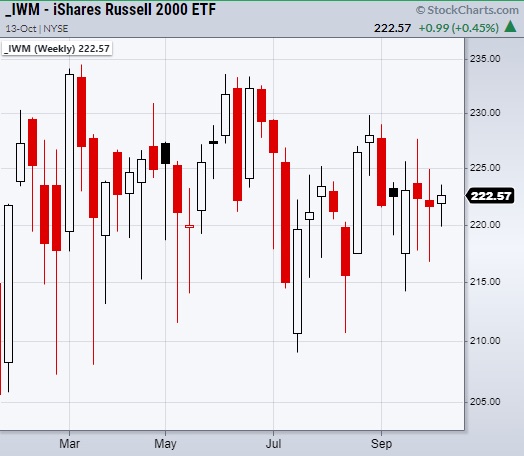

A great example is the small-cap index Russell 2000 (IWM) which has been rangebound for most of this year.

While the other major indices have continued to new highs IWM has made little progress.

Even with the recent market pullback the other major indices have struggled to make a clean rebound and are looking a bit choppy.

Currently, the intermarket relationships are still friendly right at the start of earnings season. Should earnings do well, that could spark a rally into December with the risk gauges positive.

However, these relationships can also deteriorate if like with JPM, earnings create stress.

If this is the cause, and market momentum continues to fade, then like IWM, we should begin to watch if the other indices including the S&P 500, Dow Jones, and Nasdaq 100 begin to show real warning signs of impending stagflation.

Watch Mish talk about meme stocks on Making Money with Charles Payne!

Stock Market ETFs Trading Analysis:

S&P 500 (SPY) Held the 10-day moving average at $434.

Russell 2000 (IWM) Consolidating with price support at $216.76. Trading back over the major moving averages.

Dow Jones Industrials (DIA) Weak close over the 10-day moving average at $343.65.

Nasdaq (QQQ) Also held its 10-day moving average at $358.75.

KRE (Regional Banks) Needs to get back over $70.

SMH (Semiconductors) $249.02 is price support.

IYT (Transportation) Large range day. Sitting on major moving averages at $250.

IBB (Biotechnology) $153.38 is price support.

XRT (Retail) Holding the 200-day moving average at $89.52.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.