The following chart and data highlight non-commercial commodity futures trading positions as of March 20, 2017.

This data was released with the March 23 COT Report (Commitment of Traders). Note that these charts also appeared on my blog.

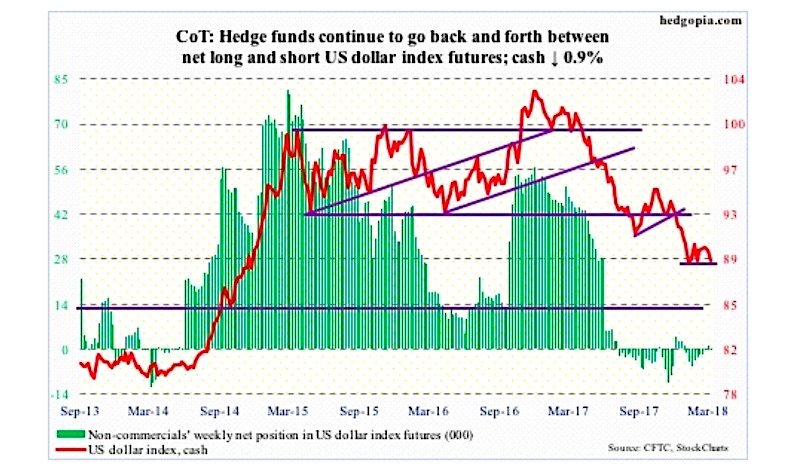

The chart below looks at non-commercial futures trading positions for the US Dollar Index. For the week, the US Dollar traded lower by -0.8%.

US Dollar Index Futures

March 23 COT Report Spec positioning: Currently net short 64, down over 900.

The US Dollar Index (cash) continues to struggle with its 50-day moving average, including on Wednesday when the Federal Reserve raised interest rates. This key moving average is falling incrementally each day, so sooner or later its likely to be taken out.

If/When this happens, the US Dollar will deal with resistance around 90.50, and just under 91.

BUT if the Dollar is to move higher, the 88-89 level must hold. Non-commercials do not seem interested in building net longs which is concerning.

Twitter: @hedgopia

Author may hold a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.