Optimists hope that government will eventually move on to tax reform, while pessimists worry that the Obamacare repeal-failure means tax reform is even less likely. Meanwhile, geopolitical concerns (here and abroad) are adding to market uncertainty for investors.

Despite the worries, the economy continues to grow and add jobs. Below is a brief market overview.

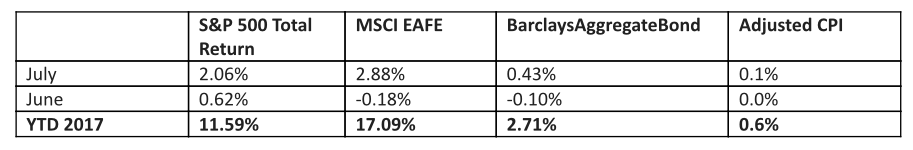

Stocks & Bonds

The U.S. stock market has continued its upward trajectory. The S&P 500 (NYSEARCA:SPY) is stalling out a bit but earnings season has been largely positive. That said, the companies that announced disappointing earnings were often sold severely. Bond yields have slipped a bit, as some are concerned the stock market rally has gotten ahead of economic fundamentals. Here are the “monthly” numbers through July:

Commodities & Currencies

Crude Oil prices rebounded in July, but are facing tough sledding in August. Gold prices (NYSEARCA:GLD) have drifted higher as uncertainty has hit our political scene along with other developed nations. Geo-political uncertainty has had an impact on commodities at times, but thus far has done more good for gold than oil.

The U.S. Dollar Index (CURRENCY:USD) has extended losses into August but is trying to firm up. Many market prognosticators had anticipated a year of dollar strength on the back of interest rate increases, so the reversal in dollar fortunes has caught some investors off-guard.

Although the economic data continues to look solid, the geo-political scene (at home and abroad) may hold the market back (and keep investors on edge). Further, it will be interesting to see how interest rates respond in the days ahead and whether that changes any language from the mouths of Fed officials.

This material was prepared by Greg Naylor, and all views within are expressly his. This information should not be construed as investment, tax or legal advice and may not be relied upon for the purpose of avoiding any Federal tax liability. This is not a solicitation or recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. The S&P500, MSCI EAFE and Barclays Aggregate Bond Index are indexes. It is not possible to invest directly in an index. The information is based on sources believed to be reliable, but its accuracy is not guaranteed.

Investing involves risks and investors may incur a profit or a loss. Past performance is not an indication of future results. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Listed entities are not affiliated.

Data Sources:

www.standardandpoors.com – S&P 500 information

www.msci.com – MSCI EAFE information

www.barcap.com – Barclays Aggregate Bond information

www.bloomberg.com – U.S. Dollar & commodities performance

www.realtor.org – Housing market data

www.bea.gov – GDP numbers

www.bls.gov – CPI and unemployment numbers

www.commerce.gov – Consumer spending data

www.napm.org – PMI numbers

www.bigcharts.com – NYMEX crude prices, gold and other commodities

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.