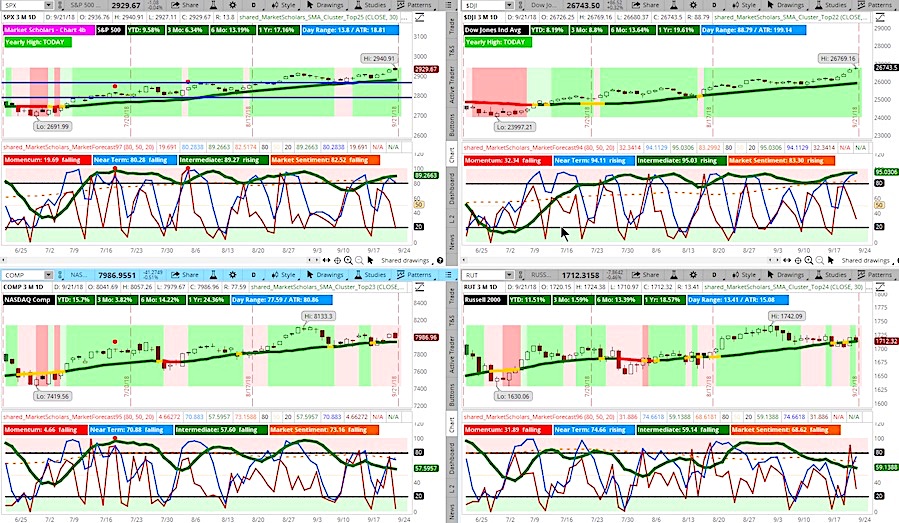

The S&P 500 and Dow Jones Industrials made new all-time highs as stocks finished another strong week.

It’s notable that all 4 major stock indices are well above their 200 day moving averages (bullish but could limit upside).

We’ve seen interesting price action the past two days as heading into expiration with expected weakness coming out of September expiration and before October Q3 earnings season according to seasonal trends

In this week’s “Weekend Market Outlook” we will discuss key stock indicators and trends, the week ahead, and a handful of current trading setups. See a summary with charts further below.

Market Outlook Video (September 22):

– S&P’s intermediate trend continued higher for second consecutive week but with more short near-term rallies and culminating with possible bearish near-term divergence this week

– S&P 500 and Dow Industrials showing overbought clusters on weekly Market Forecast charts despite weak bearish postures already on NASDAQ and Russell 2000

- Bearish divergences setting up on MACD and Stochastic indicators

- Big volume today with most of the volume to the downside late in the day ahead of busy economic calendar next week

- Volatility dropped to extremely low levels according to VIX-VIX3M ratio

- Dollar reversal suggests relative weakness compared to foreign markets – even if the bullish trend resumes after an expected pullback

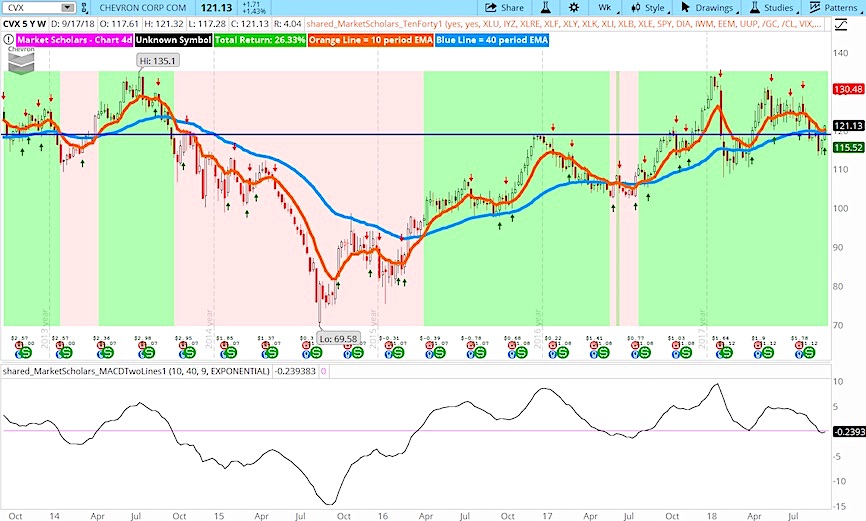

- Sector rotation supports this idea as well with Industrials, Energy and Materials improving and Technology and Discretionary starting to lag

Our Bullish trade idea: In the Energy sector is a stock (Chevron – CVX) with multiple bullish technical signals (more analysis in the video above):

Twitter: @davidsettle42 and @Market_Scholars

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.