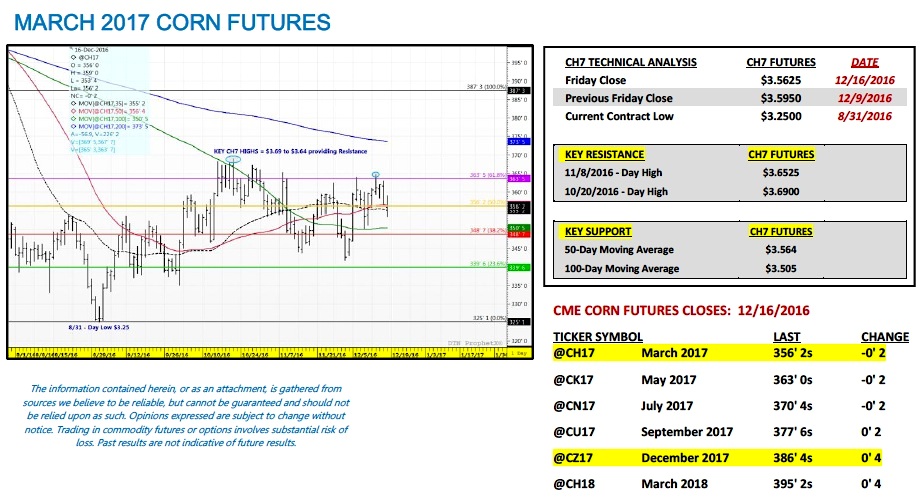

March corn futures traded in a tight range last week posting a weekly high of $3.64 ¾ per bushel, which was slightly above the prior week’s high of $3.64 on 12/6. However the market once again failed at that level, closing well below $3.60 Friday afternoon.

Let’s review the highlights from the week and what to expect going forward.

WEEKLY HIGHLIGHTS:

Solid U.S. Corn Inspections: The USDA’s weekly export inspections report showed U.S. corn shipments of 33.9 million bushels. Year-to-date U.S. corn inspections (as of the week ending 12/12/16) improved to 574.5 million bushels versus 308.3 million the previous year (+86%). If this pattern continues for the next two weeks an increase to the USDA’s December 2016/17 U.S. corn export forecast of 2,225 million seems plausible in the January WASDE report. That said the USDA could hesitate on raising exports until Q2 of 2017 given expectations for a large 2016/17 Brazilian corn crop via expanded “safrinha” planted acreage and a return to trend-line yields (current production estimate = 86.5 MMT versus 67.0 MMT in 2015/16). Brazil begins planting its safrinha corn crop in February.

Record Weekly U.S. Ethanol Production: The U.S. ethanol industry set a new record high weekly production rate of 1,040 thousand barrels per day for the week ending 12/9/16; eclipsing the previous mark of 1,029 thousand barrels per day established on 8/12/2016 and 7/15/2016. The 4-week average run-rate totaled 1,022 thousand barrels per day versus 989 thousand barrels per day the previous year (over similar 4-week period), an increase of +3.3%. Overall, strong weekly ethanol production continues to offer residual support to U.S. corn-ethanol demand for 2016/17, which was last estimated at 5,300 million bushels.

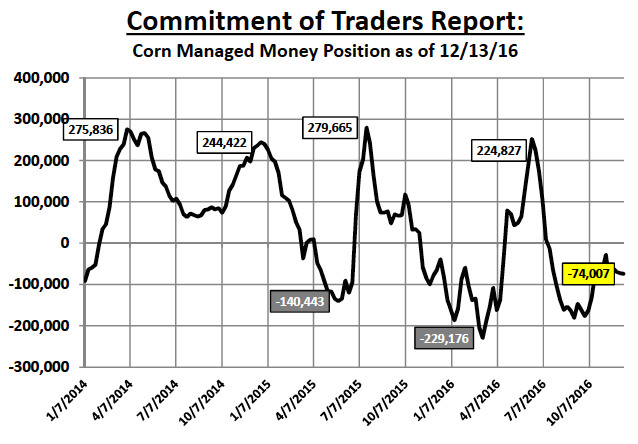

Despite good export and ethanol demand for corn, I still see neither usage sector as a legitimate answer for materially lowering U.S. corn ending stocks and pushing December 2017 corn futures above $4.00 per bushel. What then could be the spark to igniting a short-term rally over that critical price threshold?

March 2017 Corn Futures: Key Pricing Considerations For The Week Ahead

March corn futures (CH7) closed on Friday (12/16) at $3.56 ¼, finishing down 3 ¼-cents per bushel week-on-week.

Key takeaways from this week’s price action:

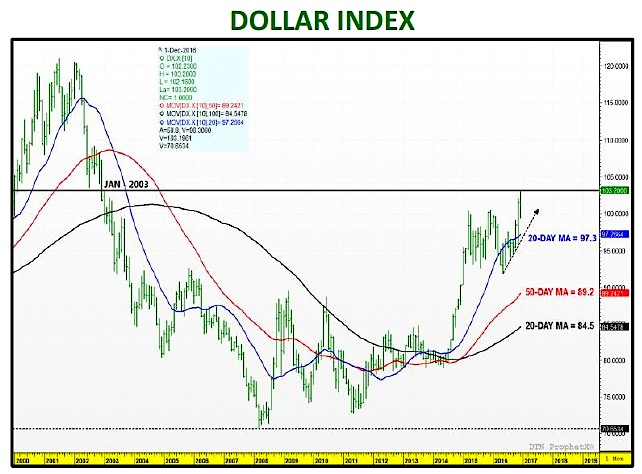

- On Wednesday the Federal Reserve raised its key short-term interest rate to a range of 0.5%-0.75% from 0.25% to 0.5%. They also signaled their intentions of 3 additional rate hikes in 2017. The impact on the Dollar Index was immediate with the Dollar spiking to its highest level since January 2003. A strong Dollar is Bearish U.S. commodity values as it makes U.S. exports more expensive in the world market. Therefore we can now add this to the list of overhead resistance factors for corn moving forward…

- On Thursday, Informa released its latest 2017 planted acreage projections for U.S corn and soybeans. Informa’s soybeans acreage forecast of 88.9 million acres was considerably higher than the USDA’s Baseline estimate of 85.5 million. This will likely serve as yet another barrier to continuation rallies above $10.50 per bushel in front-end soybean futures (SF17).

Ultimately this week’s price action was yet another indication of a corn market that will likely struggle to sustain rallies over key resistance through calendar year-end. Right now that level in March corn futures is $3.64 to $3.65 (see chart on page 7). A Bearish ending stocks outlook in both corn and soybeans (U.S. and World) combined with a sharply higher Dollar Index will likely dissuade Money Managers from buying corn futures short-term. One price support however is the 10-year corn futures seasonal, which shows a sideways to higher pattern into January 10th. That said I still anticipate a narrow, range bound market for at least the next 2-weeks, barring a major up move in soybeans (which I also can’t currently justify from a fundamental perspective).

Thanks for reading.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service