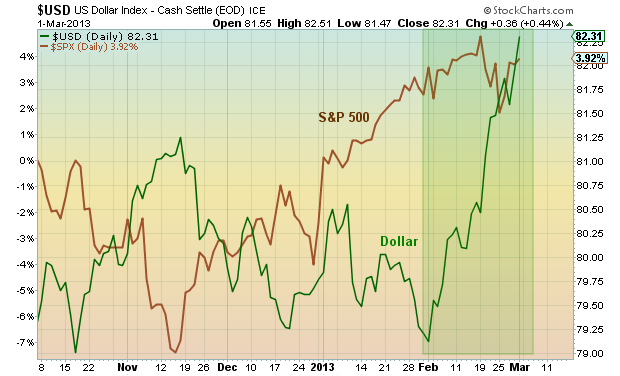

By Andrew Nyquist February was an interesting month for the US Dollar and US Equities (S&P 500). When pitting the two against each other on a performance basis, it’s easy to see the recent Dollar strength and a bit of equity weakness. But what is interesting here is that equities are shaking off the typical inverse corollary indicator that a stronger US Dollar equates to weaker US equities.

By Andrew Nyquist February was an interesting month for the US Dollar and US Equities (S&P 500). When pitting the two against each other on a performance basis, it’s easy to see the recent Dollar strength and a bit of equity weakness. But what is interesting here is that equities are shaking off the typical inverse corollary indicator that a stronger US Dollar equates to weaker US equities.

Thus far, equities have done a pretty good job of shaking off US Dollar strength to correct through time rather than price. Take a look at the chart below. Since early February, when most (including myself) were eyeing downside support levels, the US Dollar started to perk up. Continued US Dollar strength has dinged equities, but not in the way that many had originally thought it would.

More importantly, equities could see another move higher (or simply stay elevated) if US Dollar strength subsides short-term, or even sees a period of consolidation. However, on the flip side, should the US Dollar continue higher, it could eventually wear down equities and bring about that long awaited for correction. For key levels to watch on the S&P 500, see my recent “Market Update.”

I have also included an updated US Dollar chart below. This has the same technical indications/annotations that I used when pointing out a possible dollar head & shoulders pattern last month. And although the traditional pattern appears to be busted, the dollar could pause at the upper orange band. I added these only after noticing that the pattern may be tilted. That said, any pause or pullback in the dollar could be a catalyst for another “wave” higher in US equities. That said, more US Dollar strength (and a push above the recent highs) may continue to provide “lid” on equities. All food for thought. Happy trading.

Twitter: @andrewnyquist and @seeitmarket

No position in any of the mentioned securities at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.