Last week, May Corn futures closed down 2 1/4 cents per bushel, finishing at $3.86 1/4.

The April WASDE report had few surprises and Corn may be in for some additional consolidation. Here’s a recap of the WASDE report along with my analysis and short-term forecast.

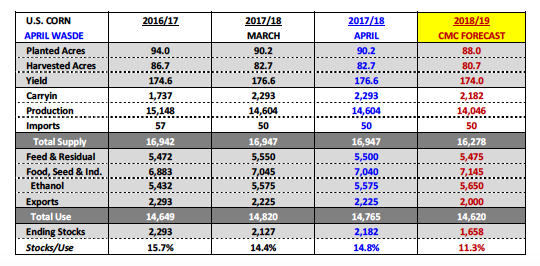

On Tuesday the USDA released its April 2018 WASDE report, which contained very few, if any, major surprises. 2017/18 U.S. corn ending stocks increased to 2.182 billion bushels, 55 million bushels higher than a month ago, and nearly identical to the pre-report average trade guess of 2.189 billion. The USDA trimmed Feed and Residual use 50 million bushels while also lowering Food, Seed, and Industrial use 5 million bushels.

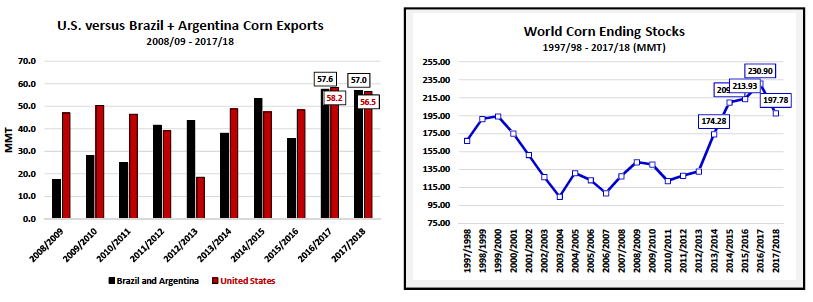

If there was a mild surprise in the report it was the USDA’s decision to leave 2017/18 U.S. corn export demand unchanged at 2.225 billion bushels. As of the week ending 4/5/2018, U.S. corn export inspections trailed the previous crop year by more than 23%. Export sales have been very strong however I still get the impression would corn buyers are booking U.S. corn as a hedge against the continued unknowns regarding the size and quality of Brazil’s 2017/18 corn crop. Therefore I believe a percentage of current U.S. corn export sales, could be canceled in the future, which would seem to explain the massive differential between the export sales pace (-2% versus 2016/17) relative to actual shipments (-23% versus 2016/17).

In the April WASDE report the USDA lowered 2017/18 Brazil corn production 2.5 MMT from March to 92 MMT. This compares to 2016/17 Brazil corn production of 98.5 MMT. 2017/18 Brazil corn exports were lowered to 33 MMT, however that remains 1.4 MMT HIGHER than Brazil’s total corn exports in 2016/17. 2017/18 Argentina corn exports were estimated at 24 MMT versus 25.99 MMT in 2016/17. That said crop year-on-year, total corn exports from the world’s 2nd (Brazil) and 3rd (Argentina) largest exporters are only projected to be down 0.59 MMT (or 23.2 million bushels). This despite the much publicized production shortfalls in both countries. All things considered I remain of the opinion that the USDA’s current 2017/18 U.S. corn export forecast is 25 to 50 million bushels too high and will be lowered at some point in the future in either the June or July WASDE reports.

The other “hot” topic this week was the persistence of sharply below-normal temperatures across essentially the entire U.S. Corn Belt. Furthermore NOAA’s most recent 8 to 14-day weather models continue to offer near winter-like temperatures into the 24th of April. Invariably this is going to result in some spring planting delays, specifically in the upper Midwest. Corn Bulls have continued to try and leverage this storyline, which should only gain momentum the longer this weather pattern holds. With the USDA already offering a much lower than expected March Prospective corn plantings forecast of 88.0 million acres for 2018/19, the risk of losing additional acres to soybeans due to planting delays certainly remains a possibility. On Monday, Missouri’s corn crop was reported just 1% planted as of April 8th versus 4% last year and 7% on average. I’m fully expecting this year’s state-by-state weekly planting percentages to continue showing a pattern of losing substantial ground to both 2017 and their 5-year averages.

That said would I buy corn based on the argument of potentially significant spring planting delays? Not necessarily. In the past 5-crop years there have been 2 notable spring planting delays in the U.S. In 2013…as of May 5th only 12% of the U.S. corn crop had been planted versus 47% on average. 3-weeks later the percentage planted had improved to 86%, nearly equal to the average pace. In 2014…as of May 4th just 29% of the U.S. corn crop had been planted versus 42% on average. That year not only did all the corn get planted once again, but the U.S. also managed what was at that time a record U.S. corn yield of 171 bpa that fall. Therefore history suggests…chasing longs on a spring planting delay is often a losing proposition.

MAY 2018 CORN FUTURES PRICE FORECAST:

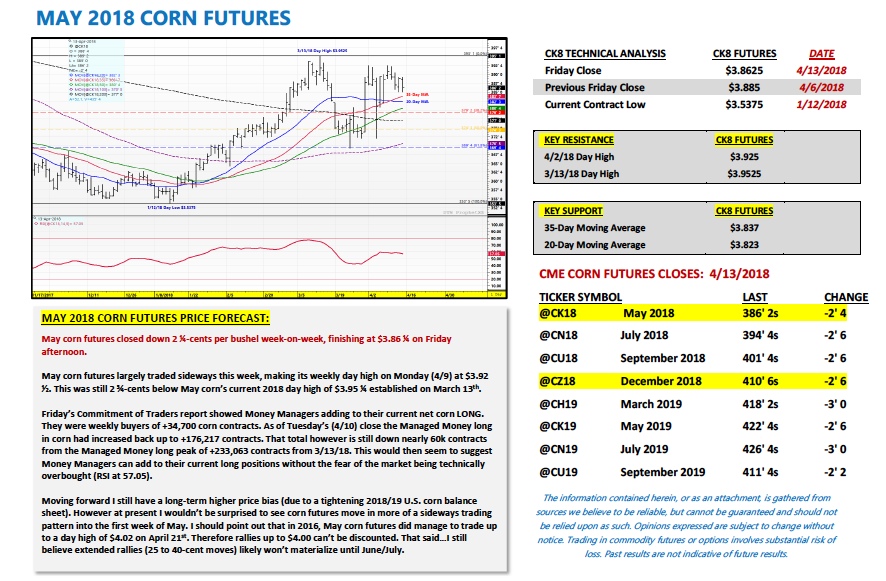

May corn futures closed down 2 ¼-cents per bushel week-on-week, finishing at $3.86 ¼ on Friday afternoon.

May corn futures largely traded sideways this week, making its weekly day high on Monday (4/9) at $3.92 ½. This was still 2 ¾-cents below May corn’s current 2018 day high of $3.95 ¼ established on March 13th.

Friday’s Commitment of Traders report showed Money Managers adding to their current net corn LONG. They were weekly buyers of +34,700 corn contracts. As of Tuesday’s (4/10) close the Managed Money long in corn had increased back up to +176,217 contracts. That total however is still down nearly 60k contracts from the Managed Money long peak of +233,063 contracts from 3/13/18. This would then seem to suggest Money Managers can add to their current long positions without the fear of the market being technically overbought (RSI at 57.05).

Moving forward I still have a long-term higher price bias (due to a tightening 2018/19 U.S. corn balance sheet). However at present I wouldn’t be surprised to see corn futures move in more of a sideways trading pattern into the first week of May. I should point out that in 2016, May corn futures did manage to trade up to a day high of $4.02 on April 21st. Therefore rallies up to $4.00 can’t be discounted. That said…I still believe extended rallies (25 to 40-cent moves) likely won’t materialize until June/July.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service