The popular stock market averages fell nearly 4.00% last week.

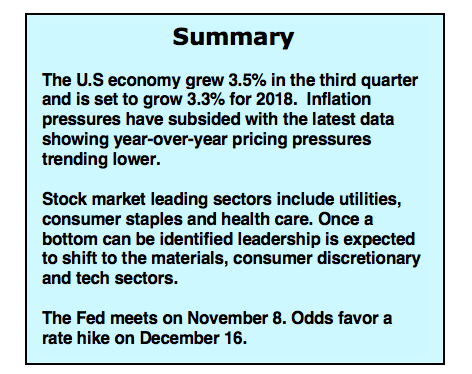

U.S. equities continue to be adversely impacted by rising interest rates, the negative influence of tariffs, and mixed signals from companies reporting third-quarter earnings.

Although 80% of those companies reporting are beating third-quarter earnings estimates, sales performance has been mixed, with more than a third of firms so far missing revenue projections.

Additionally, the markets are looking past 2018 and are beginning to factor in margin pressures associated with a strong economy including rising wages, rising interest rate costs, and a strong U.S. dollar that is already negatively impacting multinational companies.

The equity markets experienced a technical breakdown in September and early October which resulted in our cautionary outlook for stocks.

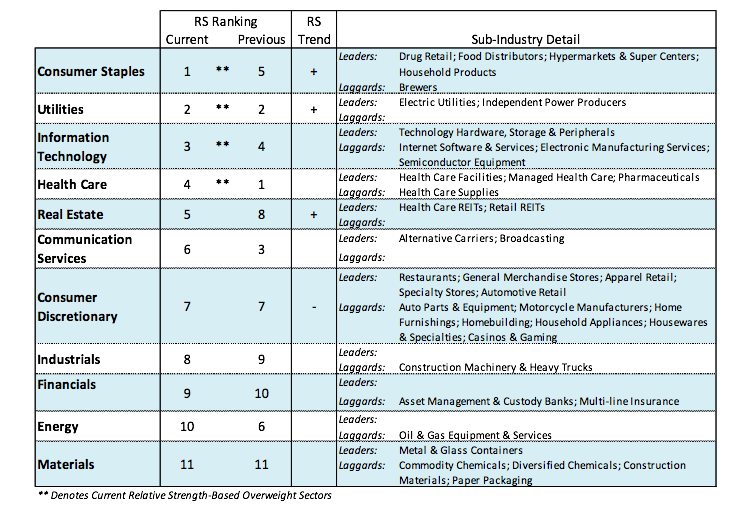

As the important averages were hitting new highs, fewer issues were participating and more stocks were actually making new 52-week lows than new highs. In a healthy bull market, nearly all areas are moving in harmony with the primary trend. The fact that the technology, consumer discretionary and health care sectors were responsible for virtually all the gains in the S&P 500 in 2018 describes a market that had become increasingly dependent on a handful of issues. Just as important, bull markets are historically global in scope.

Currently only 9% of 47 world markets are trading above their 200-day moving average. The drop in U.S. stock prices last week was accompanied by further declines in foreign markets. The breakdown in virtually all international stock markets raised not only concerns of diverging trends but the likelihood that the global economy is experiencing a slowdown in economic growth. The fact that nearly all global stock markets, including the U.S. are now synchronized to the downside argues investors stay with a cautious approach.

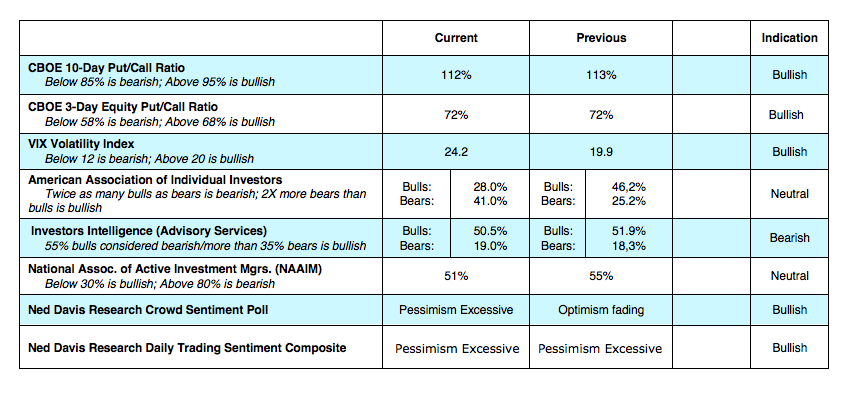

From here the stock market enters the new week in an oversold condition which could lead to a short-term rally. An indication that a market low is approaching, however, is often seen by a contraction of the number of issues hitting new lows. This is not the case in the present example as the new low list continues to balloon. An expanding number of NYSE issues (908) hit new 52-week lows last week. Additionally, evidence of an approaching low is often seen by a change in market leadership.

Currently defensive leadership remains in force with utilities, consumer stapes, health care and telecom still providing defensive leadership. Although stock buybacks slow during earnings season, data supplied by TrimTabs Investment Research shows buybacks averaging $750 million daily compared with $3.3 billion during all earnings seasons in the past three years. Given buybacks generally play a significant role in the prospects for a year-end rally, we would like to see corporate buyers turn more aggressive if a strong year-end rally is to unfold.

Bear markets are almost always associated with a recession. Given the latest economic data and the leading indicators that point to further growth, the odds of recession are low.

Currently investors should stay focused on defensive sectors including utilities, consumer staples and heath care. Once the downside momentum has been broken and a bottom identified, leadership is anticipated to be in the material, consumer discretionary and technology sectors.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.