The S&P 500 Index INDEXSP: .INX, Dow Jones Industrial Average INDEXDJX: .DJI and NASDAQ Composite INDEXNASDAQ: .IXIC all rallied more than 3 percent last week cutting the losses for August to less than 2.00%.

The month featured bouts of high volatility that shadowed the shifting trade winds and increased concerns over a slowdown in the U.S. economy.

Triggering last week’s rally was China’s overture to ease trade tensions.

Although there is no evidence of an early settlement to the trade dispute, China is under pressure to resolve the dispute given the U.S. has pending trade deals with our most important partners including Japan, Mexico, Canada and South Korea.

Although the manufacturing sector shows signs of strain, the consumer continues to spend and confidence remains high due to the vibrant labor market and rising wages. More information on the state of the U.S. economy will become available this week with the August jobs data and reports from the Institute of Supply Management (ISM) on the manufacturing and service sectors.

Later in the month the Federal Reserve meets to determine the next step in monetary policy. The stock market has built in a 25-basis point reduction in the fed funds level and at least one more 25-basis point reduction before year-end.

At this juncture volatility is likely to continue with the ongoing worries regarding recession and trade. I believe that in the current environment of low interest rates and a good, but slowing economy along with solid consumer spending backed by low unemployment and rising wages, that there are still investment opportunities.

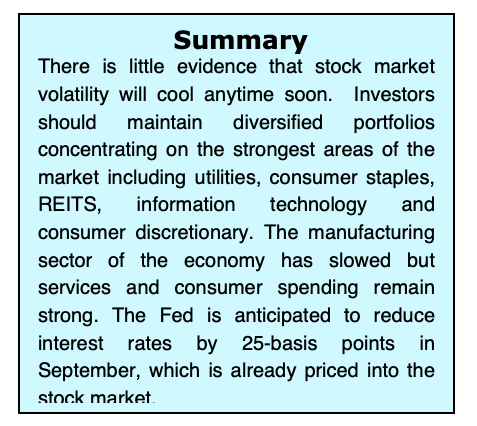

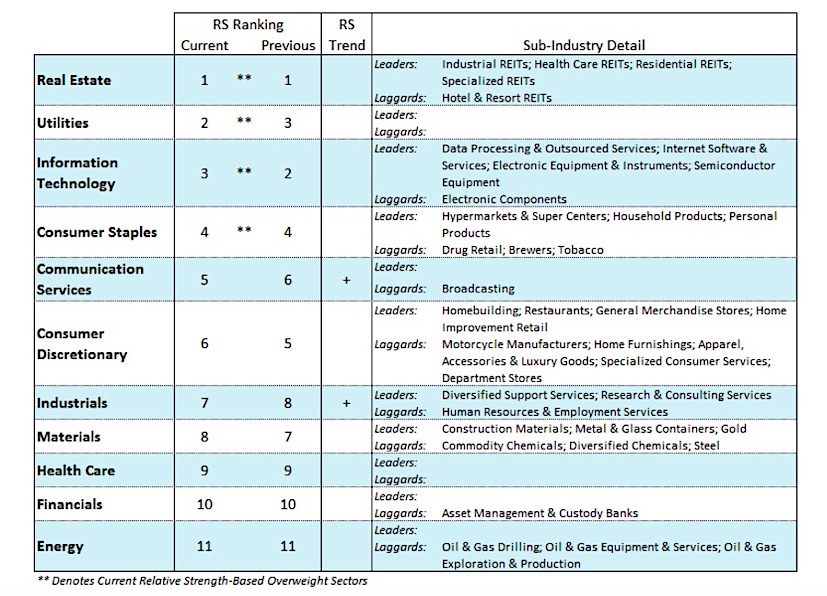

I continue to suggest staying with the defensive areas of utilities, real estate investment trusts and consumer staples, each of which derives less than 5% of their revenues from China (Strategas). All of these sectors have performed well this year and tend to outperform when interest rates are falling. Gold stands near a six-year high and is traditionally a good hedge in times of economic uncertainty. Should the trade situation improve, we will start to look at some of the current laggards such as the industrials, energy and financials.

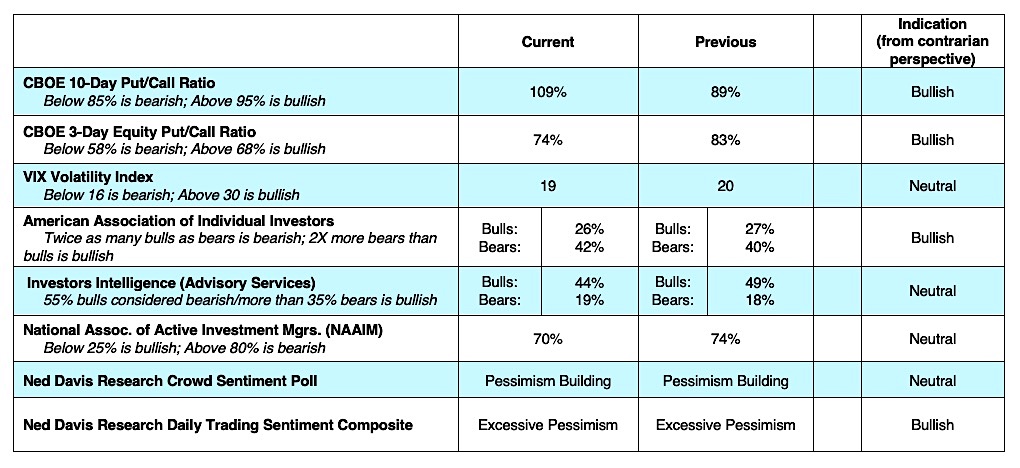

The technical picture is mixed with improving trends in stock market sentiment offset by deteriorating breadth. Measures of investor sentiment including Chicago Board of Options data, the survey from the American Association of Individual Investors (AAII) and Investors Intelligence numbers (II), which tracks the opinion of Wall Street letter writers, point to investor pessimism. From a contrarian’s perspective, this argues that the current rally has more room on the upside.

Meanwhile, deteriorating stock market breadth, from a longer-term perspective, suggests limited upside potential as fewer groups and sectors have participated in rallies. This is seen by the fact that the new highs by the S&P 500 in July were unconfirmed by new highs by the S&P small-cap index, the Dow Transports and most foreign markets. The percentage of world markets above their 50-day moving average has fallen to just 4.1%. From a technical perspective, the mix signals argue that the wide trading range market that has marked the third quarter is likely to continue.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.