The S&P 500 (NYSEARCA: SPY) hit a new record high last week in a broad-based stock market rally that was triggered by the Federal Reserve’s latest policy statement stating they will “act as appropriate to sustain the expansion.”

Economic data continues to point to full employment, rising wages, low inflation, low interest rates and investments pouring into the U.S.

We still have weakness in manufacturing but the latest economic data offers positive news on consumer spending, the jobs market and housing. Additionally, this summer Congress will vote on the USMCA (United States Mexico Canada Agreement) which will create 500,000 new jobs and be a strong positive for farmers, ranchers and manufacturers.

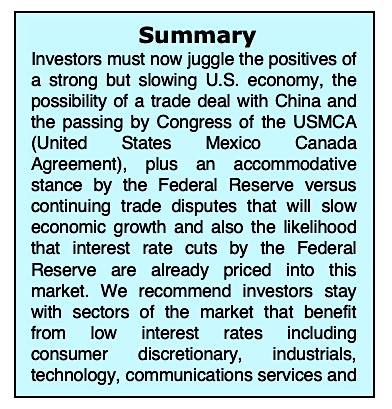

Investors must now juggle the positives of a strong, but slowing economy, the possibility of a trade deal, and an interest rate cut by Europe’s central banks versus continuing trade disputes that will lead to slower economic growth and additionally the likelihood that the Federal Reserve rate cuts may already be priced into the market.

As the presidents of the United States and China meet this week at the G-20 Summit, we will be looking for guidance as to what we can expect going forward.

Bonds also enjoyed a strong rally with the yield on the benchmark 10-year Treasury note falling to 2.0% and global yields falling deeper into negative territory as other global central banks plan to introduce new stimulus measures. With U.S. Treasury rates still higher than most other countries, we believe that our rates will remain attractive to foreign investors, keeping our rates low and continuing to boost our stock market.

We believe it is not too late at this juncture to buy short- to intermediate-term bonds to balance portfolios against stock market volatility.

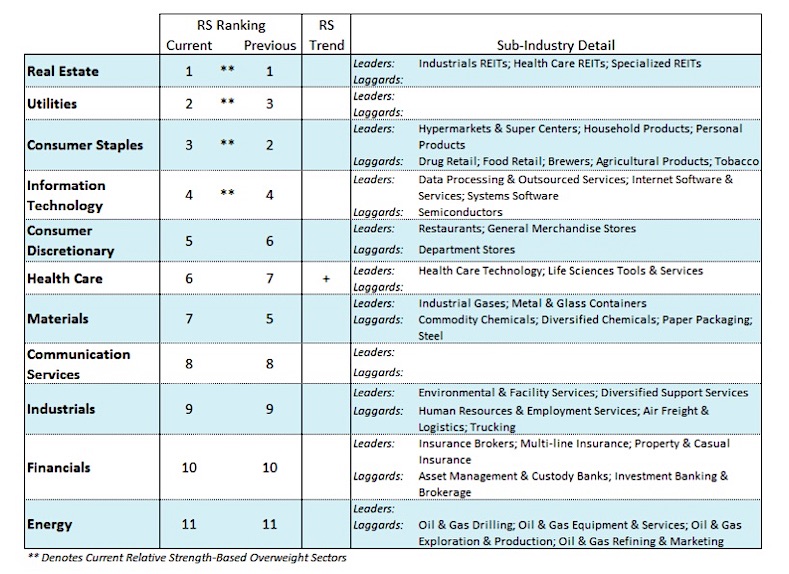

Since early this year we have suggested investors stay with the strongest areas of the market, which have been defensive in nature including utilities, consumer staples and REITs (real estate investment trusts). These sectors have been hitting all-time record highs and have been the primary support for the stock market in 2019.

At this juncture we suggest moving into sectors that do well in a low interest rate environment such as consumer discretionary, industrials, technology, communication services and materials.

We continue to think adding gold to the portfolio mix as a method to balance risk and volatility is a good idea. Investors have been seeking out gold as a safe haven if the U.S. economy slows, trade tensions continue, and uncertainties increase between the U.S. and Iran. The price of gold broke out of a long-term consolidation period last week and has outperformed since Fed Chair Powell’s remarks signaling a rate cut. If the Fed cuts its target rate, this could cause the dollar to fall and gold tends to move in the opposite direction of the dollar.

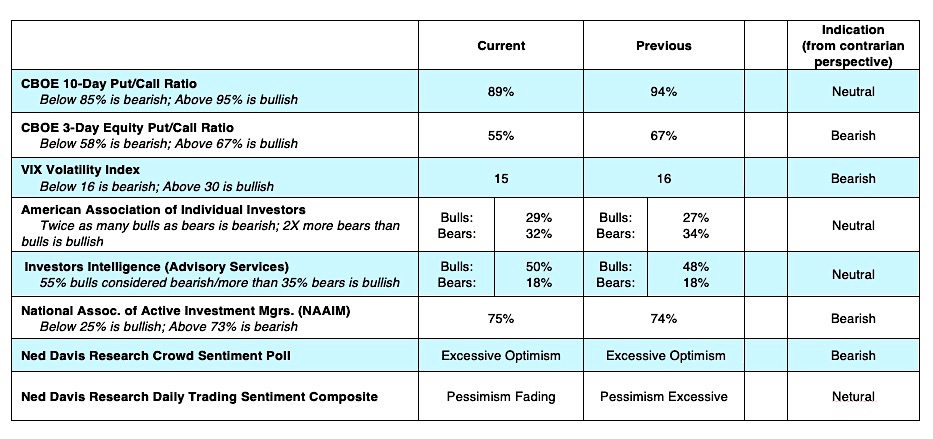

From a technical perspective, improvement is seen in market breadth with the expansion in the number of issues reaching new 52-week highs. Additionally, the percentage of S&P 500 stocks trading above their 200-day moving average expanded to 70%. A move above 74%, which was seen at the September and April peaks, would be further evidence of broad market strength. Despite the new high by the S&P 500, divergences persist. We would need to see new highs in the Dow Industrials, NASDAQ and the NY Composite indices to argue that a new leg of the bull market is underway.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.