The new Mish’s daily market update format is here.

Welcome to Mish’s Market Minute, an avatar (of me) that will give you analysis and actionable information in less than a minute.

The true meaning of the word “minute!”

I will try to deliver content on Monday, Wednesday and Friday.

Watch the video here

Accompanying the avatar link is a description of the topic covered.

Mish’s Market Minute:

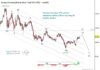

Bitcoin flashed another death cross—but is that the real signal traders should watch?

In this Market Minute, I break down how the 50-day and 200-day moving averages behave in Bitcoin and why the slope of the averages matters more than the crossover.

We cover how past cycles in 2022, 2023, and 2025 help frame what may come next.

This technical analysis focuses on trend confirmation vs noise, showing when moving average crosses signal real momentum shifts—and when they don’t.

If you follow Bitcoin using charts, trend analysis, or moving averages, this is a must-watch.

👉 Watch. Like. Share. Subscribe.

PLEASE, go to our YouTube Channel, watch the content we have shared to date.

👉 Watch. Like. Share. Subscribe.

Topics covered:

• Bitcoin death cross vs golden cross

• 50-day vs 200-day moving averages

• Why slope confirms trend direction

• What history suggests about the next move

January 27 NYSE Is Crypto the Next Silver?

January 26 PreMarketPrep Did you expect this much volatility so soon?

January 26 Yahoo Finance Metals, Stock Rotation, Earnings and the Thrill of it All

Coming Up:

February 5 BTT TV Financial Compass with Mish

February 9 CNA Asia

February 11 BFM89.9 Malaysia

ETF Summary

(Pivotal means short-term bullish above that level and bearish below)

S&P 500 (SPY) 685 the 50-DMA holding for dear life

Russell 2000 (IWM) 255 the 50-DMA support

Dow (DIA) Strong and if holds will make a new all time high

Nasdaq (QQQ) The weakest-that’s new-600 big support through 620 better

Regional banks (KRE) A leader-who would have thunk it

Semiconductors (SMH) 368-370 clutch support

Transportation (IYT) New highs-great sign for the economy

Biotechnology (IBB) 170 support

Retail (XRT) We watch 91.25 to clear, 88 to hold

Bitcoin (BTCUSD) 65k area huge support. Oversold so watch 80k resistance

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.