July corn futures closed down 11 cents per bushel week-on-week Friday, finishing at $4.15.

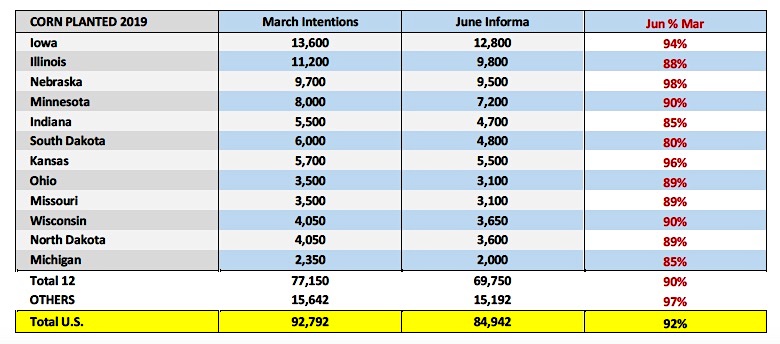

On Wednesday (6/5) Informa Economics released its revised June planted acreage estimates for U.S. corn and soybeans. Informa’s corn planted acreage forecast was reduced to 84.942 million acres, 7.85 million acres below the USDA’s March Prospective Plantings estimate of 92.792 million (-8.5%).

Informa lowered the 2019/20 U.S. corn yield to 174 bpa for total production of 13.555 billion bushels. This compares to the USDA’s May 2019 WASDE estimates of 176 bpa and 15.030 billion bushels.

At face value, assuming no changes to demand, Informa’s supply-side adjustments would lower 2019/2020 U.S. corn ending stocks to 1.010 billion bushels versus 2.485 billion bushels in May.

Meanwhile…Informa’s soybean planted acreage forecast was 85.037 million acres, up 420,000 acres versus the USDA’s March Prospective Plantings estimate of 84.617 million acres.

Informa raised its 2019/20 U.S. soybean yield to 51.6 bpa for total production of 4.313 billion bushels. In the May 2019 WASDE report the USDA offered a trend-line U.S. soybean yield of 49.5 bpa and total production of 4.150 billion bushels. After applying Informa’s supply-side adjustments in soybeans, 2019/20 U.S. soybean ending stocks would increase to an incredible 1.133 billion bushels.

What do I make of Informa’s June corn and soybean planted acreage estimates? I think they perfectly sum up the perceived real implications of the USDA’s most recent Weekly Crop Progress report.

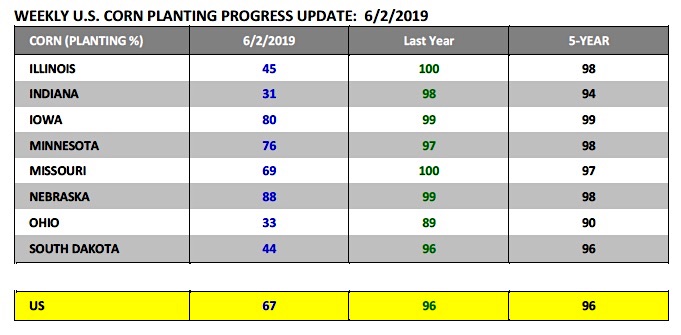

If we are to believe that the USDA’s June 2nd U.S. corn planted acreage estimate of 67% was accurate (insinuating 30.6 million corn acres remained unseeded) then Informa’s revised U.S. corn acreage figure of 84.9 million acres makes complete sense. Informa’s basically saying the best the market can hope for given prevent plant dates, the extended weather forecast, and a relatively hard cut-off date of approximately June 10thto continue planting corn (based on growing degree days required and first frost possibilities on or after September 15th) is 91 to 92% planted versus March’s intended acreage forecast. This gives us a total U.S. corn planted acreage range of 84.4 to 85.4 million acres. In soybeans, Informa’s drawing the conclusion that the USDA’s March acreage projection can still be met and exceeded with some corn-soybean acreage switching.

Let me go on record as saying if Informa is right on corn acreage corn prices in my opinion have to go higher (substantially higher…think $5.00 CZ19, not $6.00 CZ19). I don’t think the trade can assume the current CZ19 high of $4.54 on 5/29/19 is nearly enough to insure adequate demand rationing.

Additionally, Informa’s corn yield estimate of 174 bpa seems like wishful thinking given the slow emergence of this year’s corn crop, as well as, the continuation of cool and wet weather conditions now being forecasted well into the 2ndhalf of June. That said I fully expect every Weekly Crop Condition report to be hyper-analyzed, with the market looking for any signs of a U.S. corn yield drifting down toward 166 to 162 bpa.

Now as I said a week ago…there’s no guarantee the market will get a clear indication on the actual amount of lost corn acres until the June 28thAcreage report. Over the last 10-years the USDA has only lowered U.S. corn acreage one time in the June WASDE report, that being a 1.5 million acre reduction in 2011.

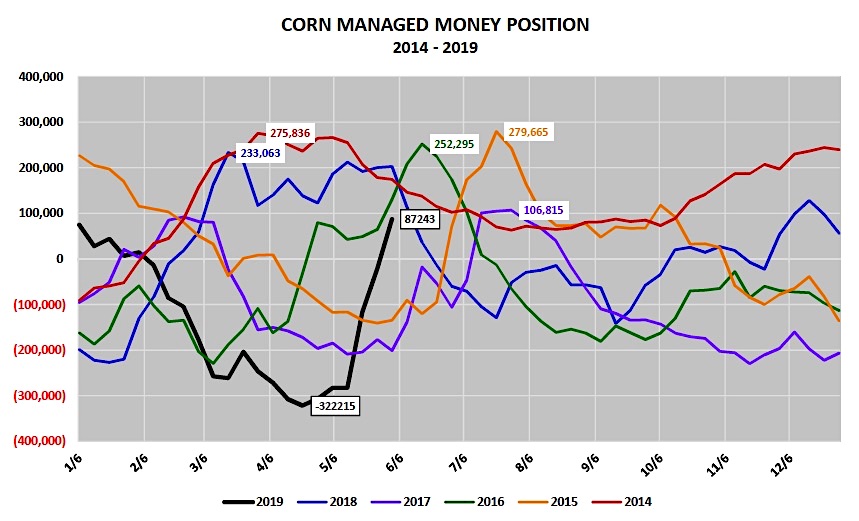

Therefore, if traders are wondering why corn futures have setback and even struggled to regain recent upward momentum despite only 67% of the corn crop being planted as of 6/2, I’m of the mindset that Money Managers are taking an intentional pause. They see a market that’s rallied basically a $1.00 per bushel off its contract lows, an improving weather forecast for late planting, several conflicting opinions on whether or not the USDA’s planting percentages are even accurate, and finally a sizable supply cushion given the USDA’s May 2019/20 U.S. corn ending stocks forecast of 2.485 billion bushels…the largest projected carryout since 1987/88.

None of this is easy…whether you believe the U.S. has lost 8 to 10 million corn acres or 4 to 5 million corn acres in 2019 invariably has more to do with where you call home.

We try to avoid backyard marketing, but it’s virtually impossible. Twitter only exacerbates this issue given you can see and read what you want (retweet), essentially affirming your opinion/underlying market bias.

What other fundamentals should you be focused on outside of corn/soybean planting progress?

There were reports this week that Mexico has already begun securing corn from Brazil, with offers significantly cheaper than the U.S. Obviously President Trump’s desire to institute a 5% tariff on goods from Mexico entering the U.S. is playing into this. That tariff is expected to go into effect on June 10th, with a plan to raise it 5% every month thereafter until it hits 25% in October if a deal with Mexico isn’t reached regarding the borders.

Also of note, I read on Wednesday that one of the world’s largest pork processors in the U.S. was going to be receiving corn from Brazil. Once again because it was cheaper than the U.S. alternative. All of says that Brazil’s ability to displace U.S. corn exports is not only real but it’s already occurring at current price levels.

One key takeaway – this is part of the reason corn prices are already facing topside resistance (strong basis levels a component as well) despite considerable supply-side balance sheet concerns moving forward. This speaks to why I’ve been more conservative on corn’s long-term upside given the huge corn supplies in Brazil, Argentina, and Ukraine.

CORN FUTURES TRADING OUTLOOK

Corn futures showed signs of stabilizing/settling into a range momentarily with traders continue to assess every new forecast (5 to 7-day precipitation models), as well as, expectations for next Monday’s Weekly Crop Progress report.

I think in general the trade anticipates U.S. corn planting progress to be reported at 80 to 85% complete as of 6/9. However I do believe there are some fears that the number could be higher, with traders still preparing for the possibility that the USDA has been underestimating progress the last two weeks.

Ultimately I expect corn values to continue trading at a higher pricing floor for the foreseeable future. I remain of the opinion that until the market can better quantify just how many corn acres the U.S. has forfeited this spring, traders will be hesitant to accumulate a significant short position.

That means waiting to see both the June 2019 WASDE report (released next Tuesday on June 11th), as well as, the June 28th Acreage report. I do believe the trade is fully expecting the USDA to make only nominal cuts to both acreage and yield in the June WASDE report. That said I don’t think anyone is putting much confidence in the USDA’s June figures; with most expecting the USDA’s real estimates to be reflected in the July 2019 WASDE report, which will be released on July 11th.

I think it’s worth pointing out that Thursday’s Weekly Export Sales report showed net corn export sales of -0.3 million bushels for the week ending 5/30/2019.

That means there were net sales cancelations. Once again this underscores that U.S. corn values aren’t competitive at current price levels. Corn Bulls need to keep this in mind when assessing corn’s upside.

Key technical price indicators…I do think CN19 takes another shot at the 5/29/19 contract high of $4.38; however the timing of that move could be delayed. I have been a fairly aggressive seller on this rally; however I want to keep my powder dry on a percentage, anticipating another surge in prices as the summer progresses (late June), with acreage and yield uncertainties underpinning prices. Bullish Disclaimer…as excited as Corn Bulls are about the what if’s regarding the U.S. corn S&D, the U.S. soybean S&D is potentially equals parts Bearish, with a 1.0 billion bushel carryout not out of the question. I’ll say it again, this isn’t 2012.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.