Does a good trading app necessarily become a good stock?

For many investors, the Robinhood IPO (stock ticker: HOOD) represents their first foray into an equity offering. While accessing the equity markets at a relatively low cost certainly seems to empower individual investors, it also appears to magnify behavioral biases such as overconfidence, overtrading and confirmation bias.

In today’s video, we’ll review the strengths and weaknesses of Robinhood the company, discuss some of the behavioral challenges facing Robinhood users, and identify key price levels that could prove significant for Robinhood the stock $HOOD. Here are a few questions we address in today’s video:

- How can traders accommodate for the fact that their own goals and the goals of their brokerage are actually quite different?

- What behavioral biases are evident in the price of Robinhood’s stock $HOOD, and how can investors minimize these biases in their investment decisions?

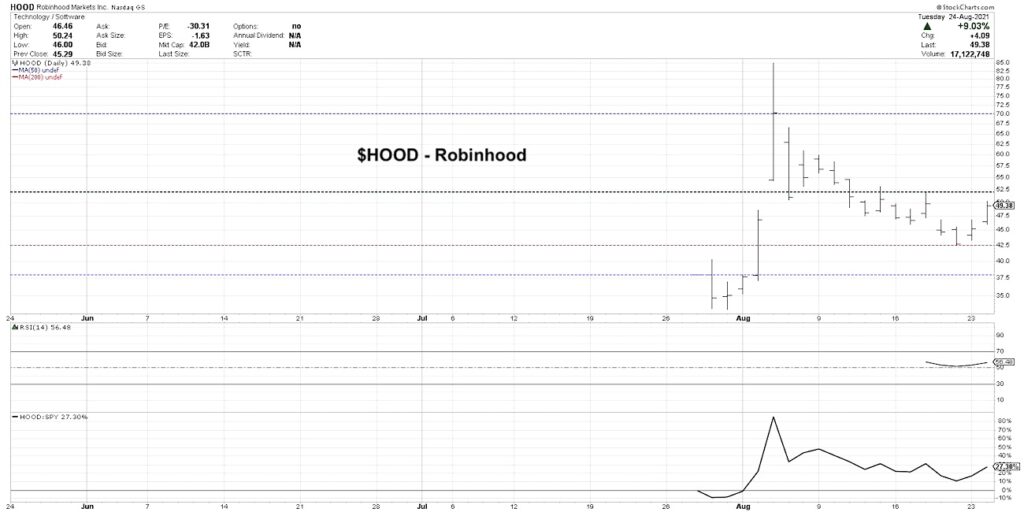

How does $HOOD’s first month of stock trading compare to similar IPOs, and what key “lines in the sand” should investors focus on to better manage risk vs. return?

One Chart [VIDEO]: A Closer Look At Robinhood’s Stock $HOOD

Robinhood Stock Price Chart

Twitter: @DKellerCMT

The author may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.