- The bull market has broadened out, and several non-tech Investor Days, Analyst Days, and Business Updates could offer color on the Main Street economy

- Improved manufacturing sentiment sets the stage for fresh corporate commentary

- Along with Q4 earnings and early-year conferences, these investor events offer both qualitative and quantitative color

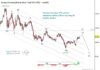

Tech stocks and the AI trade have powered global markets ever since the bull run began in October 2022. This year’s gains, which include record highs from Japan to Europe, have featured a fresh set of leaders. In the U.S., Energy and Materials have led the way, posting collective double-digit returns through early February. Not far behind are other “real economy” stocks from the Consumer Staples and Industrials sectors.

Often, this “sector rotation” is taken as a positive, particularly when the S&P 500 is able to maintain high levels as the alpha baton is passed. Some pundits, however, have grown concerned that late-cycle industries and even defensive niches are beginning to outperform—now more than three years into the bull market.

No matter the outcome—bullish or bearish—there’s more focus on cyclical and value companies right now. We’ll get two more of the Mag 7 companies reporting numbers this week, but away from Alphabet (GOOGL) and Amazon (AMZN), key macro clues will come from non-tech sectors. What’s more, corporate events such as investor conferences, shareholder meetings, interim data, analyst forums, and business updates buttress financial statement releases.

Our team spotted a handful of such gatherings from non-tech, blue-chip firms in the next several weeks that may shed light on the state of the manufacturing and Main Street economies. These events come after the best Institute for Supply Management (ISM) U.S. Manufacturing Purchasing Managers Index (PMI) reading since August 2022, released this past Monday. A new leg to the bull market may indeed be getting underway—not from tech, but from old-school areas. Here are the notable events that will help us figure that out:

Thursday, February 5: Xcel Energy 2025 Year-End Webcast

Power generation will surely be a main topic at Xcel Energy’s (XEL) Analyst Day, to be held immediately after its Q4 2025 earnings hit the tape. The $44 billion market-cap Utilities sector stock has stumbled since notching record highs late last year, but it’s not alone. The S&P 500 Utilities sector continues to wobble as monumental shifts occur in the once-quiet, small sector.

A dividend aristocrat, shares are up about 10% in the past year, and its management team outlined a more aggressive capex plan within its Q3 report back in October. We’ll see what project developments are detailed, along with trends in the all-important AI infrastructure buildout, tomorrow morning.

Tuesday, February 10: Williams Company Analyst Day 2026

Williams (WMB) will also focus on the energy market. The $81 billion market-cap Oil and Gas Storage and Transportation company weathered several significant winter storms relatively unscathed. Back in November, it too signaled a major investment initiative—namely a $5.1 billion power innovation capex endeavor—along with a stout 9% annualized growth projection.

Income investors often look to midstream Energy-sector companies for steady, rising dividends, but there may now be a key growth component. U.S. power demand is finally on the rise after years of modest to stagnant increases. We’ll hear the latest trends next Tuesday, just after its Q4 results post.

Thursday, February 12: FedEx Investor Day 2026

Among the most widely anticipated events this month is the FedEx (FDX) Investor Day on the 12th. CEO Raj Subramaniam has faced many macro curveballs during his tenure, requiring pivots and fresh strategies. This year, the Memphis-based Air Freight and Logistics industry company will spin off its FedEx Freight unit by June 1.

FDX beat earnings last December, with shares taking off following a years-long holdup. Higher by more than 50% in the past six months, the tone at the Investor Day should be upbeat. While nobody knows for sure what will be introduced, when companies hold these sorts of events, they often don’t do so to report bad news.

Monday, February 23: JPMorgan Chase & Company Update 2026

JPMorgan Chase (JPM) may have some housekeeping to address at its Business Update on Monday, February 23. The most valuable U.S. bank is transitioning back to a first-quarter reporting schedule, but that won’t be what Wall Street focuses on. The gathering will include an operational overview and a potentially market-moving Q&A with JPM’s executives.

Recall that shares tagged an all-time high on January 6 but then dipped into earnings. A further fall resulted in a 12% early-year drawdown. Can the stock bounce back on the heels of the upcoming event? Early clues could come on Tuesday, February 10, when co-CEO Troy Rohrbaugh presents at the UBS Financial Services Conference.

Wednesday, February 25: L3Harris Technologies Investor Day 2026

Tuesday, March 10: Howmet Aerospace Technology & Markets Presentation 2026

A pair of Aerospace & Defense firms—L3Harris (LHX) and Howmet Aerospace (HWM)—will host briefings in the weeks ahead. Like the banks, defense stocks have come under pressure to begin 2026. Both names were also mentioned in President Trump’s Truth Social posts—in a negative light. A floated credit card interest rate cap hurt the likes of JPM, while threatened capital controls (limits on dividends and stock buybacks) were aimed at LHX, HWM, and their peers.

LHX dipped after reporting Q4 results last week, while HWM reports in the pre-market on Thursday, February 12.

The Bottom Line

Leadership within the bull market appears to be broadening, with capital rotating toward cyclical, value, and real-economy sectors. Upcoming corporate events across Utilities, Energy, Industrials, and Financials may offer key insight into whether economic momentum is strengthening beyond tech. If these updates reinforce improving fundamentals, they could signal a more durable and diversified next phase of the bull market.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.