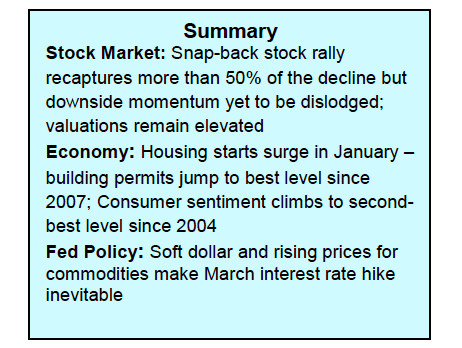

The US equity markets snapped back from a deeply oversold condition last week as the major averages posted their best weekly performance since 2013.

At this juncture, the 10% decline from the January high is seen as a normal correction in an ongoing secular bull market.

Much of the blame for the sharp pullback and rise in volatility this month is an increase of concerns over the prospects for increased inflation. The January Consumer Price Index (CPI) issued last week showed prices increasing the most in five years. The fact that stocks soared in the face of this report argues that inflation pressures have yet to reach a level to become problematic for stocks or the economy. Additionally, year-over-year CPI inflation was reported virtually unchanged at 2.1%, which has been the strategy of the Federal Reserve since 2009. The rise in pricing pressures is also a reflection of a growing global economy.

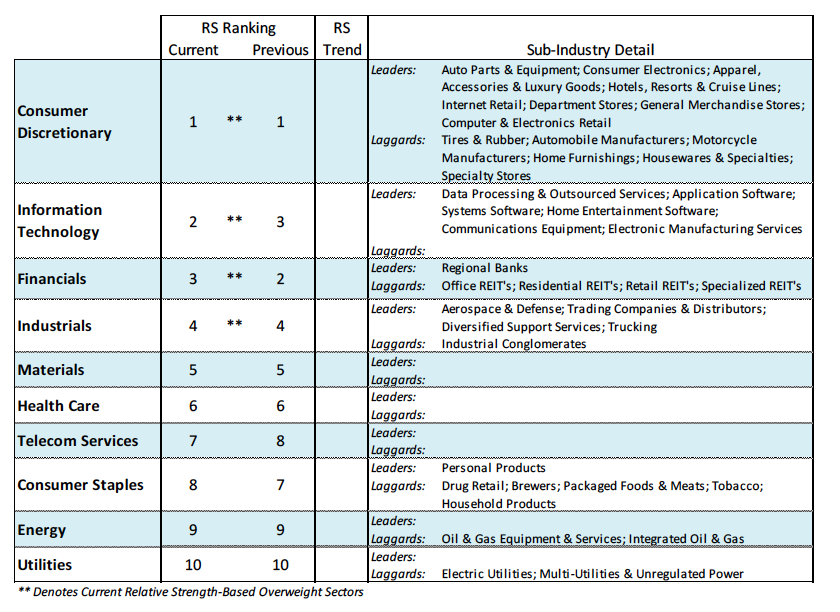

The International Monetary Fund recently raised the forecast for global growth to 3.9% from just 3.1% 18 months ago. As a result, the economic fundamentals remain supportive that the February drawdown was a correction as opposed to a change in the primary trend of the equity market. We are also encouraged by the fact that defensive sectors that typically gain in relative strength prior to a meaningful correction continue to underperform growth sectors that are most sensitive to the economy including technology, consumer discretionary and financials.

Although the economic fundamentals suggest the correction has run its course, the technical indicators leave open the potential for a retest of the recent lows.

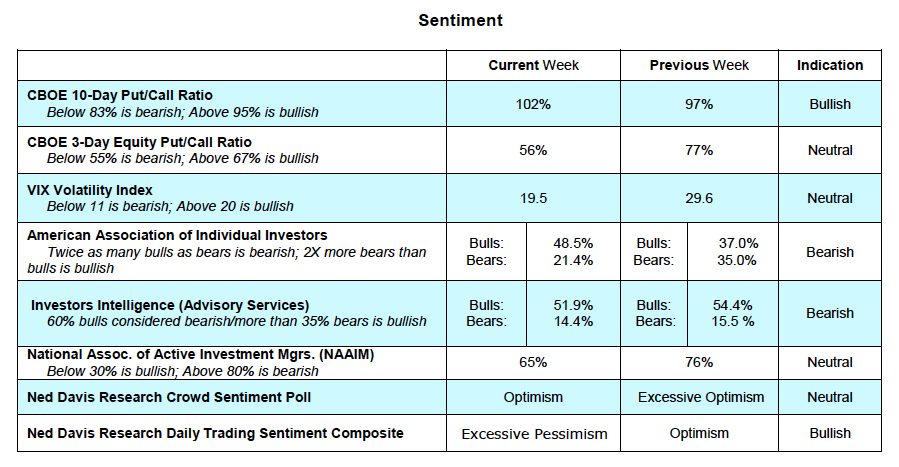

Excessive investor optimism that was pervasive in January has been replaced with caution and skepticism but there is a lack of evidence that fear has entered the building, which is often found at a good market low. We are also waiting for evidence that the downside momentum that accompanied the sharp break early in the month has been reversed. During the current decline from the January highs, the NYSE experienced three sessions where downside volume exceeded upside volume by a ratio of 10-to-1 or more.

Although the stock market averages rallied six straight days (prior to today’s minor losses) and have climbed more than 100 S&P 500 points, this has produced only one session where upside volume exceeded downside by a ratio of only 5-to-1. Two or more days of nine-to-one upside over downside volume are needed to support the prospect that the downside momentum has been broken. In the absence of a clear shift in momentum, stocks are likely to slip into a trading range with the risk to 2600 and the reward to 2790 using the S&P 500.

The bottom line is that the economic fundamentals support the prospects that the 2018 pullback is a pause before the bull market continues. The technical factors suggest a consolidation period with the potential for a retest of the February lows.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.