The oil market has the media spotlight with projected prices continuing to rise.

Shortages, inflation, and economic growth have all been major factors in the price of oil trending higher throughout this year.

With gas at a 7 year high, pressure has been mounting on the Biden administration to ease the consistent price climb.

However, this leads to the current disagreement between the U.S and OPEC (Organization of the Petroleum Exporting Countries).

While the U.S and other countries have entertained the idea of releasing personal oil reserves to calm prices, OPEC has responded with a warning that if the U.S, India, China, and South Korea all release oil, they will not ramp up their crude oil productions.

They believe that the oil market will swing into a surplus cautioning haste on releasing too much oil.

From the inflation side, JP Morgan created a study on oil prices compared to equities adjusted through inflation, showing that going back 20 years if oil had followed equities percentage increase (excluding the Nasdaq index), oil would be priced near $115 per barrel.

Currently, the price of crude oil is $78 per barrel. From this standpoint, oil is still much cheaper compared to $115.

However, with so many moving parts and potential manipulation from OPEC, it’s tough to gauge where price should be based on growing demand.

Pulling away from fundamentals, charting can add more perspective to oil’s short-term future.

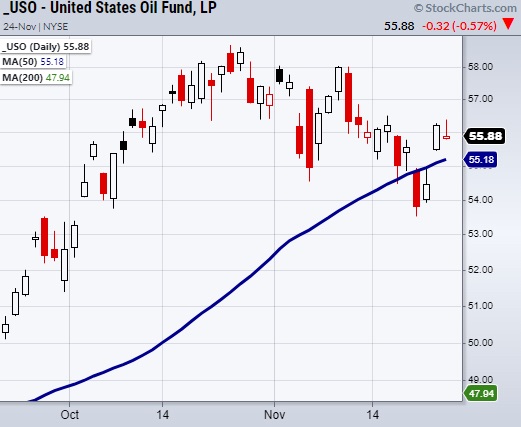

Above is a chart of United States Oil Fund ETF (USO).

Currently, USO has made a second close over its 50-Day moving average (DMA) confirming a bullish phase.

Though it is within a recent downward trend if USO can hold over its 50-DMA at $55.18 or its 10-DMA at $55.53 we could see it run back to highs near $59.

On the other hand, if USO breaks down, watch the support area from $53.50 – 54.50 to hold.

Either way, consumers are looking for cheaper prices which OPEC is hesitant to meet through adding supply.

Therefore, it will be interesting to watch the oil market going forward if demand continues to outpace supply thus putting pressure not only on travel and movement of goods but the current U.S administration.

Watch Mish’s recent appearance on Making Money with Charles Payne!

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) 464.45 is new price support to hold.

Russell 2000 (IWM) 228.26 is price support at the 50-day moving average.

Dow Jones Industrials (DIA) Watching 355.34 to see if it holds.

Nasdaq (QQQ) Watching to see if it stays over the 10-day moving average at 397.62.

KRE (Regional Banks) 75.75 is price resistance area.

SMH (Semiconductors) 300 is price support.

IYT (Transportation) 270.89 is price support.

IBB (Biotechnology) 150.21 is new price support.

XRT (Retail) Sitting in support from prior trading range.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.