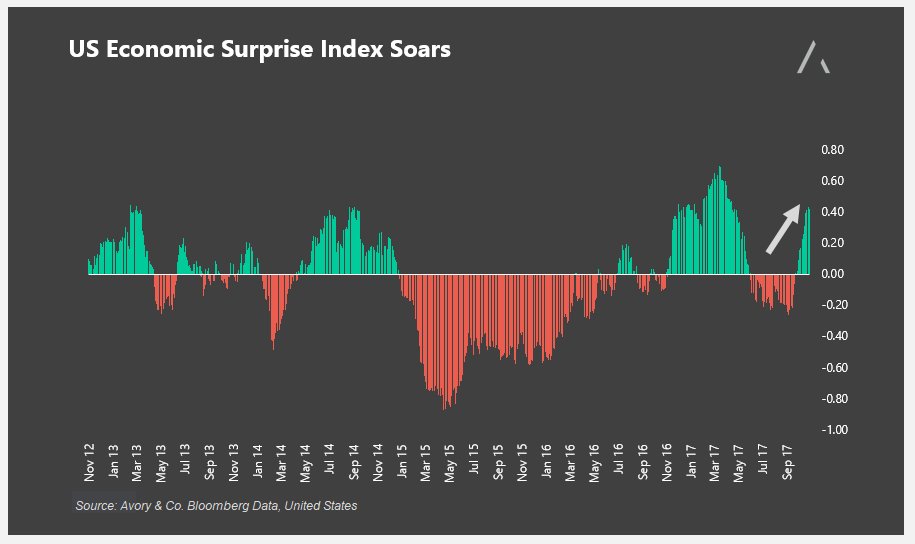

The Economic Surprise Index soars higher on increased survey readings.

We have seen an overall surprise beat from consumer confidence, empire manufacturing surveys, and the Dallas Fed survey.

This further emphasizes the hard data versus soft data debate. Hard data being those data points which are not survey based and actual evidence of strong economic activity.

Initial jobless claims, continuing claims, and non farm payroll readings have been missing estimates. While hard data missing estimates does not mean economic data is weak, is does mean that activity may be trending negatively.

U.S. Economic Surprise Index Chart – 5 Years

Twitter: @_SeanDavid

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.