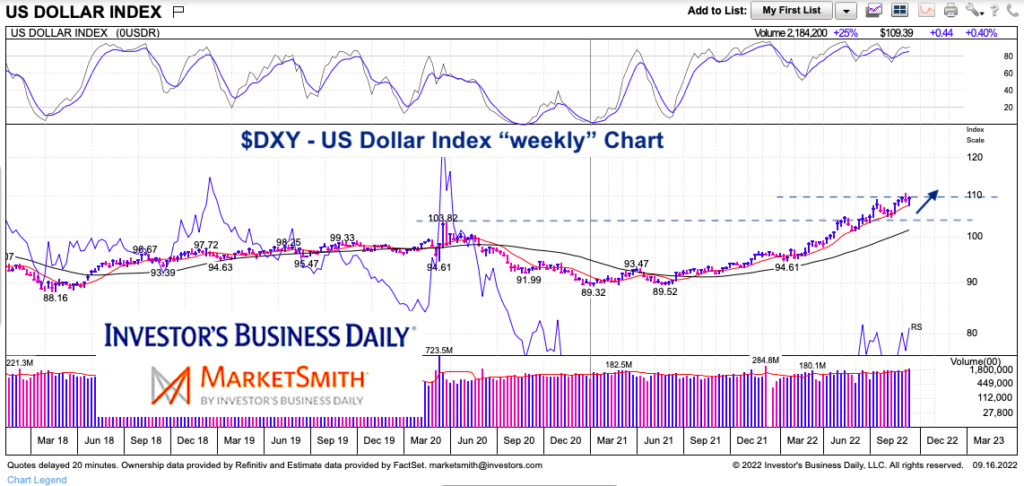

The US Dollar is now trading at new 20 year highs. And interest rates have been steadily rising alongside the strengthening Dollar.

So what’s going on?

Well, inflation is tied to rising interest rates (and the Federal Reserve raising aggressively at that). And the US Dollar strength is likely due to a mix of geopolitical tensions and weakening overseas economies (Europe, China to name a couple.

But the amount of strength over the past 18 months is somewhat worrisome, in my opinion. And it may be pointing to further geopolitical strife. As always, we take a simple look at the US Dollar… today on an intermediate term basis.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of analysts, education, and technical and fundamental data.

US Dollar Index “weekly” Chart

As you can see, the broke out the new multi-year highs (actually 20-year highs!) this summer. And it is now looking to breakout over 110. The currency is seeing unusually persistent strength. In my opinion this is somewhat worrisome that geopolitical relations (overseas) are deteriorating and something ominous may be lurking. We currently have a delicate situation with the Ukraine-Russia war and several NATO countries getting involved. We also have escalating tensions with China bubbling up.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.