The stock market turned in one of the strongest performances of the year last week with the Dow Industrials and Russell 2000 indexes gaining more than 2.00% while the S&P 500 added 44 points, or 1.67%.

The equity markets ignored mounting tensions with U.S. trading partners focusing instead on improving economic conditions at home.

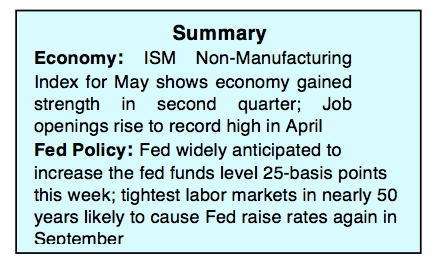

The labor markets continue to tighten. The latest JOLTS report shows the number of job openings outpaced the number of job seekers for the first time since 2000. Reports from the Institute of Supply Management (ISM) show the economy growing at a 3.00% clip.

Additionally, the U.S. trade deficit narrowed the past two months in a row, which will give second-quarter GDP growth a lift and support the Atlanta Fed’s model that shows the economy is growing at a 4.00+% rate.

Despite the favorable economic climate, stocks are likely to encounter increased volatility as we move deeper into summer. Trade tensions will continue and global disruptions that have already surfaced in emerging markets could spread resulting from the Fed’s withdrawing liquidity.

This week the Fed is widely anticipated to raise interest rates 25-basis points on Wednesday. The fed funds futures market gives a 73% probability of another rate increase in September. The European Central Bank also meets on Wednesday to consider winding down of their bond buying program. The bottom line is that long-term trends remain positive but a number of roadblocks including rising interest rates, the current Administration’s efforts to create fully reciprocal trade deals and uncertainty over the mid-term elections will likely keep stocks range bound.

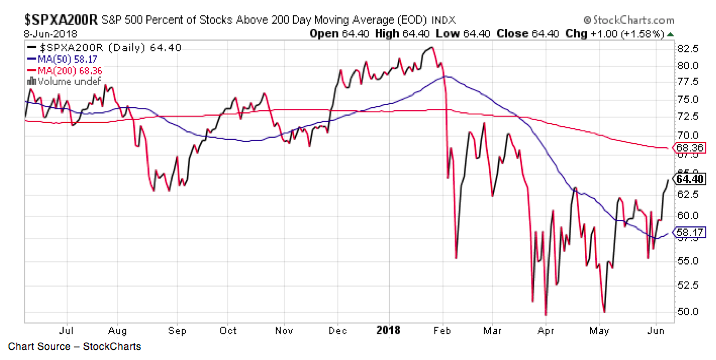

The technical message for the stock market remained mixed last week. Improvement in the broad market was offset by rising investor optimism. Although there has yet to be a session with upside volume exceeding downside volume by 9X or more, the percentage of S&P 500 issues trading above their 200-day moving average improved to 64% last week from 59%. Additionally, the percentage of S&P 500 industry groups in defined uptrends climbed to 72% from 66%. The improvement in market breadth the past two weeks, while encouraging, is less than what is required to trigger a buy signal from this valuable indicator. The rise in stock prices last week caused investor sentiment indicators to move toward excessive optimism.

Using contrary opinion, increased investor optimism is seen as a short-term negative. The shift in sentiment is seen in the latest survey from the National Association of Active Investment Managers (NAAIM), where allocation to stocks increased to 92% from 55% in May. The Ned Davis Daily Trading Sentiment Index also issued a caution signal by climbing deeper into the excessive optimism zone.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.