I haven’t had much time to write lately so I wanted to share a quick market update, including a simple animation from Hedgeye Research that clearly explains the sequence of events that have occurred in the markets the last couple of years.

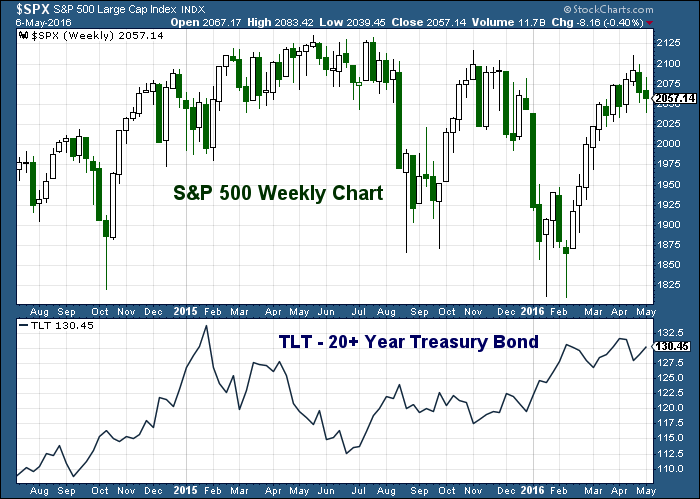

It provides the backdrop for why I exited equities (for the most part) last July and why I remain bearish on the economy. That’s why I continue to have a healthy position on US Treasury bonds, utilities, muni bonds, etc. It’s also why I continue to hold some bets on the market going lower even though there has been some pain in those positions the last 6 weeks or so.

The forces of the economic cycle may have a greater impact on the market than the mumblings of the Federal Reserve.

The goal here is to protect your wealth (and hopefully grow it even in these difficult markets) while the stock market works through a ‘reset’. After this period of price discovery in stocks we can judiciously move back in when the stock market is significantly lower that where it is today.

Enjoy the animation: An Animated History Of U.S. Growth Slowing (via Hedgeye)

Thanks for reading.

Twitter: @JeffVoudrie

The author holds positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.