In honor of Baird’s 100th Anniversary, the S&P 500 Index (INDEXSP: .INX) moved within 2 percent of the record high and the major stock market averages posted marginal gains last week as volatility took a rest.

The stock market indexes received support from the agreement with Mexico over the end of the threatened U.S. tariffs on Mexican imports as well as investor optimism that the Federal Reserve may lower interest rates.

The Federal Open Market Committee will meet this Tuesday and investors will be waiting to hear what language they will use regarding the possibility of future interest rate cuts. Most economists are expecting the Federal Reserve will leave the federal funds rate unchanged until September.

After this week, investors will turn their attention to the gathering of G20 nations on June 28 when the U.S. president and China’s President Xi Jinping may meet. Commerce Secretary Wilbur Ross spoke to reporters on Sunday saying that he does not expect a major trade deal to happen if the two leaders meet. He stated that the most that could happen might be an agreement to actively resume talks.

The great majority of Americans are well aware of China’s economic aggression, understand the necessity of tariffs on Chinese imports and that once an agreement is finally reached it will bolster the economy. Last week, the retail sales number came out much stronger than expected and the previous month’s retail figures were revised sharply higher.

Economic data is pointing to slower growth with the May employment report below expectations and negative revisions for March and April, along with weak ISM Manufacturing Surveys; but with the recent rebound in consumer spending, low interest rates, positive corporate earnings, the path of least resistance is likely to remain to the upside.

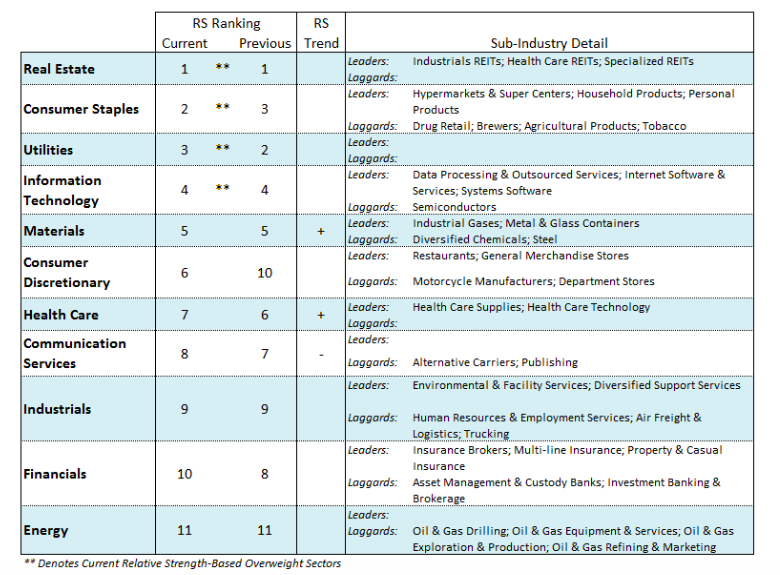

The strongest S&P 500 sectors in terms of relative strength remain defensive areas including consumer staples, REITs and utilities. Considering that these areas are sitting on top of large gains and at record highs, we would now anticipate a period of consolidation.

I suggest focusing on those sectors that have recently exhibited improving trends the past few weeks including the materials sector, consumer discretionary and technology. The materials sector jumped into the top tier in terms of relative strength within the S&P 500 benefiting from lower rates and a weakening dollar. The largest improvement last week in relative strength was recorded by the consumer discretionary sector that is benefiting from consumer confidence at a historically high level and rising incomes. The technology sector continues to be attractive and has a long history of good performance in a slow-growth economic environment.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.