This update on Silver prices follows our February post in which we wrote that traders should expect a corrective rise in silver prices. Our analysis suggests the precious metal will continue to move higher into summer. Herein we offer some price targets to watch for Silver itself and also for the iShares Silver Trust ETF (SLV).

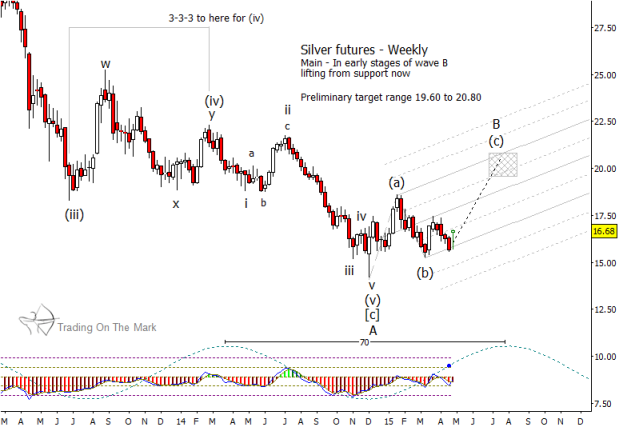

As context, we had long been watching for precious metals to make an intermediate low around November or December 2014. Late on a Sunday night, Silver prices spiked downward into our price target area. At the same time, Gold made a higher low which we view as a truncated fifth wave that marked an end to the decline. The late-2014 low for both precious metals probably represented the completion of downward wave A of a larger A-B-C correction. Now prices are moving upward in a choppy, corrective B wave.

Ideally the B wave in Silver should have a three-part structure, which we have labeled as (a)-(b)-(c) on the weekly chart below. Wave (b) reached lower than the support area we mentioned in our earlier post, but price rallied and now appears to be making a higher low as part of upward wave (c).

Silver Prices (Futures) Weekly Chart

The most likely price targets for the next move in silver are $19.60 and $20.80, but other factors may intrude to cause the present move to terminate somewhere between those levels. One such factor is resistance that we expect silver to find near the top of the Schiff channel we have drawn. Another factor is the dominant 70-week price cycle for silver, which puts the ideal timing for a peak in July 2015. (Readers who acted on our earlier post about silver should note that we now believe silver is unlikely to reach the higher price target of $28.10 that we showed in earlier versions of the chart.)

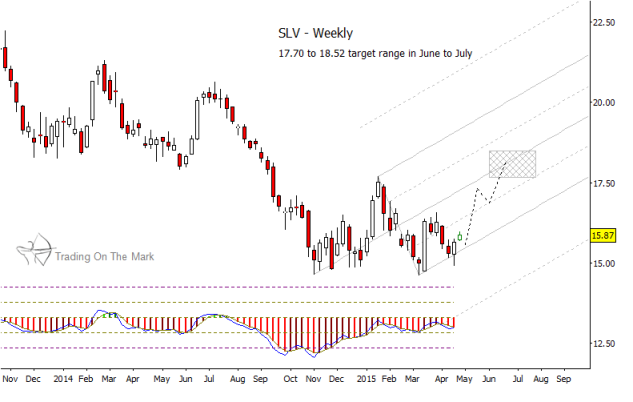

The next chart shows a similar target for a prominent Silver ETF (SLV). The Elliott wave structure going into summer should be approximately the same for SLV as for the commodity despite some differences in the positions of highs and lows in the price history. Our target area for SLV ranges from $17.70 to $18.52, although price may be affected by channel resistance and cyclical factors as described above.

iShares Silver ETF (SLV) Weekly Chart

We caution traders not to become too attached to a long position in precious metals. If our primary counts are correct, prices should begin a new leg of their decline this summer which could lead to a new low in 2016.

At our website Trading On The Mark, you can find a parallel analysis for gold and a related ETF as well as information about how you can receive several free “insider” posts that are normally exclusive to our subscribers.

Follow Tom & Kurt on Twitter: @TradingOnMark

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.