As this bull market continues to trend higher and defy nearly all bears along the way, the confusion continues to mount. Recently I noticed two things that really stood out and showed the level of confusion is about as high as it can get: Just look at the difference between what Wall Street thinks of equities and what Main Street thinks of equities here and now.

As this bull market continues to trend higher and defy nearly all bears along the way, the confusion continues to mount. Recently I noticed two things that really stood out and showed the level of confusion is about as high as it can get: Just look at the difference between what Wall Street thinks of equities and what Main Street thinks of equities here and now.

A month ago for Yahoo Finance I touched on some of the major confusion that was out there when looking at various sentiment polls, but what I’m about to show is more anecdotal.

First up, my pal Steven Russolillo of the Wall Street Journal noted that one of the longtime most bearish Wall Street strategist had just turned bullish. He didn’t just turn kind of bullish, he turned super bull in a cape bullish.

Here’s what Steve wrote –

Stifel Nicolaus stocks strategist Barry Bannister, who had been among the most pessimistic prognosticators on the Street, threw in the towel this week on his bearish forecast. He lifted his S&P 500 year-end price target to 2300—the highest among prominent strategists–from 1850, which had been tied for the lowest, according to research firm Birinyi Associates.

Wow. As a guy who claims to be a contrarian, seeing things like this always hit me hard. Sure, we’ve seen this many times before as the bull market has climbed over the years, but that jump from a 1,850 target to 2,300 is really something.

So that was Wall Street’s view. Things look good and the bull should continue. But what about the average investor? How does main street view the stock market?

Well, one of the main reasons I’ve been so bullish for going on five years now is the average investor still doesn’t trust this rally. It is all manipulated by the Fed, algos, computers, QE, whatever other reasons you want to use. I really don’t care why, just that I’m in it. When we see 4% dips like we just did and a total freak out from the masses that the big dip is finally coming, that will continue to be bullish is my view.

Josh Brown, The Chairman of the Twitter Federal Reserve, just pointed out a recent Gallup poll with some incredible results on what Main Street thinks of things. Be sure to read what Josh had to say on this, but here’s his quick summary:

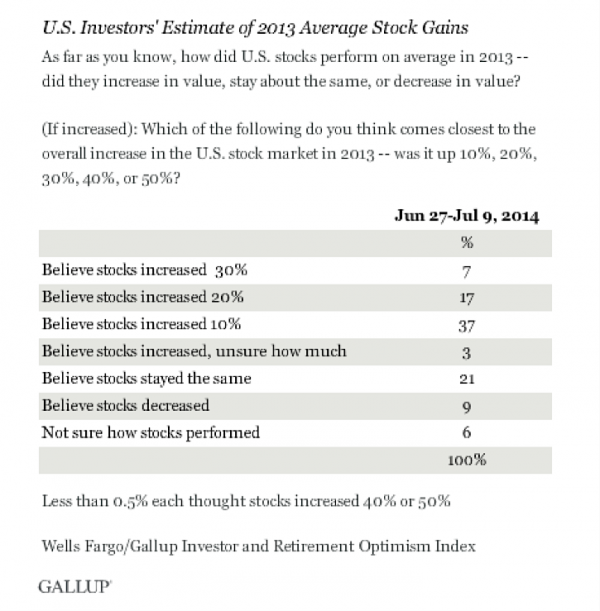

This week we learned that only 7% – SEVEN PERCENT – of Americans are aware that the US stock market went up by 30% last year.

That is just amazing, but honestly I don’t think too far off. Now sure, this poll was just a random 1,000 people, so we have room for some errors. None the less, the average person my age (mid 30s) really doesn’t care the market is making new highs. Or most were in gold and bonds last year, so they have little to no memory at this point how strong 2013 was for equities.

Here’s the data from Gallup.

Now you could get picky and point out the S&P 500 (SPX) didn’t quite gain 30% last year, while small caps sure did. Regardless, most averages were up over 20% last year by a good margin. Only 24% of those polled knew this. What really amazes me is 36% of Main Street think the market was flat to down, or they don’t even have a clue to how last year did. Not sure if this is sad or funny.

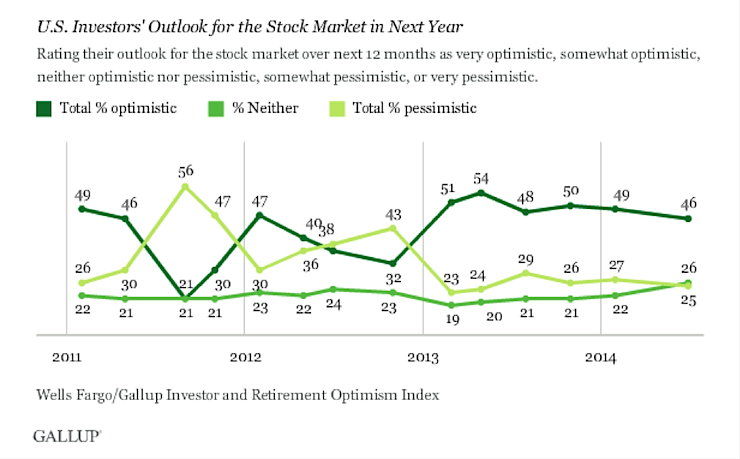

Here’s another eye-opening chart.

The number of those optimistic about the stock market over the next year has been trending lower for over a year now. Again, from a contrarian point of view you have to like seeing this.

So which contrarian indicator is right? Is Wall Street too bullish and the market due for a major correction? Or is the average investor on main street still nowhere close to caring about this bull market and that is bullish?

I still think there are many more positives than negatives and sticking with the trend higher is the way to go.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.