The past week witnessed the rising and falling of the stock markets in response to the news on the U.S.-China trade deal.

The trade dispute with China will likely trim U.S. economic growth and we are beginning to see a slow-down in spending on factories and equipment by large U.S. companies (Wall Street Journal, Big Companies Tightened Spending, 5/19/19).

But I believe the underlying fundamentals remain solid and view this as a cautionary and temporary posture on the part of U.S. corporations.

I believe that China and the U.S. will eventually come to an acceptable agreement as both sides have economic stability at stake.

The S&P 500 (NYSEARCA: SPY) and the Dow Jones Industrial Average (NYSEARCA: DIA) have made healthy gains year to date so, barring a full-blown trade war, it is not unreasonable to expect the markets to show volatility and more moderate gains going forward.

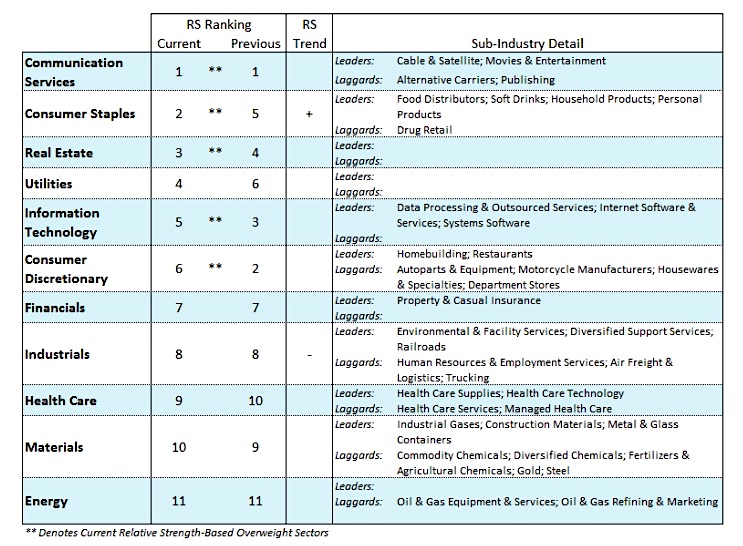

I think investors are wise to balance their portfolios with short-term Treasury bills and stay with the strongest sectors of the U.S. stock market which include defensive sectors such as consumer staples, utilities, REITs, as well as communication services and technology.

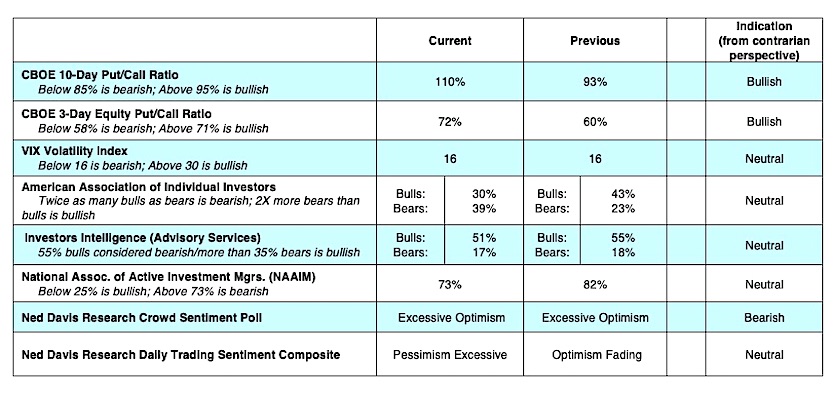

Investor sentiment indicators that showed excessive optimism four weeks ago now indicate that sentiment is contracting but outright pessimism that would trigger a buy signal using contrary opinion is still missing. The Ned Davis Research Crowd Sentiment Poll, that was in the excessive optimism zone has moved to neutral.

The latest survey from the American Association of Individual Investors (AAII) showed slightly more bears than bulls last week. This was offset, however, by the Michigan Consumer Sentiment Poll that showed expectations for stock prices to rise over the coming year jumped to 63%, just shy of the peak in August 2018.

Stock market breadth remains problematic. New highs by the S&P 500 Index and the NASDAQ have yet to be confirmed by new highs in the Dow Industrials, Dow Transports, NY Composite and the Russell 2000. The Russell 2000 Index is 12% below its August 2018 peak.

Additionally, although the S&P 500 Index is in close proximity to record highs, only 48% of S&P stocks are trading above their 50-day moving average. This is in contrast to the September peak in the index when 73% of S&P stocks were trading above their 50-day moving average. From a technical perspective, we are looking for investor sentiment to turn more pessimistic and breadth trends to improve, before a sustained uptrend can continue.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.