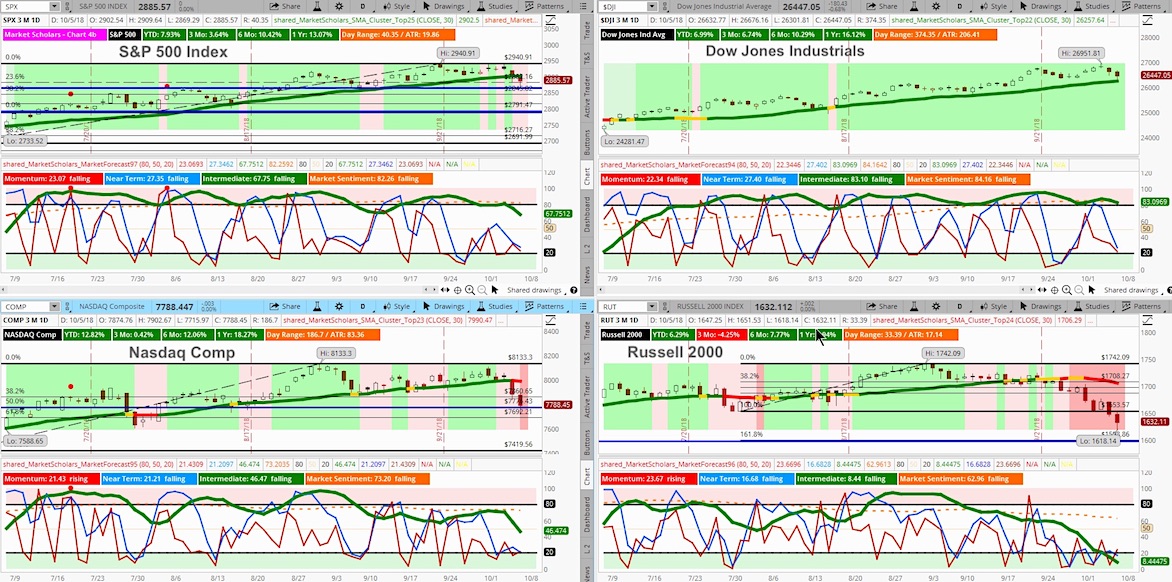

It was a rough week for stocks… and especially small cap stocks (Russell 2000) and tech stocks (Nasdaq).

The S&P 500 is also showing a new bearish posture but long lower shadows the past two days suggests bearishness is weak.

The S&P 500 sits at support with multiple layers of even stronger support below current levels.

All the major indexes are trading near support levels. The NASDAQ is sitting at its prior intermediate high from late June that aligns with the 50% retracement level of its current intermediate run.

The Russell 2000 showed a long lower shadow on Friday after trading near its 200-day MA. It produced a similar pattern in early July during stocks’ previous intermediate pullback.

Below is our weekend market outlook video… and further below is a summary of the video.

Weekend Market Outlook Video – October 6

Summary of video with analysis:

– S&P 500 expected to show some weakness next week trading in the lower end of this week’s range as it produces a similar intermediate pullback to early July.

– Multiple seasonality factors, including end-of-year, presidential cycle, strong January result and 6-month win streak specifically from April to September, all point to end-of-year strength heading into 2019

– Volume, volatility and trading ranges were large enough to point to more than a just a near-term pullback but not extreme enough to suggest we’ll automatically bounce back Monday. Expect more weakness into next week

– Extreme moves this week in bonds and relative strength of small-caps to large caps suggest major shifts continue to take place

– Yield spread is rising – but not due to falling short-term yields but from rising long-term yields. This pattern suggests long-term growth expectations are stronger right now than current inflation expectations. This is a good sign for stocks and suggests any pullback we have right now may set up for a bounce to new highs by early next year.

– Foreign stocks are struggling with the short-term move higher in the dollar this week. Expect any dollar strength to be temporary with rising commodity prices and Treasury yields.

– Sector rotation supports this idea as well with Industrials, Energy improving and Technology and Discretionary continuing to lag

– Neutral trade idea in Materials sector that shows how to trade when short-terms moves contradict long-term expectations

Twitter: @davidsettle42 and @Market_Scholars

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.