With several U.S. and European stock markets tracing potential topping patterns, a jolt to the markets this week could lock in a market top. The event that triggers the next cascade of market corrections could come in any of several forms – for example a new stumbling point on the road toward a Greek agreement, or a poorly received statement from the Fed or ECB. Here we show some of the global stock markets we’re monitoring, as well as developments that traders might view as signaling of the next downward move for markets.

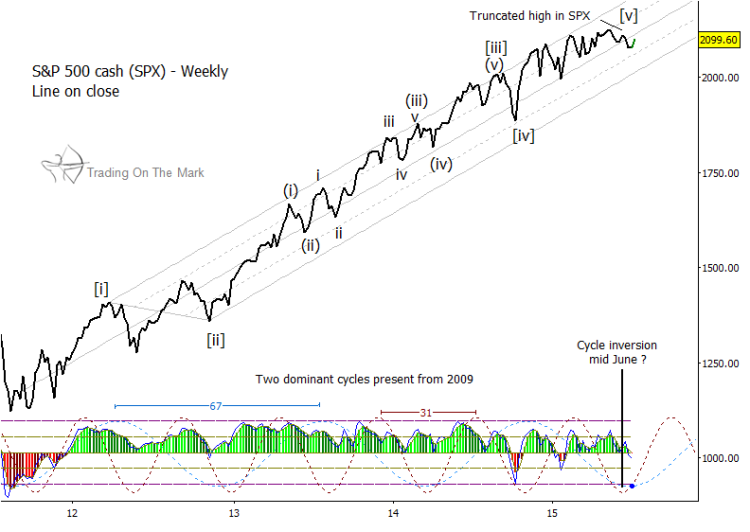

The S&P 500 (SPX) may have put in a truncated fifth-wave high earlier this year, potentially completing the entire climb up from 2009. A downward turn after this week’s bounce could lead to a test of the lower channel boundary and eventually could produce a test of the October 2014 market low. If that type of reversal transpires, market bears might begin to aim for targets in late 2015 and early 2016 that are even lower than that.

S&P 500 Weekly Chart

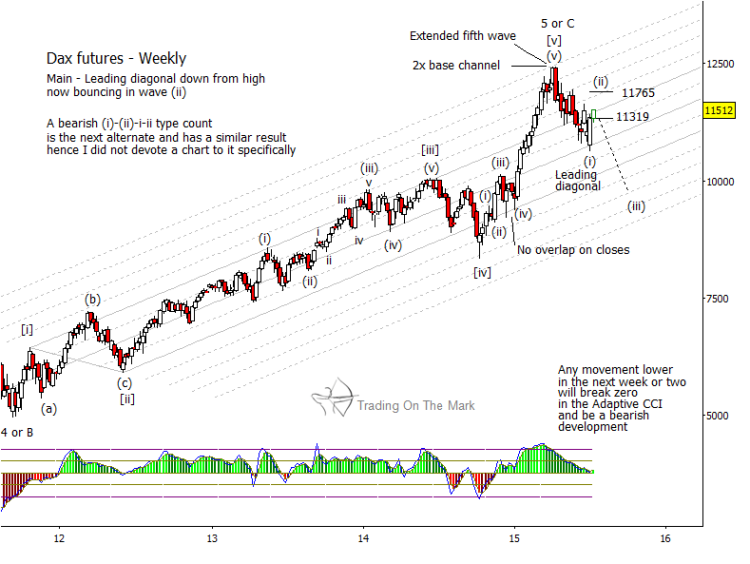

We see similar conditions in the German DAX stock market. After blazing a potential downward leading diagonal and a smaller upward retrace, the index that is the darling of market bulls is now poised to embark on a strong downward third wave. In this case, traders might aim for the 50% and 100% harmonic lines of the channel, perhaps to be followed by area of the October low.

German DAX Weekly Chart

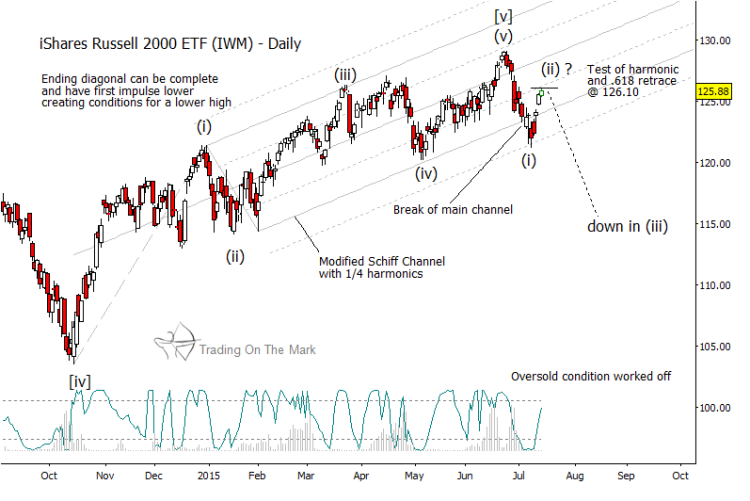

On a faster chart with daily candles, the Russell 2000 Index (RUT) and its best-known ETF show how a topping pattern may be complete. Since the high of early June, the Russell 2000 has broken out of its price channel and may now be ready to start the next downward wave.

Russell 2000 Daily Chart

Other global stock markets are also nearing a crossroads. How these big three resolve, though, will be important.

Thanks for reading and feel free to visit our site for some free samples of our work. Have a great weekend.

Twitter: @TradingOnMark

Read more from from Tom and Kurt on Trading On The Mark.

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.