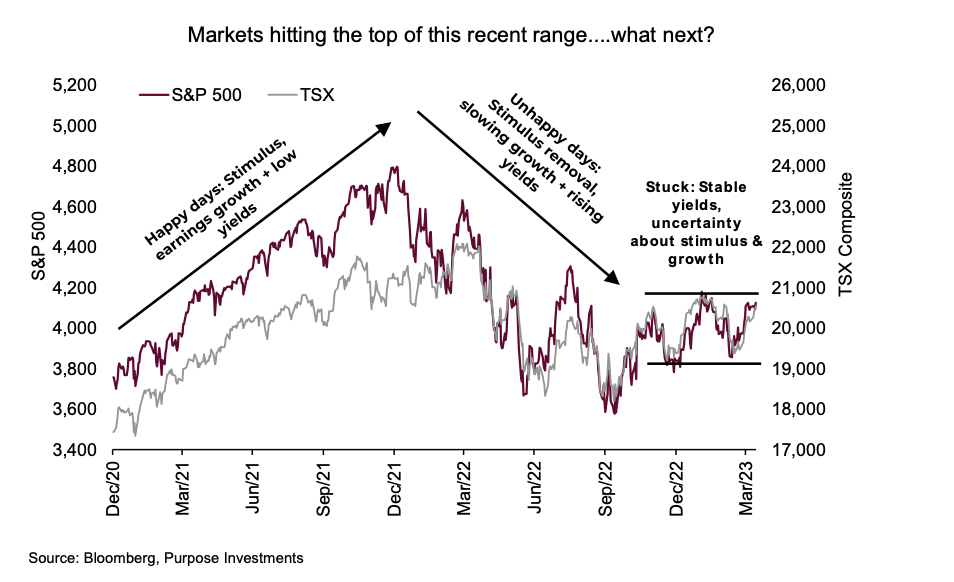

It’s been a good month, with the S&P 500 Index and TSX Index bumping up against the top of a range that has existed for half a year now. The S&P 500 rallied 7.5% over the past month from the bottom created by the U.S. banking flare up.

Sure, the mega cap-techs helped more than their share, but overall, it has been a decently broad-based advance. About 84% of index members are up over the past month, with a little over half of index members up 5% or more. The TSX is also enjoying a bounce – up 6% over the past month.

There has been some good news to help markets move higher. First, the banking flare up appears to be fading. We’re not implying banks are in the clear, but deposits are on the move in search of vehicles with more attractive yields or safer homes. This is negatively impacting some banks (regionals) and benefiting others (money center banks).

Just look at JP Morgan’s latest results, with deposits up nicely. Or look at Blackrock that enjoyed strong inflows in Q1 to bond and money market investment vehicles. Contagion or systemic risk does not appear to be an issue.

Second, inflation has improved. This was the market’s biggest angst in 2022 so continued improvement is good news. And while economic growth has been slowing, it has been gradual at this point. The growth has been just enough for bond yields to come down, but not too much to raise the market’s ire over recession risk.

10-year yields in the U.S. have now come down from almost 4.5% to 3.5% and in Canada from 3.5% to 3.0%. If you like the porridge analogy for the economy, the data is cool but not cold.

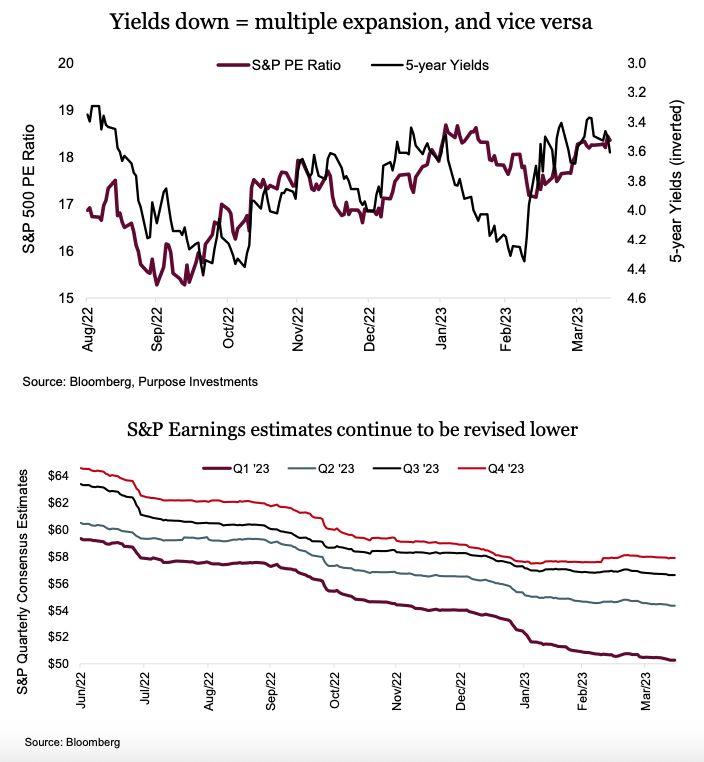

Less inflation and lower bond yields fueled multiple expansion for the equity markets. The S&P 500 was trading at 16x in late 2022 and is now valued up at 18.5x. Meanwhile, the Nasdaq trading at 21x in late 2022 is now back up to 25x – clearly pricing in a good amount of optimism. While 18.5x may not be ‘expensive’, don’t forget that the ‘E’ in the PE ratio is not proving as resilient these days. We are in the early days of Q1 earnings season which, based on current forecasts, has S&P earnings pegged at just over $50 – nearly $60 last summer. Subsequent quarterly earnings have not been revised down as much. As each quarter’s earnings season approaches, we would expect downward revisions to accelerate. That has been the norm lately.

The recent high rally in the equity markets is fueled by multiple expansion, thanks to falling inflation

and bond yields. However, falling inflation will prove to be a headwind for earnings going forward. And

those lower bond yields? Well, they are lower because optimism for economic growth continues to dwindle, which is good for lower yields but not good for future earnings.

Final thoughts

Future earnings are a bit “squishy”. With the market enjoying the lift from bank fears cooling, inflation cooling and lower bond yields, could it keep going? Of course. The recent market has been reacting to just about any news as good news: glass half full. And when the Fed finally announces the end of rate hikes, markets may rejoice. However, this advance is being built on a shaky foundation. Don’t be afraid to take advantage of this recent bounce and continue pivoting to a defensive position. Or at least, be ready to do so in case the market switches to a glass half empty mindset.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.