My intermediate-term outlook for stocks has not changed even after the rally off the June low and the stock market breadth thrusts talked about in the media. I am bearish.

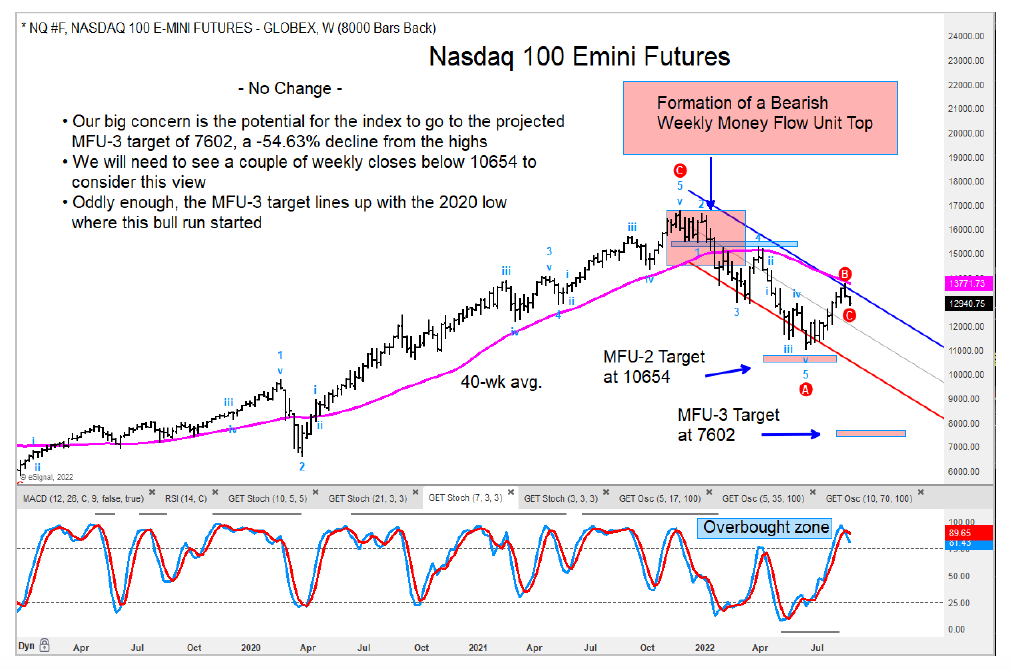

After the strong stock market rally off the 2020 low and the subsequent distributive tops formed in the major market indices, the bearish Money Flow Unit (MFU) tops that formed.

And with this, I continue to believe that a more significant retracement of that rally will continue. In a strange way, this market reminds me of the 2008 market top. We will see.

There are reversal patterns unfolding in the following indices: S&P 500, Nasdaq 100, Russell 2000, Nasdaq Composite, Dow Transportation Index, MSCI All Country World Index, German DAX, French CAC, and FTSE MIB (to name a few). The European stock market indices look particularly weak.

Below I share charts of the S&P 500 Index and Nasdaq 100 Index with potential longer-term targets.

A very bullish formation continues to unfold for the US Dollar Index. I am looking for a BIG move higher. I have highlighted this in prior reports.

· With the expected strength in the DXY, we have gold in a weak downtrend. We highlight the downside target area on page 13.

· We remain firm on our bullish outlook on Crude Oil and the energy sector. On page 14, we review the chart of WTI, which is carving out a low into a MOB target and support area.

· The 10 Year T-Note has had a strong reversal off the recent low and is poised to move higher from here. The MFU target of 4.29 has not changed, and we expect the uptrend to continue.

Twitter: @GuyCerundolo

The author or his firm have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.