The Transportation Sector ETF (IYT) bounced off $268 closing +0.32% on the day.

This was a pivotal level to hold and becomes more important when compared to the rest of Mish’s Economic Modern Family.

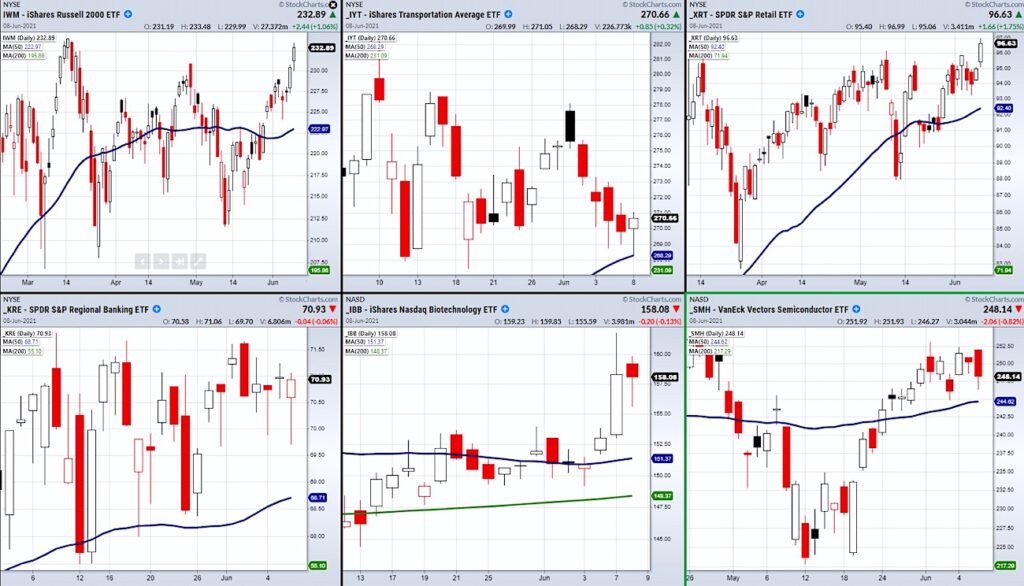

Besides IYT, the Family consists of the Retail Sector ETF (XRT), Regional Banking ETF (KRE), Biotech Sector ETF (IBB), Semiconductors Sector ETF (SMH), and the small-cap index Russell 2000 ETF (IWM).

This Family of sector and index ETFs provides an easy way to grasp a quick picture of the overall stock market direction.

As seen in the charts above, the Transportation Sector ETF (IYT) was the only member to test its 50-Day moving average (DMA).

Moreover, while other members are not far from their 50-DMA, we have paid special attention to the transportation sectors as it shows investors sentiment towards the movement of goods.

The general idea is that if the movement of goods begins to slow it could be a warning signal for the rest of the market which relies upon its long-term strength to push to new highs.

While IYT held this specific price level, IWM and XRT cleared their important levels.

The Russell 2000 ETF (IWM) was able to clear resistance from its previous high on 4/29 at $230.95 and retail XRT broke its high from 3/10 at $96.27.

With that said, the market has not been easy to trade and while IYT was able to hold over $268 Tuesday, the volatility near these pivotal price areas has increased.

Therefore, we can continue to watch for these breakout and support prices to hold going through the week.

It should also be noted that Thursday, the CPI (Consumer Price Index) report is released, which is a way for the Fed to gauge the rate of inflation and progress of the economy.

While the Fed has kept a firm stance that it does not want to make any changes until it has seen a larger economic recovery, the report still can hint towards policy adjustments later down the road.

Stock Market ETFs Analysis & Summary:

S&P 500 (SPY) 422.82 needs to clear and hold. Bounced off the 10-DMA 4.20.26

Russell 2000 (IWM) 234.53 high to clear.

Dow (DIA) 351 resistance. 342.43 support.

Nasdaq (QQQ) 338.19 resistance area.

KRE (Regional Banks) Holding 70.00 with 71.82 resistance.

SMH (Semiconductors) 244.61 support. 258.59 resistance.

IYT (Transportation) 268.30 the 50-DMA.

IBB (Biotechnology) 159.30 resistance area.

XRT (Retail) Cleared 96.27 resistance.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.