JULY corn futures closed up 13-CENTS per bushel last week, finishing at $3.98 ½.

Here’s a look at the week ahead and what I’m watching in the corn market… and how July Corn futures are shaping up.

Weekly Highlights and Corn Outlook:

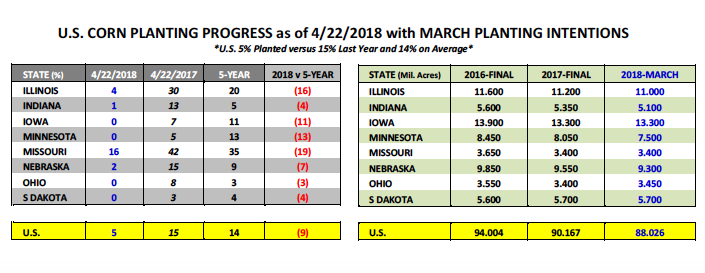

Monday’s Weekly Crop Progress report showed the U.S. corn crop 5% planted as of April 22nd versus 15% last year and 14% on average. For the 2nd consecutive week the USDA confirmed what traders had largely already anticipated, which was U.S. corn planting progress running well behind schedule across the Corn Belt. Illinois’s corn crop was just 4% planted versus 30% in 2017 and 20% on average. Missouri only 16% planted compared to 42% in 2017 and 35% on average. No corn planting progress had been reported for Iowa, Minnesota, South Dakota, North Dakota, Wisconsin, Michigan, and Ohio.

What was the market’s reaction to the “delayed” corn planting start? On Tuesday corn futures closed up a relatively disinterested 2 ½ to 2 ¾-cents per bushel. Keep in mind even after including Tuesday’s higher close, that still left July corn futures nearly 13-cents removed from its current 2018 day high of $4.02 ¾ on March 13th. Therefore as I’ve alluded to in previous commentaries, this week’s price response to a slow planting start seemed to reinforce the historical view that the market doesn’t aggressively chase fresh longs (or new highs) due to a spring planting delay (especially during the last week of April).

Thursday’s Weekly Export Sales summary showed U.S. corn export sales of 27.4 million bushels (2017/18) for the week ending 4/19/2018. Crop year-to-date sales improved to 1.968 billion bushels versus 2.010 billion in 2016/17 (-2%). Needless-to-say the export “sales” pace in corn continues to validate the USDA’s 2017/18 U.S. corn export projection of 2.225 billion bushels versus 2016/17’s 2.293 billion bushels (-3%). However…most traders have now shifted their attention to actual physical export shipments/inspections versus sales. This week’s U.S. corn export inspections figured totaled a respectable 67.0 million bushels. That said the crop year-to-date U.S. corn export inspections total still trails 2016/17 by approximately 20%. Therefore until that gap narrows considerably (within 5 to 6% of “sales”) I believe the market will be wary of future potential cuts to the USDA’s 2017/18 export projection of 2.225 billion bushels.

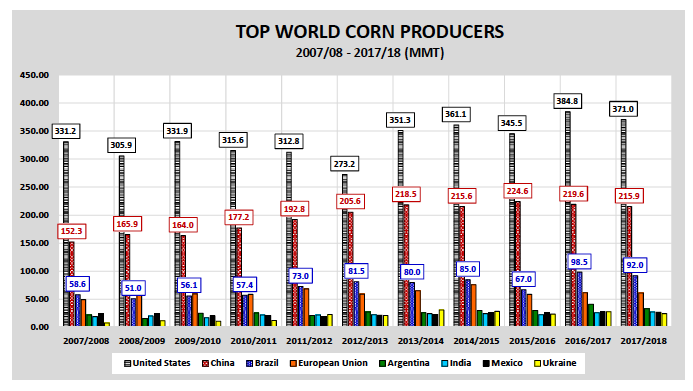

There was some talk this week regarding Brazil’s safrinha corn crop and potential problem areas (in need of rain) in Parana, southern Mato Grosso do Sul, and southern Sao Paulo. Parana is probably the area of greatest concern considering it accounts for a large percentage of Brazil’s total safrinha corn crop. That said noted South American crop analyst Michael Cordonnier left his 2017/18 Brazil corn production forecast unchanged this week at 87 MMT. This compares to the USDA’s April estimate of 92 MMT (a difference of 5 MMT or 197 million bushels). Everything I read from reputable sources on Brazil’s corn production prospects suggests the USDA will likely have to come down on their current projection to something closer to 88 to 90 MMT. Brazil’s safrinha corn harvest is primarily during the months of June, July, and August. Any drop in Brazil’s corn production figure should support the U.S. corn export market in 2018/19.

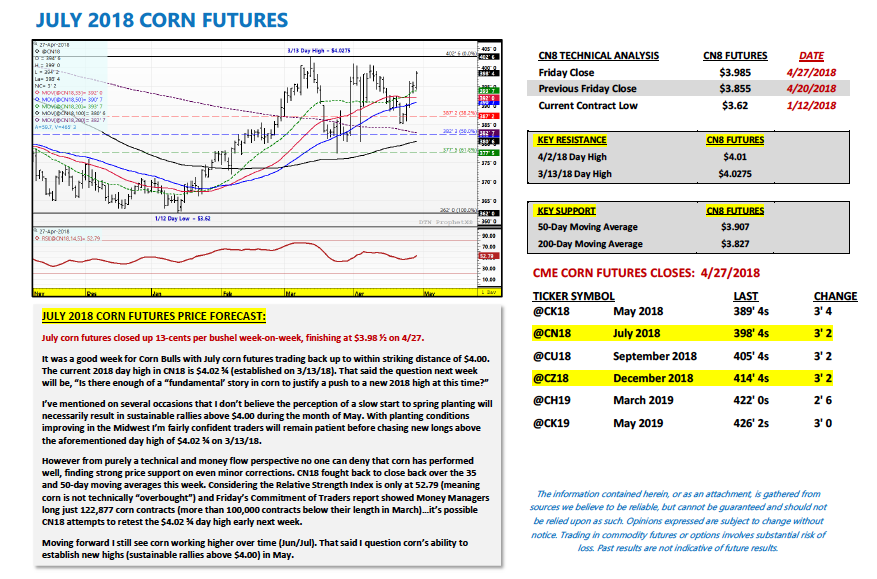

JULY 2018 CORN FUTURES PRICE FORECAST:

July corn futures closed up 13-cents per bushel week-on-week, finishing at $3.98 ½ on 4/27.

It was a good week for Corn Bulls with July corn futures trading back up to within striking distance of $4.00. The current 2018 day high in CN18 is $4.02 ¾ (established on 3/13/18). That said the question next week will be, “Is there enough of a “fundamental’ story in corn to justify a push to a new 2018 high at this time?”

I’ve mentioned on several occasions that I don’t believe the perception of a slow start to spring planting will necessarily result in sustainable rallies above $4.00 during the month of May. With planting conditions improving in the Midwest I’m fairly confident traders will remain patient before chasing new longs above the aforementioned day high of $4.02 ¾ on 3/13/18.

However from purely a technical and money flow perspective no one can deny that corn has performed well, finding strong price support on even minor corrections. CN18 fought back to close back over the 35 and 50-day moving averages this week. Considering the Relative Strength Index is only at 52.79 (meaning corn is not technically “overbought”) and Friday’s Commitment of Traders report showed Money Managers long just 122,877 corn contracts (more than 100,000 contracts below their length in March)…it’s possible CN18 attempts to retest the $4.02 ¾ day high early next week.

Moving forward I still see corn working higher over time (Jun/Jul). That said I question corn’s ability to establish new highs (sustainable rallies above $4.00) in May.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service