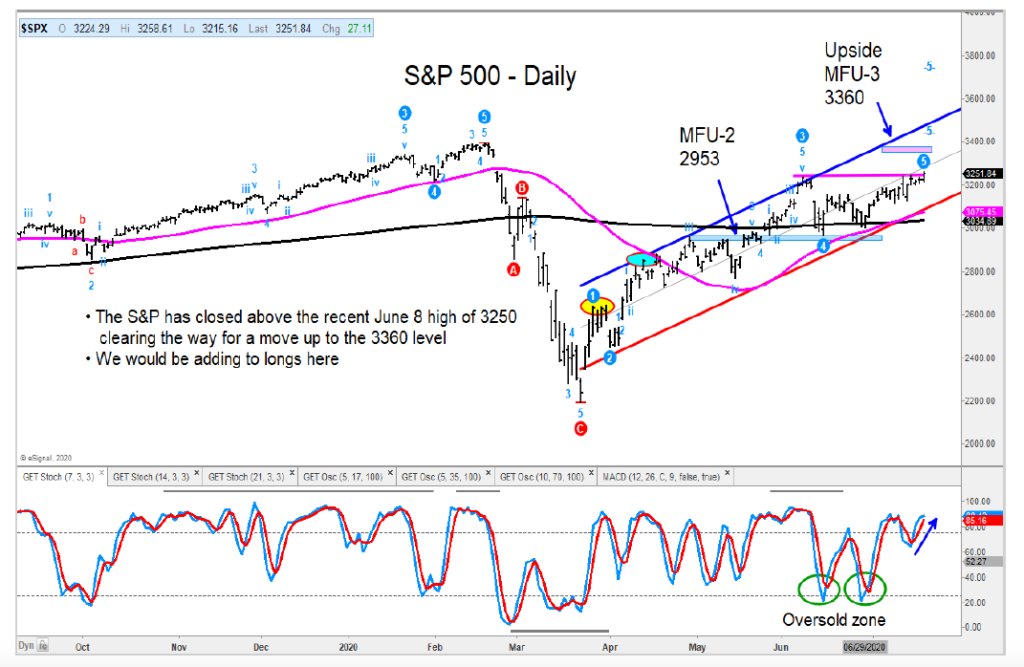

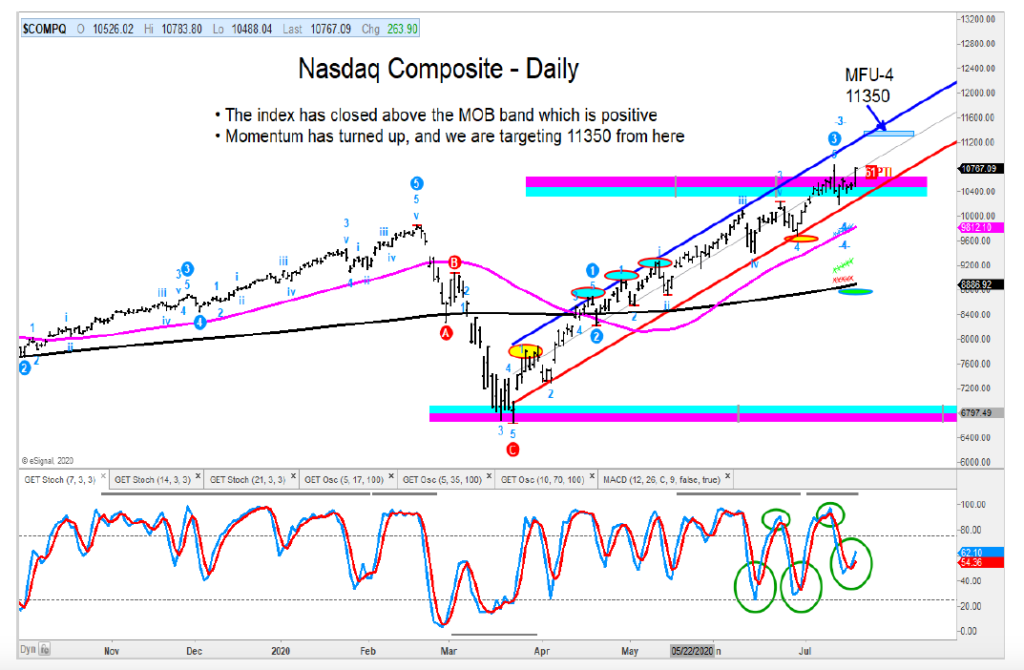

Improving upside momentum has both the S&P 500 and Nasdaq Composite ready for another leg higher.

The small and mid-cap stocks have been in a tight price range in recent days, and closing above their 200-day averages would be positive.

The Biotech Sector recently broke out of a consolidation pattern and is poised for another leg higher. We would be adding selectively to this group.

The iShares Tech-Software ETF (IGV) had a sharp price reversal from support and looks to go a lot higher.

There are several stocks there that screen well.

I have attached a couple charts below of the S&P 500 Index and Nasdaq composite. See notes on the charts.

S&P 500 Index Chart

Nasdaq Composite Chart

The author may have position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.