The broader stock market has made a nice recovery from the September pullback.

Yes, it was just a pullback. And not even a strong pullback at that.

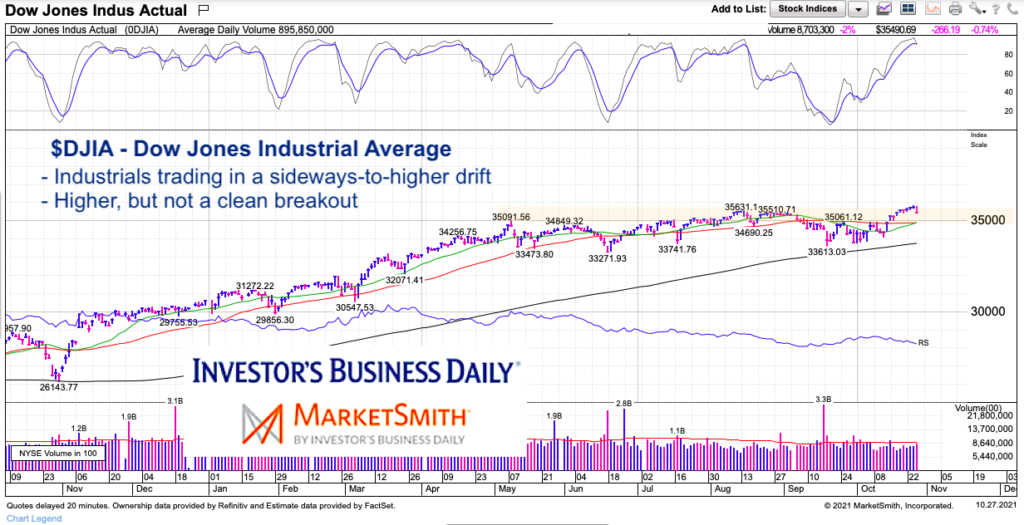

After months of sideways action on the Dow Jones Industrial Average (even though we made new highs), this stock market index needs a refresh and strong breakout.

Sure the Dow Jones Industrials pulled back a bit into October and the index is now rallying… but the overall picture says drift up to 36,000-37,000 then head markedly lower. Or correction soon, then head higher.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of analysts, education, and technical and fundamental data.

Dow Jones Industrial Average Chart

After a lot of blah, blah, blah above, the bottom line is that the Industrials have traded sideways much like the Russell 2000 Index. And while it is good that the index made slightly higher highs, it has been uninspiring. The S&P 500 and Nasdaq may continue higher and pull the Dow Industrials up to the 36,000-37,000 before a correction. My thoughts are to look elsewhere for index ETFS, or below the surface for outperforming stocks. The Industrials will need a true refresh at some point to fuel a bigger breakout.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.