It’s no secret that gas prices significantly impact the economy, discretionary spending, and stock market prices.

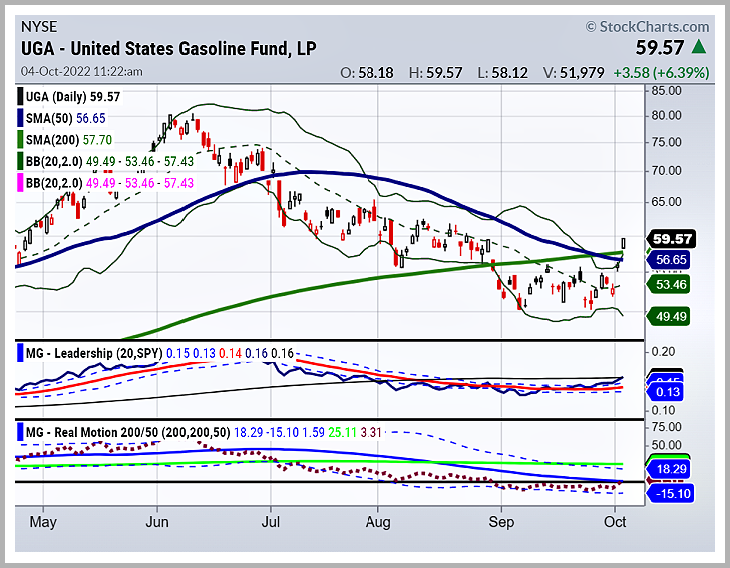

Gas prices were at record highs following an incredible run-up over the summer and have declined steadily until recently, as represented by the United States Gasoline Fund (UGA).

Treasury yields have fallen, the dollar has softened, and oil has risen recently as OPEC+ announced it was contemplating cutting output by as much as 2 million barrels per day.

These combined moves caused UNG, a U.S. gasoline ETF, to rise almost 10% over the last five trading days.

As traders speculate on a less hawkish Fed, stocks and oil continue to rebound sharply.

While higher gasoline prices are good news for oil producers, they are an ominous sign for the global economy and the stock market.

Gasoline prices have moderated until very recently in the U.S. partially due to less global demand. The White House also released Strategic Petroleum Reserves to subsidize costs.

The U.S. Gasoline Fund started the session in a bearish phase, then gapped higher, transitioning to an accumulation phase. That represents the first signs that the steady price decline of gasoline might be over.

The price of UGA ticked up to 59.57 recently and crossed over the 50-day moving average and the 200-day moving average. Depending on the slope of the continued move, a transition to an accumulation phase presents profitable trading opportunities.

The war in Ukraine seems to be escalating, and the recent price gains in UGA could signal a new uptrend. As an investor, you should pay close attention. This accumulation phase can represent a significant potential market shift.

Central banks are also keeping a close eye on the situation because a steep increase in gas prices could lead to global stagflation. All of this can eventually lead to a decline in stock prices.

So, keep an eye on high gasoline prices, which could be bad news for stocks.

Check out Mish’s latest media:

BNN Bloomberg-Unraveling? 09-30-22

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) 370 support and 380 resistance

Russell 2000 (IWM) 173 support and 176 resistance

Dow (DIA) 297 support and 303 resistance

Nasdaq (QQQ) 279 support and 283 resistance

KRE (Regional Banks) 61.40 support and 64.00 resistance

SMH (Semiconductors) 194 support 200-201 resistance

IYT (Transportation) 206 support and 212 resistance

IBB (Biotechnology) 121.00 support and 124.25 resistance

XRT (Retail) 58.70 support and 62.75 resistance

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.