Stocks declined for the fourth week in a row last week on escalating trade tensions.

This triggered renewed concerns over the global economy and the potential for slower growth at home.

Will trade tensions impact individual investors and business confidence?

There is a growing consensus in the U.S. that China is an economic predator and the U.S. as well as our global trade partners must operate in a fairer economic system and that China cannot be allowed to steal our intellectual property.

The trade war is harming CEO confidence and has created a large decline in manufacturing.

The good news is that over the weekend, Japan and the U.S. forged an impressive new trade deal.

This deal will have a positive impact on both countries and be a great deal for the American heartland where Japan has agreed to lower tariffs on U.S. beef and pork and agreed to buy more corn and agricultural products. The most important take-away is that the U.S. is moving fast to gain allies in the trade war against China.

We are expecting to see more bi-lateral trade agreements this week. A top economic adviser for the White House said on Sunday that the U.S. is continuing to plan for a visit from China sometime in September. Additionally, the United States Mexico Canada Agreement (USMCA) will hopefully be approved by the U.S. Congress in the coming months.

Is a recession in the U.S. on the way?

The U.S. is now in the 11th year of an economic expansion without a downturn. Slowing global growth, rising trade tensions, and a strong dollar have led to a falling demand for U.S. exports leading to a decrease in manufacturing, falling business confidence and a possible downturn in the economy. Additionally, the yield curve inverted (long-term rates are below short-term rates). The yield curve inversion worried investors because a yield curve inversion has often, but not always, preceded a U.S. recession.

The inversion and what is driving long-term interest rates down is more a result of the fact that the growth outlook has slowed and also because negative rates abroad (the entire German yield curve is below zero) have encouraged investors to buy U.S. Treasuries which pushes yields lower.

In spite of the slowing global growth, consumer spending has been supported by the strong job market and rising wages. Last week very strong earnings were reported from some of the nation’s largest retailers that showed the consumer is in good shape.

Uncertainty breeds a slowdown in investment and the risk of a recession is rising, but for now healthy consumer spending, which accounts for approximately 70% of the U.S. economic output, may offset weak manufacturing data and weak business investment. After the recent positive data on consumer spending, the Atlanta Federal Reserve raised its third-quarter GDP estimate to 2.2% from 1.9%.

How should investors position their portfolios in the current environment?

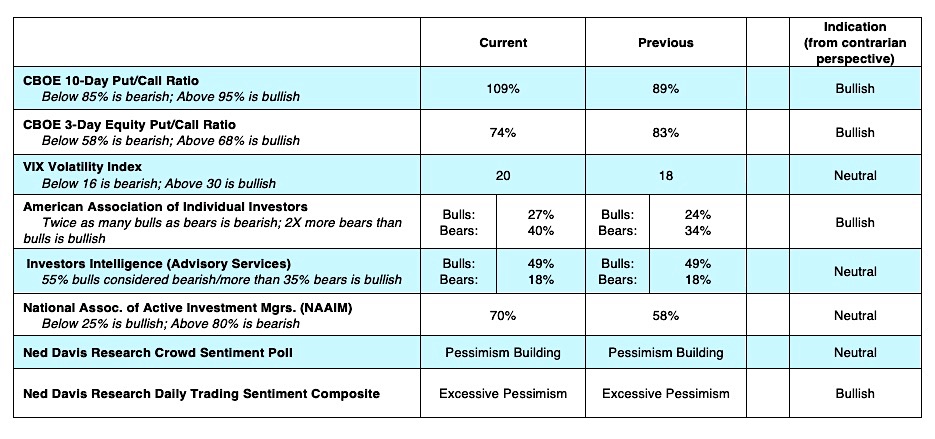

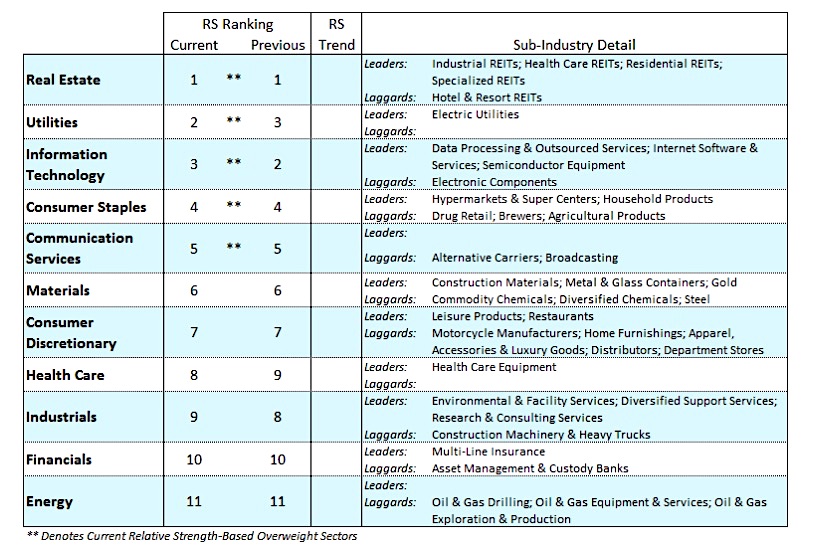

The escalating trade war creates uncertainty which leads to a demand for safe haven assets. Since early this year and more recently, investors have been flocking to (and have been rewarded by) the traditional safe havens in the market – the defensive areas of utilities, real estate investment trusts and consumer staples, as well as dividend-paying stocks, U.S. Treasury notes, high quality corporate bonds and gold. The defensive sectors of utilities, real estate investment trusts and consumer staples are the only S&P 500 sectors to have risen in the past month. We think investors should stay with the strongest sectors. Gold stands near a six-year high and is traditionally a good hedge in times of economic uncertainty.

At this juncture, volatility is expected to continue with the worries about recession and trade. No one can predict which asset class will win or lose but diversification helps provide opportunities to reduce risk.

Large capitalized companies with healthy balance sheets and strong cash flows tend to perform better in times of uncertainty and in the later stages of an economic cycle. Morningstar Financial recently upgraded the Gold-rated Baird Aggregate Bond Fund and the Baird Short Term Bond Fund. With the Federal Reserve set to lower the fed funds rate at least one more time this year, there remains some opportunity in fixed income investments and actively managed funds.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.