The US Dollar Index (CURRENCY:USD) is starting to catch traders’ eyes again. The recent rally has been relentless, hitting Gold and Emerging Markets over the head.

However, the US Dollar rally is now extremely overbought and looks due for a pause.

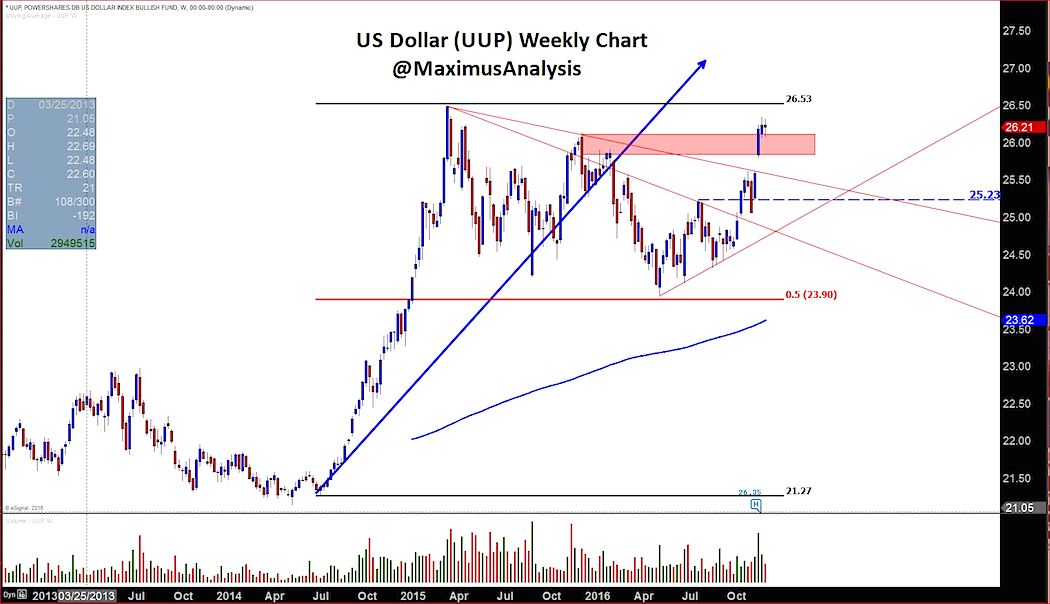

Using the US Dollar Index Bullish ETF (NYSEARCA:UUP) as a trading proxy, one can see how overbought it is. The 26.00 to 26.50 area looks like a solid resistance zone, with 26.53 being prior highs (and breakout resistance).

A couple thoughts here: Make sure you are always managing risk! And be very careful chasing this trade (use tight stops!). If you haven’t gotten in on the long side of this trade, you may want to wait for a better setup. This trade has room to retrace lower (0r move sideways) and still be bullish. Traders must know their timeframes here.

Traders also need to be aware of other futures instruments that are influenced by the Dollar. Trade safe.

US Dollar Bullish ETF (UUP) Chart

Thanks for reading.

Twitter: @MaximusAnalysis

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.