The often-cited investment adage that stocks go up in the long run seems to apply just about everywhere except Japan.

The Nikkei index is still below its peak in 1989, and many of the attempted reforms, ranging from monetary, fiscal, and governance, have fallen short and disappointed equity investors. Perhaps these factors contributed to the creation of yokocho drinking alleys, helping investors drown their sorrows (a must-visit for any trip to Tokyo).

Despite all this, we have recently become increasingly positive on this subcategory of global equities.

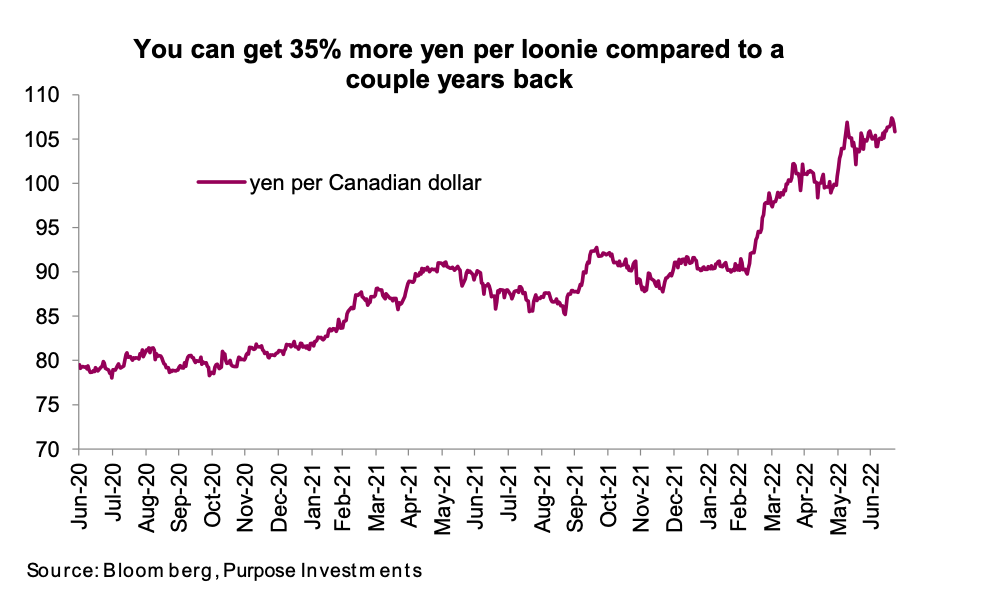

There is no denying the Japanese yen has been crushed. The Bank of Japan (BOJ) is the last major central bank still in the dovish camp while by any measure the rest have become hawkish. At the other extreme end of the dovish/hawkish spectrum are the Bank of Canada (BOC) and the U.S. Federal Reserve (Fed). Based on market expectations and pricing, both are on a path to raise rates many more times this year in efforts to combat inflation. While inflation in Japan has picked up, after decades of fighting deflation and stronger demographic headwinds, the BOJ has opted to remain dovish. No surprise, this has been very negative for the yen and very positive for the CAD and USD.

The above chart is more pronounced against the USD, and less so against many other currencies but shows a similar trend – a weaker yen. We often view developed market currencies as a zero-sum game in the long term but there can be opportunities or headwinds. With the yen down so much against the loonie, we believe there is an opportunity from a few perspectives.

Currency potential

At the moment, the BOJ is at one end of the dovish/hawkish spectrum with the BOC and the Fed at the other. However, with inflation starting to crack and economic growth slowing quickly, we believe this spread will narrow. Maybe the BOJ will become a little less dovish and/or the other banks will become less hawkish. Any combination would lead to a rebound in the yen/CAD, which is positive for unhedged exposure to Japan.

Loosening restrictions

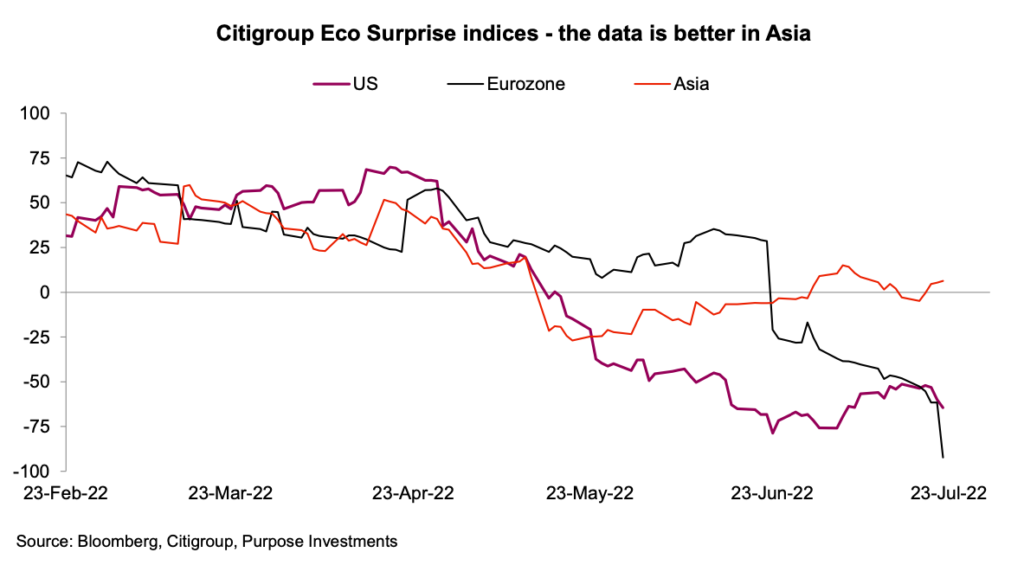

It is not just currency though. Most Asian economies have remained on stricter lockdown protocols, given less efficacy/penetration of vaccines plus a much higher population density. And while we have long given up trying to guess the path of this pandemic, it appears that many Asian countries are loosening restrictions. When North America and Europe “opened up,” there was a material boost to economic activity. In 2021, the U.S. economy grew by 5.7%, Canada by 4.6%, and Europe by 5.2%. Asia has some catching up to do with the reopening boost.

Economic conditions

However, many nations in Asia are in the emerging market category, which we do not have a positive investment view on (see last week’s Ethos). While Richardson Wealth is positive on the Asian economies, we are less enthusiastic on the equity markets. Enter Japan. As a developed economy, it would benefit from thereopening economic boost of the region while being less at risk from the emerging market headwinds.

There is no denying global economic growth is showing a softening trend. However, this trend is softer in Asia and several countries are seeing economic forecasts tick higher. The Japanese equity market enjoys about 50% of sales from international trade and operations; it is more international than the S&P 500. Now these companies are even more competitive given the lower yen.

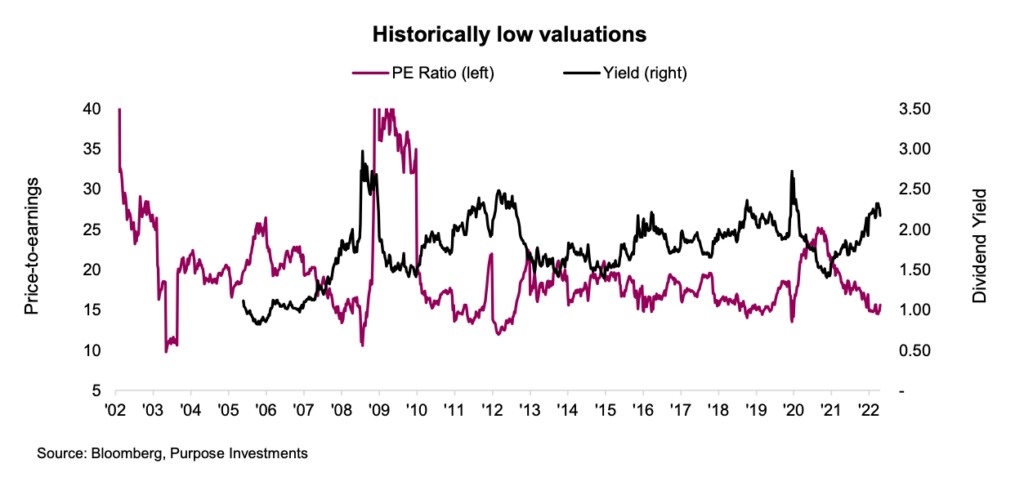

Valuations improving

Finally, valuations are certainly attractive. Most metrics, including price-to-earnings are at or near multi-decade trough levels. Even the yield is improving as more companies have been increasing cash flow back to investor viadividends and share buybacks.

Impact on portfolios

There are several positives for Canadian investors: the yen is on sale, the Japanese equity market is on the cheap side, and the region appears to be better poised for growth than most others. But there are also negatives: the Covid lockdowns could tighten, China certainly has a real estate issue now that could spill over, and the BOJ could misstep. Overall however, we think the risk/reward appears attractive at this point.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.