The S&P 500 Index climbed to a new recovery high last week. Support for the advance was provided by optimism regarding U.S./China trade talks, a recovery in major global markets, as well as confidence in the central banks shift to a more dovish stance.

At this juncture, good news about a U.S./China trade deal and a more accommodative Federal Reserve has most likely already been priced into the markets.

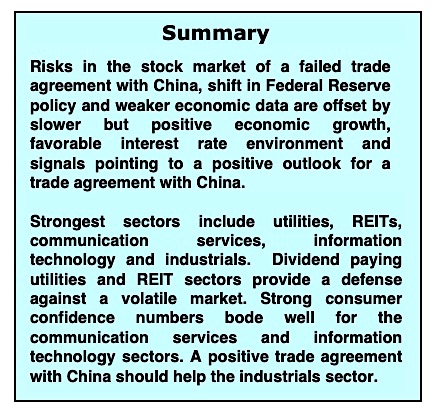

The risks continue to be a failed trade agreement with China, weak economic data and a shift in Federal Reserve policy. We believe that the current environment of slower but positive economic growth, along with favorable interest rates, will help offset the risks.

If the U.S. and China agree on a solid trade agreement, this would be a positive for growth in the U.S. It is in China’s best interest to come to the table in good faith and we believe the statements from the current administration that the trade talks with China will have a positive outcome.

This week the focus will be on comments from the Federal Reserve Open Market Policy Committee meeting on Tuesday and Wednesday regarding interest rates and comments regarding economic growth.

Investors will also be looking at housing and manufacturing data this week for signs of a healthy economy.

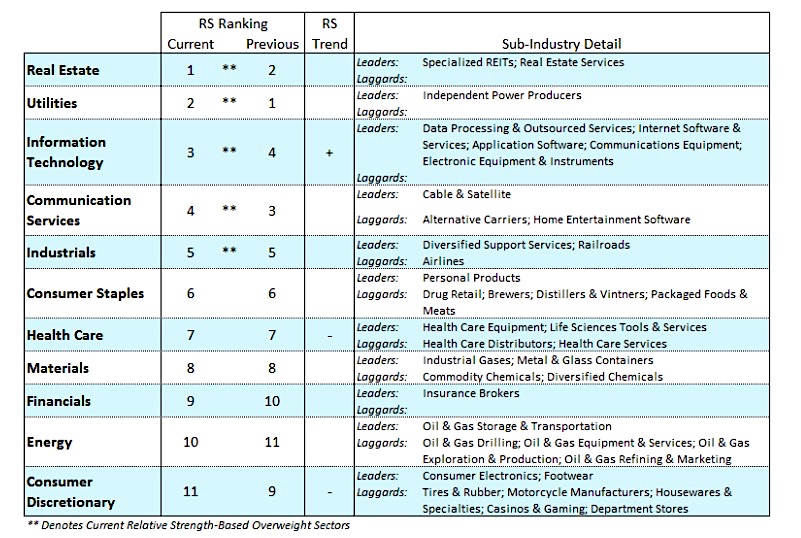

I suggest that investors focus on the strongest sectors of the market which includes utilities, real estate investment trusts (REITS), communication services, information technology and industrials. Economic data is pointing to signs of growth, but at a slower pace.

This should make defensive sectors like utilities and real estate investments trusts more attractive as dividend-paying stocks could provide some stability should market volatility pick up.

Consumer confidence posted a strong number in February which should bode well for the communications services sector and the information technology sector. We like communications services sector due to the increase in demand in the wireless area as well as the 5G technology focus.

I believe that companies will continue to invest in ways to increase efficiency, which would be a positive for the information technology sector. Additionally, a trade agreement with China could have positive ramifications for the industrials sector.

The technical condition of the stock market deteriorated last week. The new recovery high by the S&P 500 Index on Friday was accompanied by a host of negative divergences as the Dow Industrials, Dow Transports and small-cap averages failed to confirm action in the S&P 500. Further evidence of non-confirmation was the reduced number of issues (518) hitting new highs on the NY Composite and NASDAQ on Friday, down from the previous high of 591.

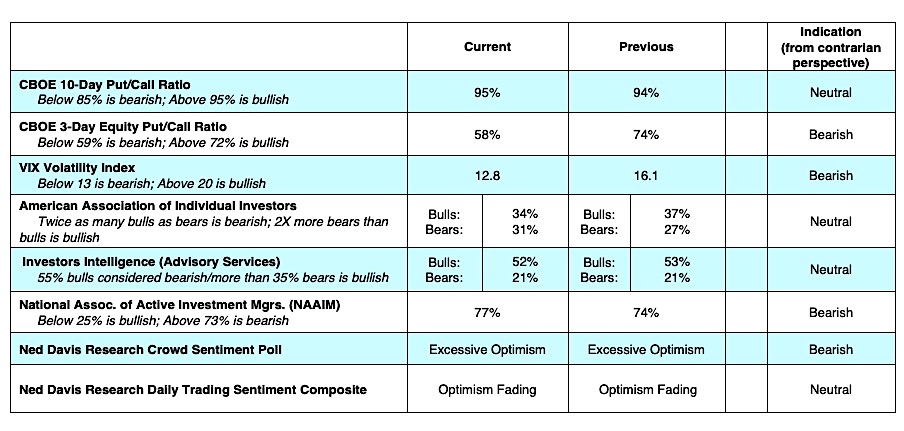

Measures of investor psychology show rising optimism but short of what is considered market threatening or excessive. Nevertheless, there is room for concern given the fact that the CBOE Volatility Index (VIX), which uses a basket of S&P 500 near-term options to measure the level of fear or complacency in the stock market, fell to the lowest level since early October. Growing investor optimism can also be found by the fact that an unusually large $14.2 billion flowed into equity funds in the latest week, according to Bank of America/Merrill Lynch. The flows into stock funds were the largest since the peak in the popular averages in September.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.