The major stock market indices (S&P 500, Nasdaq, Russell 2000) reached new record highs in August with the exception of the Dow Jones Industrials which remains 2.00% below its January peak.

The support for the rally is the strong underlying economic fundamentals that have produced two consecutive quarters of profit growth above 20%.

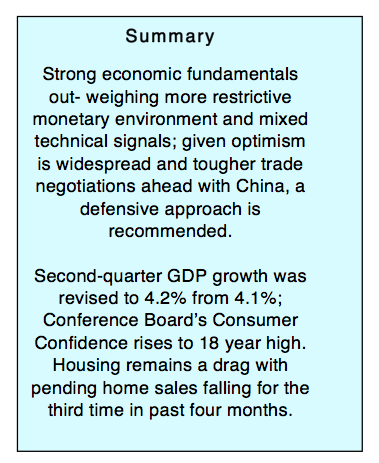

Confirming the strength of the U.S. economy, second-quarter GDP was upgraded to 4.2% from 4.1%.

In the current environment, the economic fundamentals are overwhelming the potential negative impact of rising interest rates and the threat of a global economic slowdown due to the unresolved conflicts over tariffs and trade. The strength in the U.S. economy accompanied by rapid profit growth supports the long-term prospects for a continuation of the secular bull market. Short term, however, the likelihood of a pullback cannot be ignored.

Bullish sentiment is rising not only on Wall Street but also on Main Street. This suggests that much of the good news on the economy is already built into current prices. There are indications that second half of the year growth will be less robust than seen in the second quarter as short-term stimulus from U.S. corporate tax cuts begins to wane. Additionally, the Administration is expected to impose new tariffs on Chinese goods that is likely to result in retaliation from China. This week, the financial markets will be focused on Friday’s employment report. consensus estimates are that the economy generated 190,00 new jobs in August (versus 157,000 the previous month) with the unemployment rate ratchetting down to 3.8% from 3.9%.

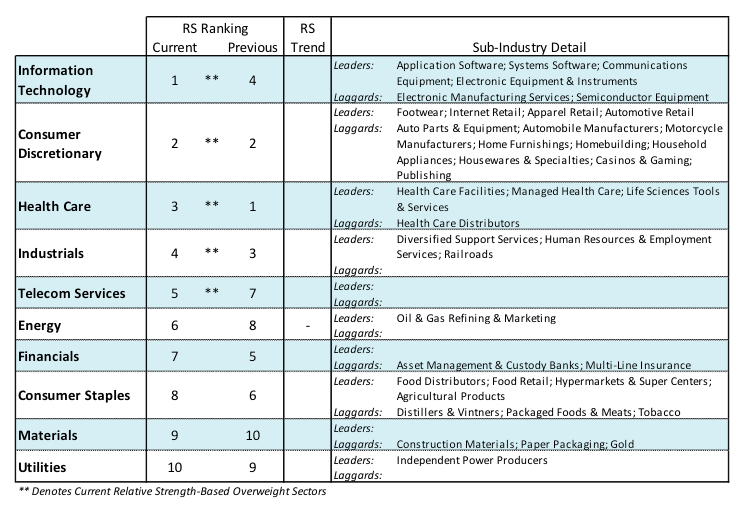

Attention will also be on wage growth for signs that inflation pressures are growing stronger. Investors should focus on defensive sectors that have outperformed in August including health care and telecom.

Entering the final month of the third quarter, the stock market is faced with some short-term technical hurdles. Over a span of the last 67 years, September has the distinction of being the worst month for stocks. The fact that the S&P 500 has risen for five months in a row and is in an overbought condition entering the month could make the September period more difficult.

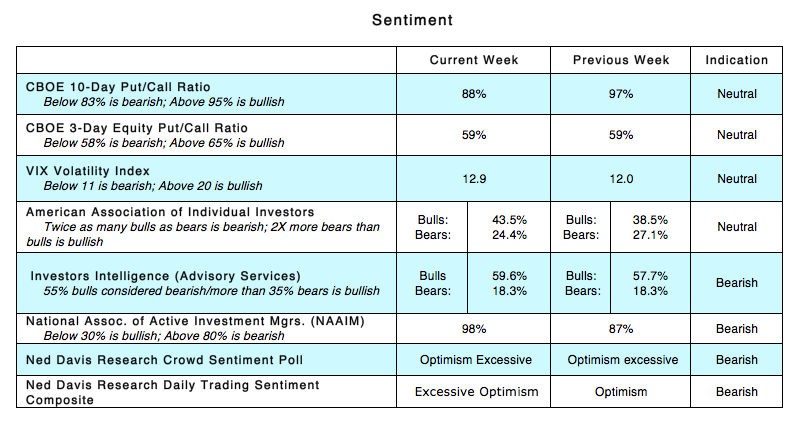

Applying contrary opinion, several indicators of investor sentiment also suggest near-term caution. The latest report from Investors Intelligence (II) shows 59.6% of the advisory services are bullish. A reading above 60% has often been a signal that investor enthusiasm has reached a peak. At the January stock market peak, the II data showed 66% bulls. Ned Davis Research points out that the II data has a long history and often peaks prior to a market peak. Optimism on Main Street is also worrisome. Elevated levels of consumer confidence, while bullish for the economy, are not necessarily bullish for stocks. The fact that consumer confidence, according to the Conference Board, is near an all-time high and small-business investor sentiment is the second highest in its history are seen as a potential headwind for stocks near term.

Stock market breadth has shown modest improvement but despite the recent highs by the S&P 500 and NASDAQ, the number of issues within those indices reaching new highs is less than half of what was witnessed in January. The bottom line is that while the fundamentals remain bullish, the short-term technical picture argues in favor of caution.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.